- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Interest on Annual fee

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Interest on Annual fee

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest on Annual fee

My DW has BCP and paying the AF. She got the card with 15 month APR at 0%.

I just saw the statement (cut date 3/29) and they charged $0.03 in interests. They charged AF on 3/29, so it is a 1 day interest for a charge done at the last day.

She has a balance, paying it down and will be at $0 when the 0% promo ends.

My question: is this normal? All cards with AF do this?

As she only has 2 years credit and no other card with AF and more than 12 months at 0%, so we didn't know that. After a chat with them, they said the charge is valid and tried to explain how things work. He pointed me to information about balance transfers and cash advances that charge fees in the first day. Told him that we guessed wrong that the AF will have a 'grace period' as other purchases.

For me is a bad way to do things, and for what? 3 cents? how about customer service? My DW paid several hundred dollars on 3/22, so if I undertand correctly, if the AF were charged before that date, then no interest will generate.

So she just paid the AF. We don't know if they will charge a few more days interest or not. Maybe they will charge $0.03 daily from 3/30 until this payment, like $0.12 more?

Anyway, if all lessons in life cost $0.03/$0.15 ... hehe

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

Bank Cards: NFCU Flagship Rewards $25K | NFCU Cash Rewards $20K |NFCU More Rewards Amex $17K | PenFed Power Cash $12.5K | PenFed Platinum Rewards $12.5K | PenFed Pathfinder Rewards $10K | PenFed Gold Card $7.5K | PayPal Cashback Mastercard $5K | Apple Card $3.5K

Store Cards: Bergdorf Goodman $10.5K | Neiman Marcus $7.5K | Care Credit $7K |

Scores: EX 656 | EQ 667 | TU 680

Goal Card: Amex Platinum (Amex IIB, waiting for 5 year mark)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@newhis wrote:My DW has BCP and paying the AF. She got the card with 15 month APR at 0%.

I just saw the statement (cut date 3/29) and they charged $0.03 in interests. They charged AF on 3/29, so it is a 1 day interest for a charge done at the last day.

She has a balance, paying it down and will be at $0 when the 0% promo ends.

My question: is this normal? All cards with AF do this?

As she only has 2 years credit and no other card with AF and more than 12 months at 0%, so we didn't know that. After a chat with them, they said the charge is valid and tried to explain how things work. He pointed me to information about balance transfers and cash advances that charge fees in the first day. Told him that we guessed wrong that the AF will have a 'grace period' as other purchases.

For me is a bad way to do things, and for what? 3 cents? how about customer service? My DW paid several hundred dollars on 3/22, so if I undertand correctly, if the AF were charged before that date, then no interest will generate.

So she just paid the AF. We don't know if they will charge a few more days interest or not. Maybe they will charge $0.03 daily from 3/30 until this payment, like $0.12 more?

Anyway, if all lessons in life cost $0.03/$0.15 ... hehe

Yes and I have the letter to back it up where they charged me .01 when my annual fee dropped all my Navy federal flagship credit card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@Saleen099, thank you.

I think this policy of charging the AF at closing date is bad for consumers:

- it can generate interest

- it can be reported as balance when someone want the card to be at $0 for score purposes

I'll chat with them again and I'll ask if they will be charging interests on April's statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@newhis wrote:

My question: is this normal? All cards with AF do this?

So she just paid the AF. We don't know if they will charge a few more days interest or not. Maybe they will charge $0.03 daily from 3/30 until this payment, like $0.12 more?

Anyway, if all lessons in life cost $0.03/$0.15 ... hehe

Just pay the $75 fee, plus the minimum payment, apart from whatever payment DW is making anyway during this statement cycle.

The way the payments work, the minimum payment is applied to lowest APR first, so that will applyl to the 0% APR, then amounts above the minimum payment apply to balances with highest APR, working down from there. So the additional $75 over the minimum payment should take out the AF from further interest. Then the larger payment bringing the balance down will apply to the 0% APR again.

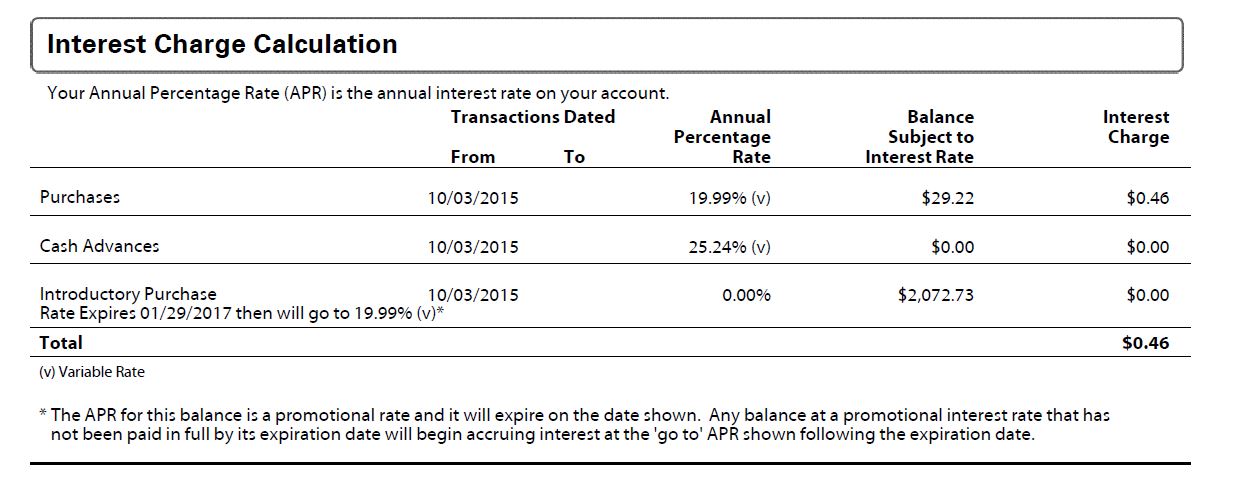

On my EDP first statement in October, they charged the AF at the end of the statement, then $.46 interest on the November statement.

The minimum payment from the October statement was $35. I paid $101 during November. The November statement showed a remaining balance on that Interest Charging amount of $29, which was then paid with the December payment more than the minimum.

Check the Interest Charge Calculation section of the statement.

This is from the November statement.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@newhis wrote:@Saleen099, thank you.

I think this policy of charging the AF at closing date is bad for consumers:

- it can generate interest

- it can be reported as balance when someone want the card to be at $0 for score purposes

I'll chat with them again and I'll ask if they will be charging interests on April's statement.

How much of a score impact would this have if someone is trying to zero a $75 or $95 balance ![]()

The AF is charged on the closing date of the statement because that is when the computer goes through all the processing of generating the statement:

Listing of charges, and a total

Listing of payments, and a total

Calculation of any interest charges, and add to statement

Calculation / trigger of any Annual Fee, and add to statement (as a purchase outside any promotional APR arrangements)

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@NRB525, thank you, will do that.

My DW didn't get a CLI at activation, so she paid in full the first and second statement, so the AF last year didn't generated any interest.

Just did a chat with them again asking if they will generate interest for March 30 and 31, and April 01 (DW paid AF April 02), and the CSR was kind enough to remove the interest and said that there will be no more interest for the Annual fee. I'll report back if anything changes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interest on Annual fee

@NRB525 wrote:

How much of a score impact would this have if someone is trying to zero a $75 or $95 balance

The AF is charged on the closing date of the statement because that is when the computer goes through all the processing of generating the statement:

Listing of charges, and a total

Listing of payments, and a total

Calculation of any interest charges, and add to statement

Calculation / trigger of any Annual Fee, and add to statement (as a purchase outside any promotional APR arrangements)

I know ![]() just saying. I know is a computer thing, but the 'emotional damage' for paying interest when you have never paid a cent in interest is huuuuuge

just saying. I know is a computer thing, but the 'emotional damage' for paying interest when you have never paid a cent in interest is huuuuuge ![]() j/k

j/k

This was not a big deal and just wanted to post because I didn't know that this will happen and I like learning all the little details on the 'credit game'.