- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: How does Chase Freedom point system work?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How does Chase Freedom point system work?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does Chase Freedom point system work?

I know they have 5% rotating categories and 1% everything else but I've read something about them giving back 10% of the rewards earned every month or every year?

How does that work? Do I have to keep the points in the account and not spend it in order to get that extra 10%?

[5%] Gas, Grocery, Amazon, Airline tickets, Drug Stores, Dept. Stores, Target, MyHabit

[3%] Restaurants

[2%] Everything Else

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

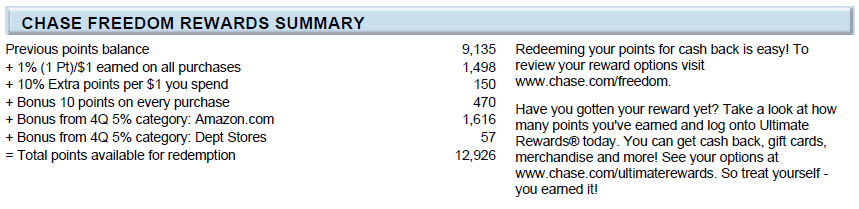

+ 1% (1 Pt) per $1 earned on all purchases

+ 10% Extra points per $1 you spend

+ Bonus 10 points on every purchase (only if you have a checking/credit card relationship before March 2013. Program ends soon and will be replaced with annual 10% bonus)

+ Bonus 5% quarter category

Hope that helps! ![]()

FYI, Chase currently has a $200 sign up bonus going on if you spend $500 within 3 months of account opening. Pretty good deal if you ask me!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

@maiden_girl wrote:+ 1% (1 Pt) per $1 earned on all purchases

+ 10% Extra points per $1 you spend

+ Bonus 10 points on every purchase (only if you have a checking/credit card relationship before March 2013. Program ends soon and will be replaced with annual 10% bonus)

+ Bonus 5% quarter category

Hope that helps!

Thanks,

For clarification,

is 1% category 1.1 points per dollar + 10 points per purchase regardless of the purchase amount

and 5% category is just 5 points per dollar and no + 10 points per purchase?

I do have two checking accounts with Chase opened a while ago.

When the current program ends and the annual 10% bonus happens, will I need to keep the points in my accounts in order to get the 10% or will they give it to me regardless whether I'd already spent all my points or not?

Also will the 10% bonus only apply to 1% categories?

Thanks again in advance.

EDIT: Actually, I've been using my CS to buy lunch to get 2% back. However, if I buy a $10 sandwich with Freedom, does that mean I would have gotten 1.1% + 10 points (which is equivalent to another 1% in this case) for a total of 2.1%?

[5%] Gas, Grocery, Amazon, Airline tickets, Drug Stores, Dept. Stores, Target, MyHabit

[3%] Restaurants

[2%] Everything Else

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

The 10 points bonus has ended for most and should end for all by year end so I wouldn't worry about that.

The 10% bonus (for those with Chase Checking) applies to all points (not just basis points) which is why a few people may do better with the new scheme. You don't need to keep them, like the CSP bonus, it is based on points earned, whether you redeem them or not doesn't matter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

I have never seen a 10% bonus on my freedom

CSP-$8700, Amex BCE-17.2k, Chase Freedom-$5700

Discover It-$6600, USAA MC-$5900 Ink Bold- $12k United Explorer-$5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

@E150GT wrote:I have never seen a 10% bonus on my freedom

Check your statement. As of now, it's calculated monthly. This was pulled from my own statement ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Chase Freedom point system work?

The old 10&10 program (what maiden_girl is describing, but is no longer available to new customers) and current 10% annual bonus are for people who have a properly linked Chase checking account. The bonus is retroactive, so if you've been using your Freedom card heavily you should still be able to open up a Chase checking this month and get the 10% bonus on all points earned in 2013.

J.P. Morgan Palladium ($250k) | AmEx Platinum (NPSL) | AmEx SPG Personal/Business ($50k/$50k) | Citi Executive AAdvantage WEMC ($50k) | Citi Dividend WEMC ($50k) | Chase Sapphire Preferred VS ($50k) | Chase Ink Bold WEMC ($50k Flex) | Chase Ink Plus WEMC ($25k) | Chase Freedom VS ($25k) | Chase Freedom WMC ($25k) | Chase MileagePlus Explorer ($25k) | Chase Southwest RR Plus Business/Personal ($15k/$15k) | Barclays US Airways ($25k) | Barclays Hawaiian Airlines ($25k) | BofA Alaska Airlines ($10k) | Lexus Financial Services ($30k) | Mercedes-Benz Financial Services ($50k)