- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: How much cash back do you earn a year?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How much cash back do you earn a year?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

@newUser0 wrote:

@longtimelurker wrote:

@dearppl wrote:Just out of curiousity, how much cash back are you guys earning a year? I think it was around $300 more or less for me last year.

There are at least three different classes of cashback:

1) Cashback through regular spending. (I bought this stuff as I usually would, and my card gave me cashback)

2) Signup bonuses (I get the card, meet minimum spend, and may or may not use the card again)

3) Manufactured spend (I buy (near) cash equivalents, get the points, convert to cash, pay the credit card, and repeat)

In general 1 << 2 << 3

so as a fairly light MS user, I got ~ $10K on one card (of which $2K was expense). Others do much more.

Just curious, was this card Amex BC?

No, it was the Citi 5x TYP. Using the BC more lightly at first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

This year I hope to do more. I didn't get a some of my cards until near the end of the year. I also didn't really get into maximizing bonuses until mid year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

Did you consider the "opportunity cost" for the manufactured spending? Instead of using the prepaid visa to pay for expenses, you could be getting maybe 2% using your credit card. But, agree with you, it's still a good deal when you get 5% back even taking the opportunity cost into consideration.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

@dearppl wrote:Did you consider the "opportunity cost" for the manufactured spending? Instead of using the prepaid visa to pay for expenses, you could be getting maybe 2% using your credit card. But, agree with you, it's still a good deal when you get 5% back even taking the opportunity cost into consideration.

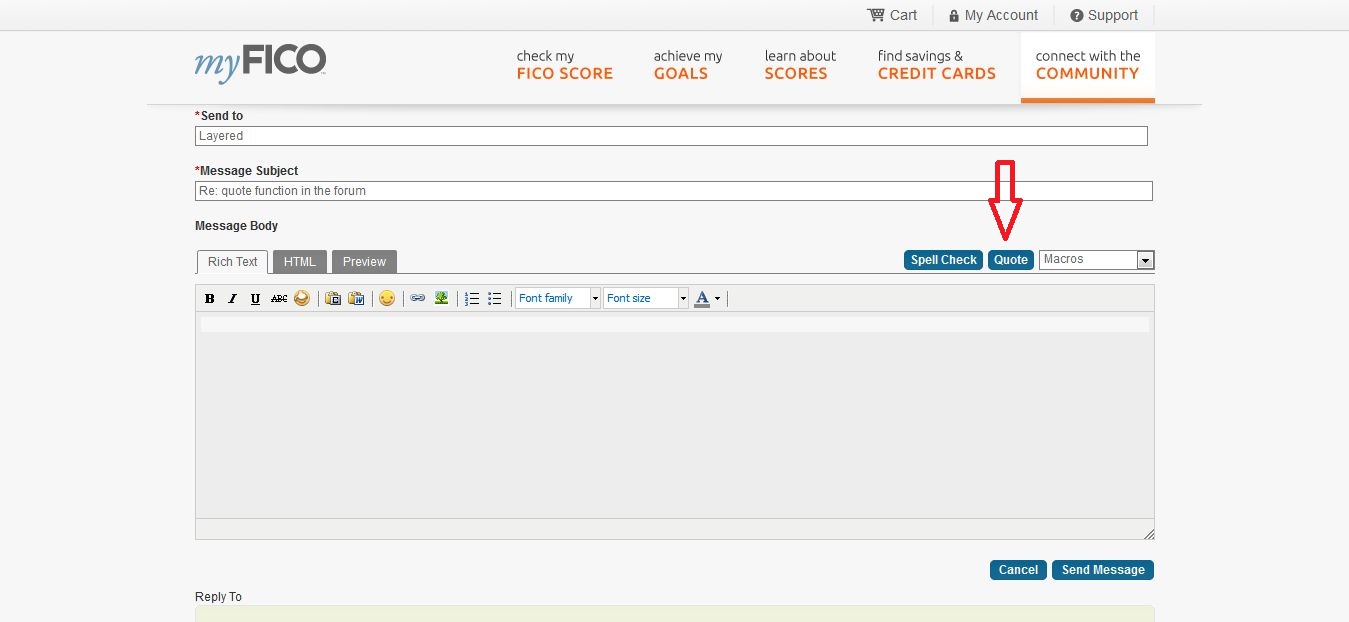

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

Going to take some digging to get an actual total. I can easily find $466 but that's not everything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

@dearppl wrote:Did you consider the "opportunity cost" for the manufactured spending? Instead of using the prepaid visa to pay for expenses, you could be getting maybe 2% using your credit card. But, agree with you, it's still a good deal when you get 5% back even taking the opportunity cost into consideration.

Not quite sure what you mean here. There are two common models:

1) Paying rent/mortgage etc, with bluebird/serve etc

2) Cashing out giftcards via money order or similar

The whole point of 1) is to do this when you CAN'T use a credit card to pay or to get additional category bonuses.

In 2) the prepaid cards aren't used for purchases at all, just to convert to cash.

I agree there would be an opportunity cost if you merely bought gift cards and used them for purchases but precisely for those reasons, I don't think it is common. (With the possible exception of Amex Gift Cards bought through cashback portals)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

I will bank roughly ~700$ year Cash Back on my Cap One QS...

Guys, I've gotten way too tired of playing Rotating Cats or Targeted Cats games, while having to manage 5-6 cards a month just for maximizing 5% Cashbacks (after a while it really does become exhausting)... I guess I really brought into those Samuel L Jackson commericals.... I wanted ONE card that gains me Cash Back on all spending.

My QuickSilver is my Auto Bill Payments "Catcher" card, if you will. I route roughly $2K worth of Monthly Bills throught it, I have set up all my Auto Pays to Push to the Card within a 2 week window so that I can always PIF before the statement cut, so a 0$ balance always reports to the CRAs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

@Blackbeauty212 wrote:I will bank roughly ~700$ year Cash Back on my Cap One QS...

Guys, I've gotten way too tired of playing Rotating Cats or Targeted Cats games, while having to manage 5-6 cards a month just for maximizing 5% Cashbacks (after a while it really does become exhausting)... I guess I really brought into those Samuel L Jackson commericals.... I wanted ONE card that gains me Cash Back on all spending.

My QuickSilver is my Auto Bill Payments "Catcher" card, if you will. I route roughly $2K worth of Monthly Bills throught it, I have set up all my Auto Pays to Push to the Card within a 2 week window so that I can always PIF before the statement cut, so a 0$ balance always reports to the CRAs.

I am with you to be honest. I don't use more than three cards, and 99% of everything goes on a CSP or Freedom. I just have no desire to manage more than that. But I do love me the UR shopping portal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much cash back do you earn a year?

probalby around 300. Capital One, Chase, and AmEx are bread winners

Goldman Sachs Signature Loan $29,000 TU 750 score pulled at time of loan.

Student Loan Debt $1,500

Credit Card Debt $300 1>% of $166,700

FAKO Transunion 723 Equifax 744

What's in my wallet? Chase Sapphire Reserve, Chase Freedom Unlimited, and AMEX Blue for Business