- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Help with combining Cap 1 cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Help with combining Cap 1 cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with combining Cap 1 cards

I have 2 QS1’s and a Spark Classic.

The first was opened on Nov 04, 2009 as a Platinum and then upgraded to a QS1. Only 1 missed payment (32 days) from so long ago it is no longer on my credit. Other than that, always in good standing. However, until I joined this site I always made the minimum payments. I finally got an auto CLI in April 2015 from $500 to $1500. It got another $250 bump 2-5-16 when I hit the LUV button and then converted on the same day to a QS1. Current limit is $1750. I anticipate the next CLI will be around 8-5-16.

The second Cap 1 was opened on Oct 13, 2015 ($2000 SL) after a cold app for a QS1 I pre-qualified for on their site. It has always been in good standing. And since I got it just before joining myFICO it has always had decent payment amounts even when carrying a balance which has only happened 2-3 times. LUV button CLI on 2-11-16 to $2150, and an auto-CLI to $2650 in March 2016. Both QS1’s have a 0 balance now. I anticipate another CLI by request around 7-9-16.

I also have a Spark Classic opened on Jan 06, 2016 that began as $500 but bumped to $1500 at 3 months on 4-5-2016. It turns 6 months old in a couple of weeks. This one is always PIF but usage varies so some months might be low, some may be the full limit but never allowed to carry over. I anticipate another bump on or around 7-6-16. Last LUV button attempt was on 6-7 and denied “account has recently been increased”.

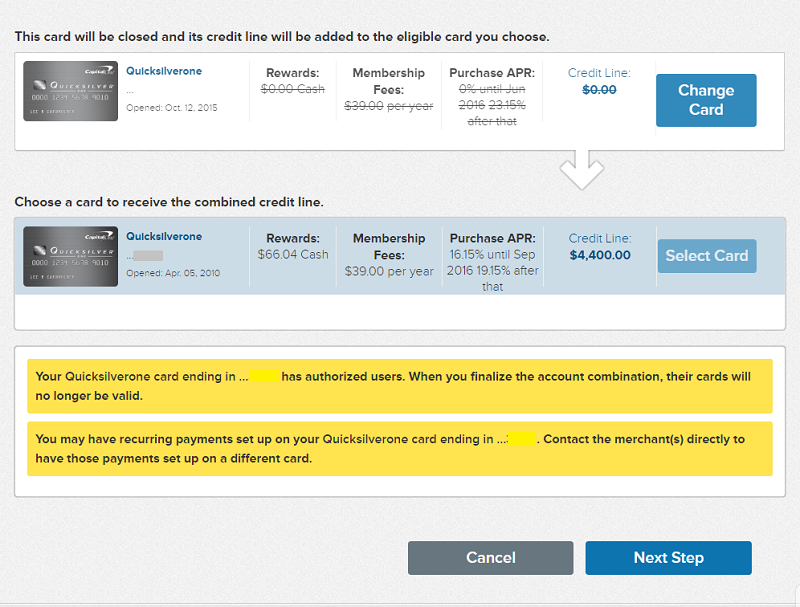

I can combine my QS1’s and transfer their rewards balance and I know I want to roll it into the oldest card for AAoA reasons. But, I cannot seem to get anymore CLI’s on any of my cards. I try regularly, like a couple of times a month. I don’t want to combine until I get another round of CLI’s because with my scores going up and good payment history I anticipate decent increases. Especially when they are giving out $20k limits on Ventures. I also know auto-increases seem to make LUV button increases not possible for 6 months afterwards. So when would you try for an increase on each card?

My ultimate goal is to get CLI’s on all (hopefully in the thousands), then PC one of my QS1’s to a QS, then combine the other QS1 into it. I don’t think the Spark can be combined with a personal card and even if it can, I like it being a business card so I don’t want to combine it, just want a decent CLI. I might try and PC it to a Spark Cash too.

Capital one does not show me any pre-qual offers and will not grant me CLI’s. Not sure why. I need advice on what I should do and when.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

One more question. Is it maybe because I am still in credit steps on atleast 1 of these that I can't get prequalified on thei site for anything anymore?

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

@MyLoFICO wrote:One more question. Is it maybe because I am still in credit steps on atleast 1 of these that I can't get prequalified on thei site for anything anymore?

"I am still in credit steps on atleast 1 of these " Is exactly the reason...I called earlier because i wanted to do the same thing...Many variables exist...I didnt have my address in the same format and that made a difference..."This is relativly new and is being expanded to make our options better and the procedure more efficient...! " At least thats the answer i was given...#GOFIGURE

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

I will keep trying. By mid august I will be out of credit steps. After that if I can't get prequal or CLI's Cap 1 must just hate me lol

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

No CLI's as of last night. 0 balances. ugh... I will leave them at 0 and keep trying until I get some CLI's, then combine.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Help with combining Cap 1 cards

I called Cap 1 and the guy told me he needed a few minutes to talk to his supervisor. He came back after like 10 minutes and said neither of them could figure out why my limits are so low or why their system wouldn’t give me a higher limit. He said my account history is perfect. High balances PIF and lots of card usage. He said there is a 6 month wait after each CLI. He said one account hits 6 months on 8-6-16 and the other is 10-19-16 and I should try again then. He also told me it does not matter how many times you submit the online LUV button request (meaning it doesn’t harm your account) so I won’t feel bad testing the waters, but I won't accept any until the 6 month mark.

I asked why I could not PC them and he said it’s because my Spark Classic is less than 6 months old which gives more credit to the myth that they have a new 6 month rule after a new account. It turns 6 months old 15 days so I will test the PC waters then. I won’t merge these until after I get both the CLI’s though. Even if it means another AF gets paid.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18