- myFICO® Forums

- Types of Credit

- Credit Cards

- I'd Love Some Opinions On My Situation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I'd Love Some Opinions On My Situation

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'd Love Some Opinions On My Situation

@NRB525 wrote:If you want to jump right to the good stuff, then just list out all the cards you currently have, their limits and how long you have had them, and you will get lots of specific advice for what to look for to optimize the features. All lenders are different in how they handle their credit card portfolio. Use the hive mind here to draw on the knowlege of many.

I recieved the above advice so I thought I'd act on it. I'd love it if some of you super knowledgable posters would chime in.

Background: I botched up my credit pretty good about 7 years ago (I crashed my horse, broke a bunch of stuff, had a few surgeries, unable to work, blah blah blah). I had several credit cards charged off and an auto loan (paid off in 2013) that is riddled with late payments (13 to be exact). Regarding the auto loan account, I wrote a thread about it here (I'm having a dispute with Experian, not the original creditor): http://ficoforums.myfico.com/t5/Rebuilding-Your-Credit/Dispute-with-Experian-Itself/td-p/4985774

As of March all of the charge-offs have fallen away. Now all that's left is the 13 late payments which begin to fall off in October of this year and will continue until January 2019.

In 2013 I got a secured card from Capital One with a $500 CL. In August of 2016 I got a Capital One Quicksilver One with a starting limit of $500 (later auto-increased to $4,500).

This year, after the charge offs went bye bye, it was time to get some accounts. I thought long and hard about the best way to do this -- go all in or open a new one every 2 years until I had a nice number of them). I decided to just go all in -- after all, with only a 3 year old card that was about to get closed anyway and a 10 month old card, I really didn't have an AAofA to ruin. I intended to close the secured card because though it was my oldest account I didn't want to pay that yearly fee. So, in quick succession (within hours) I applied for 5 cards thinking I wouldn't get all 5. That proved correct. What I got was a Discover It for $4,500, an Amex BCE for $5,000, and a Chase Slate for $3,200. Bank of America and Citi denied me. Once I recieved the new cards I closed my Cap One secured card. My current credit card details are in my signature.

I started reading through the 'rebuilding' and 'credit card' material on this site about a week ago. It had been my plan to sit tight with my 4 less-than-a-year-old cards and wait for 2 years to do anything else. I figured there was nothing to be done other than let time go by, watch the late-payments on the car fall away, and watch the inquiries expire. Then, at the end of 2 years, I was going to reassess. Maybe a couple new credit cards, maybe a new car. I have no specific goal in mind other than driving my score up/getting massive limits on my cards.

So, after reading on this forum that many credit card companies only do soft pulls for CLI's and about Capital One often being willing to upgrade their QS1, I jumped on both those things. Though I didn't read about the Amex 3X CLI in time (I could just kick myself!), I did get Amex and Discover to increase my limits and Capital One to upgrade me to a QS card. I'm not due for a CLI from Capital One yet and Chase...Chase has me worried.

I did a Chase search and have been reading all about how stingy they are and how they often do multiple pulls and still not give the customer a CLI. So A) I'm thinking Chase Slate was a mistake and not a good card to get a high limit out of eventually and B) that maybe I shouldn't waste any hard pulls on them at all (which I wasn't planning to do for at least 1 year anyway). Maybe just use Slate a bit, keep it payed off, and if they give me auto-increases then so be it. Maybe I should even close it. I don't know.

Does anyone feel like I should be doing something different? Something I haven't already thought of? What's everyone's opinion on this Chase situation?

Any and all help is much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

That's a whole lotta readin to do for a Chase CLI question!!!

J/K but really.... it is.

Damage is done from all of the apps so, you might as well keep everything in good order moving forward. I bounced in and out of the other thread with some comments as well.

I've been playing this game with CC's and finances for awhile now and the best thing to do for the long term is sit tight and not app for anything for a little while and let time work some magic on these new accounts.

The late pays will fall off on their own and sometimes you can do what's called early exclusion where they remove them early from your reports.

A HP in itself isn't a bad thing when it comes to points. It's the new accounts that kill scores. So, I would stay away from apps and hit the accounts for CLI's every 6 months or sooner depending on the lender. Mostly though a good rule of thumb is 6 months to get the most bang for your buck.

As to Chase.... I have an old Slate that was carried over from WAMU back in 2008 when things collapsed. $5500 limit and never moved over the years and stinky high APR to boot. Anyway back on 6/4 I got to thinking more about how banks "code" your account when you open it with the scoring bucket/profile you're in when you open it. Well I went back to Chase and pulled the trigger on a cold app for FU since the pre-qual app in my "offers" had crap terms on it anyway. Came back instant approved for 25.9K/0% for 15 mo's and so on. Needless to say if you don't see any movement now.... when you're done with the 24 months in app purgatory you should be able to nail down a better SL and APR with Chase since you should be a golden 800+ at that point.

Just stick to your guns on apps and keep a finger on the pulse around here with your favorite / current lender threads and all will be well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

@austinguy907 wrote:That's a whole lotta readin to do for a Chase CLI question!!!

J/K but really.... it is.

Damage is done from all of the apps so, you might as well keep everything in good order moving forward. I bounced in and out of the other thread with some comments as well.

I've been playing this game with CC's and finances for awhile now and the best thing to do for the long term is sit tight and not app for anything for a little while and let time work some magic on these new accounts.

The late pays will fall off on their own and sometimes you can do what's called early exclusion where they remove them early from your reports.

A HP in itself isn't a bad thing when it comes to points. It's the new accounts that kill scores. So, I would stay away from apps and hit the accounts for CLI's every 6 months or sooner depending on the lender. Mostly though a good rule of thumb is 6 months to get the most bang for your buck.

As to Chase.... I have an old Slate that was carried over from WAMU back in 2008 when things collapsed. $5500 limit and never moved over the years and stinky high APR to boot. Anyway back on 6/4 I got to thinking more about how banks "code" your account when you open it with the scoring bucket/profile you're in when you open it. Well I went back to Chase and pulled the trigger on a cold app for FU since the pre-qual app in my "offers" had crap terms on it anyway. Came back instant approved for 25.9K/0% for 15 mo's and so on. Needless to say if you don't see any movement now.... when you're done with the 24 months in app purgatory you should be able to nail down a better SL and APR with Chase since you should be a golden 800+ at that point.

Just stick to your guns on apps and keep a finger on the pulse around here with your favorite / current lender threads and all will be well.

I know, the post is super long -- I tried to keep it as brief as possible. It really wasn't about a Chase CLI, it was about my history, where I am now, and what I've done to help my scores. I wrote all that to see what people thought of my choices -- if I could have done something better, if I should do something different than what I'm planning now.

That's an interesting story about your Chase experience. I haven't heard of this scoring bucket thing. This seems to mostly apply to Chase, yeah? Because my other 3 cards have given me CLI's despite the age of the accounts. Do you think I shouldn't waste a hard pull on Chase? I heard what you said about hard pulls for CLI's not being the issue that brand new accounts are but I'd like to let all the inquires go away if at all possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

You have a good set of cards, with quite good limits for rebuilding. First off, I'd suggest not applying for anything else for a while.

The Slate card has no rewards. It is possible to Product Change the Slate to a Chase Freedom or Freedom Unlimited. You would not get the sign up bonus, but you would start earning 5% on the quarterly categories if a regular Freedom card. Q3 2017, starting today, is dining on the Freedom card. Freedom Unlimited is 1.5% all the time.

The Discover has the 5% categories. After you have been with Discover a while, there is a SP CLI available for that.

The AMEX is eligible for a CLI in another 6 months. Meantime, watch the various Offers on your on-line account. There are interesting possibilities if you are spending at those merchants anyway.

The Capital One card may reach a limit of CLI. If you have the Quicksilver that is simple 1.5% cash back.

BofA and Citi can wait for now. Use these cards, preferably for a year with some CLI where you can get them. As the baddies drop off, more options will open up. Patience.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

@NRB525 wrote:You have a good set of cards, with quite good limits for rebuilding. First off, I'd suggest not applying for anything else for a while.

The Slate card has no rewards. It is possible to Product Change the Slate to a Chase Freedom or Freedom Unlimited. You would not get the sign up bonus, but you would start earning 5% on the quarterly categories if a regular Freedom card. Q3 2017, starting today, is dining on the Freedom card. Freedom Unlimited is 1.5% all the time.

The Discover has the 5% categories. After you have been with Discover a while, there is a SP CLI available for that.

The AMEX is eligible for a CLI in another 6 months. Meantime, watch the various Offers on your on-line account. There are interesting possibilities if you are spending at those merchants anyway.

The Capital One card may reach a limit of CLI. If you have the Quicksilver that is simple 1.5% cash back.

BofA and Citi can wait for now. Use these cards, preferably for a year with some CLI where you can get them. As the baddies drop off, more options will open up. Patience.

Yeah, my plan was to garden for the next 2 years but I wondered if anyone thought waiting 1 year and then getting one new card was a better idea.

So the Quicksilver has a credit limit ceiling? Is it a low one?

Thanks to this forum I pressed forward on the soft pull CLI's which I would not have thought to do on my own. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

My take on buckets from another post/thread the other day.....

06-30-2017 04:15 PM

Well, it's a bit of a secret from the bigger lenders as to who falls where but, here's a breakdown:

https://www.nerdwallet.com/blog/finance/credit-score-ranges-and-how-to-improve/

FICO score ranges Range % Range % Source: FICO Score 8 data as of April 2015, courtesy of Fair Isaac Corp.

| 300 - 499 | 4.9% | 650 - 699 | 13% |

| 500 - 549 | 7.6% | 700 - 749 | 16.6% |

| 550 - 599 | 9.4% | 750 - 799 | 18.2% |

| 600 - 649 | 10.3% | 800 to 850 | 19.9% |

So, say you pick up a card when you're at 650 and using the table you see you're in the upper 50% of the pool of people. So, your account gets a code / bucket assigned when you open it. Unfortunately with most of the big banks you don't get credit for improving things while maintaining the account with a rate reduction or CLI as someone in the 700 tier.

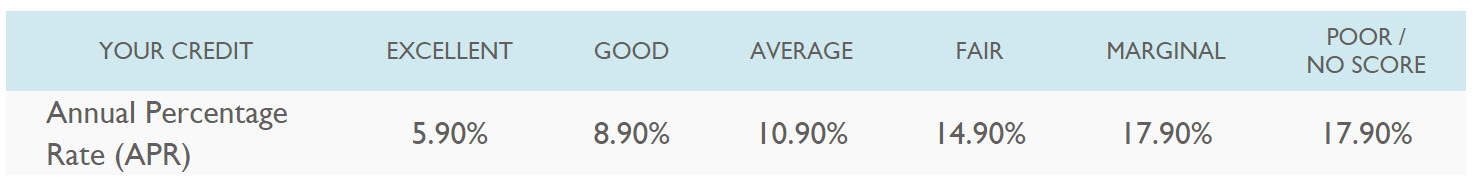

So, if you look at one of my CU's they also have a table where APR's are assigned based on score. The difference with them though is that as your scores go up your rates go down if you ask them for a reduction / CLI.

So, IIRC a 650 would get you a Fair rating on this table @ 14.9%. As you move up to 680 you can drop to the 10.9 and over 720 you would be good for the 8.9 rate. Over 760.... 5.9% is your ideal rate if you were to carry a balance.

So, depending on where your profile is now is probably where your bracket/bucket/code would be for the life of the CC. This is why you see people apping for additional Cap1 / Chase / BOA / etc. and then folding them into the existing line or moving the old account limit into the new one. You not only grow the CL but, you get better terms if you keep the newer account.

For instance I have a Chase Slate that was a carry over from WAMU back in the day and my scores were probably mid 6's at that point. So, they have kept the rate high and the limit low $5,500 / 21.x% and in the last year they dropped the rate to an enticing 17.x%. So, I tried everything with the account for several years but didn't get anywhere and just SD'd it to keep the age since it's been open since 2007. So, I started seeing the "offers' when logged in and laughed at the rates all 3 offers being over 20%.

Testing the coding/bucket theory I decided to pull a cold app on the FU and see how they acted now that my reports are spotless and scores in the 830-840 range. Filled things out and hit submit. Instant approval for $25.9K / 15.74% / 0% for 15 months. Meanwhile that trusty old Slate is sitting there in the background collecting dust and a free Fico each month.

Of course each bank is going to be different where those cut off points are for each bracket they assign. In general though they tend to be sub 600, 600-650, 650-680, 680-720, 720-750/760, up to 850 from there. Once you hit 750 though there's not much to be gained from credit products unless you're going for a mortgage. Once you get above 740 you start getting discount points off your mortgage rate up to 1% less than the advertised rate in some cases.

That's an interesting story about your Chase experience. I haven't heard of this scoring bucket thing. This seems to mostly apply to Chase, yeah? Because my other 3 cards have given me CLI's despite the age of the accounts. Do you think I shouldn't waste a hard pull on Chase? I heard what you said about hard pulls for CLI's not being the issue that brand new accounts are but I'd like to let all the inquires go away if at all possible.

All CCC's do bucketing whether they say it or not. CU's are more upfront about it but when they code your account it's not stuck in concrete boots. As you slide up the scale in score in the picture above you'll see your rates go down. Unfortunately with the big banks they tend to leave you treading water at the same limit/apr as they opened you at. For instance Crap1 left me sitting at $1500 for many years and then I applied for a replacement after seeing the results on Chase and they denied me for too many inq's which was a total of 2 across any / all CR's. So, I reconned a couple of times to find that out and now they're not in my wallet anymore.

Anyway...

HP's only cost a couple of points

HP + new account = reduced AAOA which factors more points lost

CLI's generally work in your favor because your utilization goes down when they report if you actually are carrying a balance. +++they give other lenders somewhere to comepte with on new accounts down the road

Lenders can't see your HP's after 12 months.... you see them for 24 months though for some reason... who knows...I'm sure someone will chime in.

I looked back over my account open dates and it seems I apply for new accounts on ODD years like 2015 was AMEX / Disco and this year it was Chase x 2 + BOA - Crap1 and killed off 3 accounts to keep the number at par.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

Man, Austinguy, that is a lot to chew on. Thank you so much for taking the time to write all that out -- there's some fascinating stuff there!

What did you mean at the end where you said you killed off Capital One and 3 other accounts to remain at par? Are you keeping only a certain number of credit cards at any given time or something? I wasn't aware there was such a thing as too many cards. You know, assuming utilization isn't a problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

Austin, that information is simply amazing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

Austinguy,

It seems, because of bucketing, rather than apply for a product change with Chase I'd be much better off waiting 2 years, applying for a new Chase card and then rolling over the Slate's credit limit into the new card. Yes? And then sock drawer the Slate? Because at that point it will be among my oldest cards and since it has no fees it would be best to keep it open. Do I have all this right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I'd Love Some Opinions On My Situation

Par / Net 0 = no change in count

I don't need 30-50-100 cards to deal with in my portfolio aka Quicken.

I killed 3 lines for 12,100 and added 3 lines for 45.9K so it more than makes up for the "loss" of dead weight. When you manage your accounts with software and spreadsheets you know you have enough of them. Off the top of my head I know I have 4 CU accounts and the rest are major issuers but, 1 is a Synch Sam's MC.

Quality over Quantity is my rule of thumb over the last few years as I go into the garden and pick the weeds every once in awhile. It's been awhile though since I've closed any accounts other than one (10K loss) a couple of years ago that closed due to non-use after 22-23 months and got replaced with AMEX / Disco (combined 14.5K). That 10K loss replacement scenario is now worth 98K for an account that wouldn't budge from 10K..... and it's direct replacement is the Sam's card that actually got up to 25K after fighting with GEMB/Synch to get there finally.

I still keep my pet Slate around for nostalgia (oldest red headed stepchild) and tender moments by the fire place. Once you get off the starting blocks and into the race it's a good idea to come up with a map of where you're going or want to end up. It's good even if it's a loose idea of what cards catch your eye like AMEX/Disco/Chase/BOA/etc. Everyone has that white whale of a card they covet so badly they burn multiple inquiries on over the years until they get invited in the club front doors.

The best thing to do is pick your whales and then read up on here about how to get them, compile some info on them like the specs to get approved, track how they do CLI's and then go out in the woods and find tree to sit in while you wait for it to start walking towards you. Set your sties on it, double check your info, take it off saftey, calm your breathing, and squeeze the trigger. Then snapshot it and post it on here ![]()

Some of it comes from leanring from others and other times it's just through experiences over time like closing a mortgage or two in a day vs sweating bullets on your first mortgage experience and making sure your I's and T's are in order.