- myFICO® Forums

- Types of Credit

- Credit Cards

- How to Control "The Itch"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to Control "The Itch"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

This post blew up after I fell asleep! ![]()

And the advice is amazing thank you ![]() .

.

As for the want vs need, more or less... A want for the rewards card, but the travel card is something I'd need.

I travel a fair amount of times from NC to NYC, ( my man's family is up there.) So we go up there for holidays, and sometimes weddings for his friends.![]()

I haven't pulled my credit report from here yet, but CK says my TU is 676, and EQ at 678.

However, my Discover card just started showing my score and it says 708 ![]()

As for the signature, I tried doing it, but I kept getting errors when trying ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

I got it to work!

WOOHOO!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

@Anonymous wrote:Hey everyone!

I was wondering... How do you curb your itch to apply for really good cards?

I only ask this because I just hit 6months in my credit history; and WABAM!

I am getting offers out of nowhere.

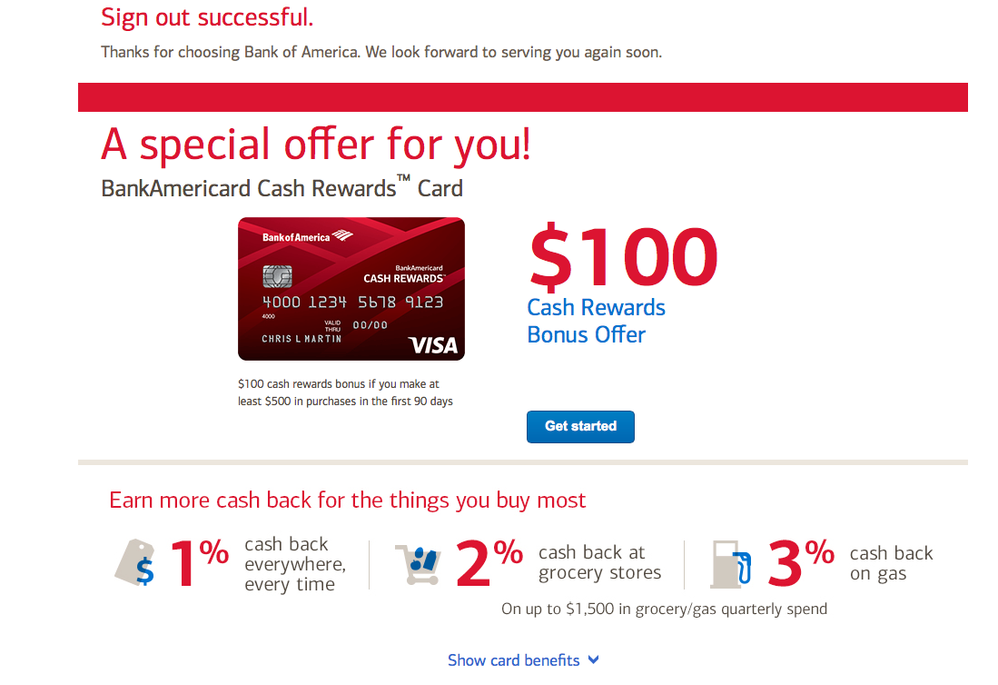

I just signed off of my BoA, and it said " Chelsey, you're preselected!" And there they are.

The shiny unsecured Rewards card, with an online bonus of $100 when you spend $500.

And the Travel Rewards card, with the 20,000 miles bonus.

These are two cards that I've wanted to work up to so badly.

But I know that I can't app, I just can't.

I have to build up my history for my car loan that I need

But oh boy, is the temptation so real right now!

So do anyone of you have any tips, to help this poor newbie restraining themselves very hard right now?

Easily. Get thousands of dollars worth of rewards, and bonuses for signing up for new checking accounts. Doctor of credit has the best links for those. I would say 3-5 checking accounts a year is safe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

Ice your CRs. ![]()

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

You have a good cash rewards card already with Discover It. Hopefully you're on the double cashback promo too.

About the car loan - I would keep growing the FICO score until you're nearer the top tier. Because the rate difference between high 600 scores and mid 700 scores would easily eat up any cash rewards you could hope to earn.. over the life of the loan.

Just think what it would feel like to accept an offer but get declined.. then you would have a hard pull on the file, and have to wait even longer for the score to go up. And auto loan will help your score grow faster too, since FICO likes to see diverse loan types.

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

Calamine lotion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

p.s. If it said "preselected" that's not really a sure approval, people have been denied after preselected. If it's a real offer, you should be able to click on the benefits and see a single interest rate, not a range of interest rates. I just signed out of my BoA, and here's what the preapproval looks like. They're "offering" me a 20% APR, which is really bad because they've offered 14% before. Sneaky.

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

@Bman70 wrote:

p.s. If it said "preselected" that's not really a sure approval, people have been denied after preselected. If it's a real offer, you should be able to click on the benefits and see a single interest rate, not a range of interest rates. I just signed out of my BoA, and here's what the preapproval looks like. They're "offering" me a 20% APR, which is really bad because they've offered 14% before. Sneaky.

I'll be damned, I just learned something! I never actually sign out of my accounts, just leave the site. Just used the sign out link and an "invitation to apply" for the Alaska Airlines business card popped up. Not an actual offer, but interesting nonetheless.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to Control "The Itch"

@Bman70 wrote:

You have a good cash rewards card already with Discover It. Hopefully you're on the double cashback promo too.

About the car loan - I would keep growing the FICO score until you're nearer the top tier. Because the rate difference between high 600 scores and mid 700 scores would easily eat up any cash rewards you could hope to earn.. over the life of the loan.

Just think what it would feel like to accept an offer but get declined.. then you would have a hard pull on the file, and have to wait even longer for the score to go up. And auto loan will help your score grow faster too, since FICO likes to see diverse loan types.

Yes sir! I am on the double cashback promo ![]() , it came with the 12month 0% APR aswell!

, it came with the 12month 0% APR aswell!

How the 5% cashback works is slightly confusing, but I am slowly learning it.

I actually didn't know that about the car loan, thank you ![]()

However, the car loan fiasco is a other topic for a different time LOL, I've over stuffed my brain with that information from here.

*P.S. I giggled way to much at the "calamine lotion" comment.