- myFICO® Forums

- Types of Credit

- Credit Cards

- I need a recommendation on an everyday credit card...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I need a recommendation on an everyday credit card...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@longtimelurker wrote:

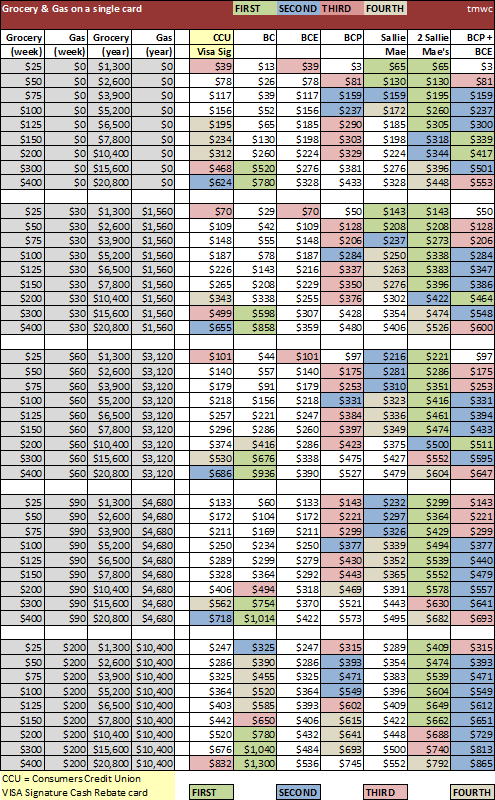

@Anonymous wrote:I think that the Sallie Mae CC will be my best bet! I spend about 75 each week in fuel. Maybe a bit more.

Would it still be worth it, even though Im going over the $250 limit?

Yes, you still get 1% on the amount over $250 per month, so the Sallie Mae is a good choice for your spend.

The best year round cash back fuel cards include Penfed Platinum Cash and Fort Knox, which both give 5%, but both are harder to get than many cards (Penfed being very conservative in particular)

You can always get 2 Sallie Mae's I think you have to wait 6 months between apps. That way you you can spend up to $500 a month and get the 5% back. Also the Sallie Mae Uppromise is a card that a lot people on here like.

Also the Sallie is 5% on groceries I am sure you buy groceries also.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'd have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

NPSL | $27,600 | $15,000 | $7,000 | $2,800 | $11,000 | $13,530 | $5,200

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@irrational wrote:The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'. d have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

I don't have the Sallie Mae nor would I get one I do think a little like you do I would rather have a two to three card combo than try and juggle 8 cards. I like to keep it simple,

I do understand why people recommended the Sallie Mae including myself is the OP stated he would put primarily gas on the card. I think differently I would rather put everything I can on my CC why not get rewards for things I am going to normally buy since I pay it off when the statement cuts anyway. Rarely do I carry a balance if I do it would only be for a cycle or two.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@irrational wrote:The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'd have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

Depends on what you mean by "everyday". It sounds like you mean "all sorts of purchases" whereas Sallie Mae lovers, Citi and Amex tend to mean groceries, gas (and drug stores). So for gas and groceries, extended warranty really doesn't apply much (and consumer protection also). There are price points where BCP is better than SM, but really not many.

On its own, SM provides year round amazon and bookstore coverage, the Freedom can equally be added to it to get Lowe's and dining coverage.

The love for Sallie Mae really is grounded in reality. It is a no Fee card that covers three widely used categories at 5%. The caps are fairly low, but are fine for many.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@longtimelurker wrote:

@irrational wrote:The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'd have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

Depends on what you mean by "everyday". It sounds like you mean "all sorts of purchases" whereas Sallie Mae lovers, Citi and Amex tend to mean groceries, gas (and drug stores). So for gas and groceries, extended warranty really doesn't apply much (and consumer protection also). There are price points where BCP is better than SM, but really not many.

On its own, SM provides year round amazon and bookstore coverage, the Freedom can equally be added to it to get Lowe's and dining coverage.

The love for Sallie Mae really is grounded in reality. It is a no Fee card that covers three widely used categories at 5%. The caps are fairly low, but are fine for many.

I Don't like the SM card ![]() They also hate me lol. Darn Barclay's sensitivity to inq's lol

They also hate me lol. Darn Barclay's sensitivity to inq's lol

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@Closingracer99 wrote:

@longtimelurker wrote:

@irrational wrote:The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'd have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

Depends on what you mean by "everyday". It sounds like you mean "all sorts of purchases" whereas Sallie Mae lovers, Citi and Amex tend to mean groceries, gas (and drug stores). So for gas and groceries, extended warranty really doesn't apply much (and consumer protection also). There are price points where BCP is better than SM, but really not many.

On its own, SM provides year round amazon and bookstore coverage, the Freedom can equally be added to it to get Lowe's and dining coverage.

The love for Sallie Mae really is grounded in reality. It is a no Fee card that covers three widely used categories at 5%. The caps are fairly low, but are fine for many.

I Don't like the SM card

They also hate me lol. Darn Barclay's sensitivity to inq's lol

Sounds like you were apping for cards from an issuer other than Barclays. No wonder they took offense!

But if you really want one at some stage, gardening should fix the inq problem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

Damn haha. I dont know which card to go with. I would be putting about 300 a month using fuel only on the card. Would a fuel only card be worth it?

Or should I take the other users advice and get a card that does less % back and goes more for everything? I could always use it for gorcerys etc etc....

I know, Im running your guys crazy by now Im sure. There is just too many options, hence me coming here and posting on which way to go...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@longtimelurker wrote:

@Closingracer99 wrote:

@longtimelurker wrote:

@irrational wrote:The love for the Sallie Mae card around here is crazy. You guys are in love with that thing, lol.

My 2-cents, for "everyday" purchases you're better off with Amex. The extended warranty, and their consumer protection are top notch. Hard to best that.

With the OP's score, he might be able to get his foot in the door with one of their charge cards (Green or PRG would be my recommendation). After 12 months, I'd app for the BCP and Chase Freedom, and close the Amex charge card before the first AF. With the combo of BCP plus Freedom, the OP would have ~4% CB on gas (3% half of the year with BCP, and 5% half the year on Freedom), plus 6% back on groceries, 3% back at department stores! And for a rotating quarter of the year he'd have 5% back at Amazon, Lowe's and eating out!

Just my 2-cents on what I've found has worked for me.

Depends on what you mean by "everyday". It sounds like you mean "all sorts of purchases" whereas Sallie Mae lovers, Citi and Amex tend to mean groceries, gas (and drug stores). So for gas and groceries, extended warranty really doesn't apply much (and consumer protection also). There are price points where BCP is better than SM, but really not many.

On its own, SM provides year round amazon and bookstore coverage, the Freedom can equally be added to it to get Lowe's and dining coverage.

The love for Sallie Mae really is grounded in reality. It is a no Fee card that covers three widely used categories at 5%. The caps are fairly low, but are fine for many.

I Don't like the SM card

They also hate me lol. Darn Barclay's sensitivity to inq's lol

Sounds like you were apping for cards from an issuer other than Barclays. No wonder they took offense!

But if you really want one at some stage, gardening should fix the inq problem.

Oh I know Just poking at my own expense ![]()

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

For Grocery and/or Gas purchase, its hard to beat a Sallie Mae for low spending in those categories. And you can apply for another after a few months, so that solves most spending patterns. The Bookstore category giving you 5% on amazon.com purchases is just icing on the cake.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I need a recommendation on an everyday credit card...

@Anonymous wrote:Damn haha. I dont know which card to go with. I would be putting about 300 a month using fuel only on the card. Would a fuel only card be worth it?

Or should I take the other users advice and get a card that does less % back and goes more for everything? I could always use it for gorcerys etc etc....

I know, Im running your guys crazy by now Im sure. There is just too many options, hence me coming here and posting on which way to go...

If you want to do $300 Gas only then actually the SM card would be better since you will earn $13 dollars in CB a month $12.50 for the first $250 you spend and then $0.50 for the rest of the $300 which would be $50.

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740