- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Largest balance transfer?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Largest balance transfer?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

@ryanbush wrote:

@youngandcreditwrthy wrote:

Thanks for the concern and advice everyone.

@oscar_actuary: I will look into that boa card.

I have no problem paying off my debt. If I see that I have no other outlet to bt or skim by with another 0% offer, I will reduce debt accordingly. Why just today, I paid another $1,000 on Amex lol...

I'm actually proud of myself for never defaulting on any credit card, ever. Period. To me, organizing and paying my cc bills is a little too much fun; I'm a finance nerd.

I'm obviously in a transitional period credit wise i.e. cutting lines, reducing debt. I'm taking these measures to ensure a better future for my creditworthiness. Lol

And for the record, I've been out of REITs for MONTHS! Once they start cutting those huge dividends, I bailed. Ain't nobody got time for losin' money!

It is worth noting that I made a few hundred dollars just by having about $10,000 worth of cc balances at 0%. :-)

And when you all say that the 3-5%fee compounds the debt when you do it...

Here's my perspective:

A. I always pay WAY more than the min pmt-

B. if you're using a 0% for purchases, and you have cash avail to pay a diff balance, you can AVOID that 3% fee.

C. Why would anyone continuously transfer balances and pay a fee every single time and only pay the minimum? You think I got to $170k in cred by "just paying the min"

Wth.

Please excuse those horendous assumptions. I didn't get all this cred by paying the mins and continuously xferring balances year after year. I have a credit history of paying balances IN FULL, even if not every month.

Lastly, my FICO may not be 850 or even 750 quite yet, and maybe I do have a larger debt burden than most folks my age- but I'm doin' alright :-pNot to sound like a broken record but I don't believe you got all of that credit by paying more than the minimum, you got most of that credit by fudging your income on your applications.

I think that is the point of most of the people here, if you really had the income you put on your applications you wouldn't have a problem paying down your credit card debt.

I'm not going to say anything bad about you carry debt, I charged about 25k in May for wedding/honeymoon stuff and carried that balance at 0% for most of the summer. but with less income than you as well as a truck payment/house payment and wife in college I was still able to pay 5k/month on my balance until it was paid off

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

@FinStar wrote:

@ryanbush wrote:

@youngandcreditwrthy wrote:

Thanks for the concern and advice everyone.

@oscar_actuary: I will look into that boa card.

I have no problem paying off my debt. If I see that I have no other outlet to bt or skim by with another 0% offer, I will reduce debt accordingly. Why just today, I paid another $1,000 on Amex lol...

I'm actually proud of myself for never defaulting on any credit card, ever. Period. To me, organizing and paying my cc bills is a little too much fun; I'm a finance nerd.

I'm obviously in a transitional period credit wise i.e. cutting lines, reducing debt. I'm taking these measures to ensure a better future for my creditworthiness. Lol

And for the record, I've been out of REITs for MONTHS! Once they start cutting those huge dividends, I bailed. Ain't nobody got time for losin' money!

It is worth noting that I made a few hundred dollars just by having about $10,000 worth of cc balances at 0%. :-)

And when you all say that the 3-5%fee compounds the debt when you do it...

Here's my perspective:

A. I always pay WAY more than the min pmt-

B. if you're using a 0% for purchases, and you have cash avail to pay a diff balance, you can AVOID that 3% fee.

C. Why would anyone continuously transfer balances and pay a fee every single time and only pay the minimum? You think I got to $170k in cred by "just paying the min"

Wth.

Please excuse those horendous assumptions. I didn't get all this cred by paying the mins and continuously xferring balances year after year. I have a credit history of paying balances IN FULL, even if not every month.

Lastly, my FICO may not be 850 or even 750 quite yet, and maybe I do have a larger debt burden than most folks my age- but I'm doin' alright :-pNot to sound like a broken record but I don't believe you got all of that credit by paying more than the minimum, you got most of that credit by fudging your income on your applications.

I think that is the point of most of the people here, if you really had the income you put on your applications you wouldn't have a problem paying down your credit card debt.

I'm not going to say anything bad about you carry debt, I charged about 25k in May for wedding/honeymoon stuff and carried that balance at 0% for most of the summer. but with less income than you as well as a truck payment/house payment and wife in college I was still able to pay 5k/month on my balance until it was paid off

did I miss out on something? ![]()

Anyhow.......@young, It was mentioned that you had been moving debt around by playing around with a few BTs in the past, so I am not too sure what's been used, and what's left. I doubt Citi will extend you any credit either considering how they just took AA against you, so the Simplicity is out of the question.

The only real good offer left is the Slate. You could also try checking out some credit unions......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

He can't do Slate because his Freedom is maxed out.

FinStar was responding to the bold comments on income and paying min pyts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

I have no mortgage or auto loan debt.

Citi can suck it; I wouldn't app for a Citi product if my life depended on it.

As far as Chase is concerned, I considered paying that whole $4,465 balance on Freedom then apping for Slate and xferring the limit, but I still have til end of Nov to decide.

I'll admit, I don't have $16,000 to retire all cc debt, but I have $8000 to apply towards it, which would be enough to reduce that Chase util and convince another creditor to extend me some cheap cred.

Am I the only one that gets time value of money?

HELLLO...

Even 1% is greater than 0%.

And that isn't fudging income necessarily Ryan..CARD Act allows it arguably. This is my final response to that broken record sounding accusation bro.

Just lemme use your folks' Centurion card and all will be well ☝👌😏

In Fact, I don't believe you on that fromt. Show me? Lol 😉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

No one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

@youngandcreditwrthy wrote:

Omg. 😔😣😳😠Did anyone read the fact that I've been making MULTI THOUSAND DOLLAR PAYMENTS?

I have no mortgage or auto loan debt.

Citi can suck it; I wouldn't app for a Citi product if my life depended on it.

As far as Chase is concerned, I considered paying that whole $4,465 balance on Freedom then apping for Slate and xferring the limit, but I still have til end of Nov to decide.

I'll admit, I don't have $16,000 to retire all cc debt, but I have $8000 to apply towards it, which would be enough to reduce that Chase util and convince another creditor to extend me some cheap cred.

Am I the only one that gets time value of money?

HELLLO...

Even 1% is greater than 0%.

And that isn't fudging income necessarily Ryan..CARD Act allows it arguably. This is my final response to that broken record sounding accusation bro.

Just lemme use your folks' Centurion card and all will be well ☝👌😏

In Fact, I don't believe you on that fromt. Show me? Lol 😉

Please show me one place in the CARD Act that says you can claim your parents income + your income on applications. If that was the case every college kid would have 20k+ credit lines.

Yeah let me take a picture of my dads centurian card and send it to a stranger, sounds like a good idea at first right?

I'm normally the only guy in this whole place that is in your court but come on, everytime you post it's the same story about how your carrying 8-10k in credit card debt. if you're earning interest and you have the cash to back the debt then pay off the debt, churn some 0% cards and cash out the balance you need an re-invest it.

Every card I have seen has the ability to cash out the CL to your bank account or a check for balance transfters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

@youngandcreditwrthy wrote:

And who said anything w me having a problem paying down debt? Lol

No one.

If you don't have a problem then quit asking how to BT it and just pay it off... easy peasy...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

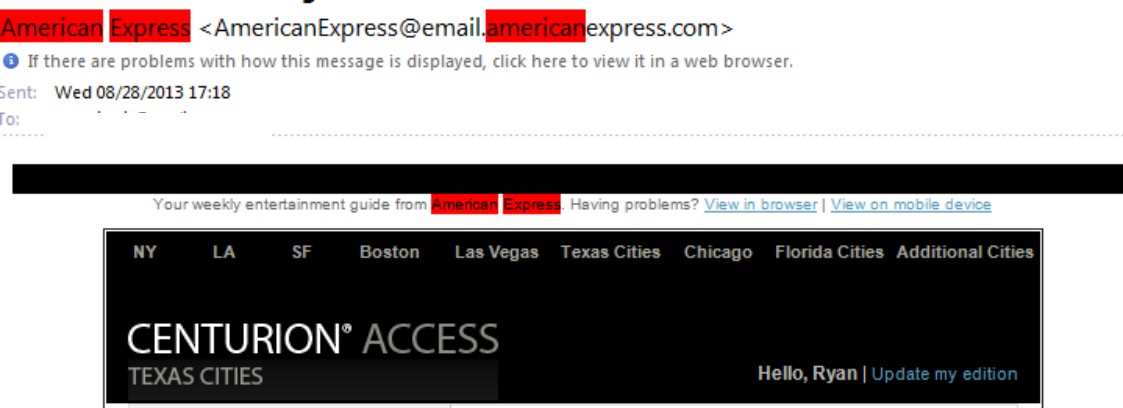

Funny that just after you asked me for proof of a Centurian Card i noticed this in my email... maybe a little excerpt of a screen shot will ease your worries...

in all reality though a Centurian Card is not that hard to get, especially the business version... just spend money and be willing to pay the AF.

EDIT: Just to disclose I added this with my full name and email address as to curtail any suspicions that it was fake, a moderator edited it to remove my email address after consulting with me. I will happily remove the image if it violates any terms.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

@youngandcreditwrthy wrote:

I'll admit, I don't have $16,000 to retire all cc debt, but I have $8000 to apply towards it, which would be enough to reduce that Chase util and convince another creditor to extend me some cheap cred.

I just want to point out that that isn't exactly a small number. People often focus only on utilisation, but the dollar amount is also important.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Largest balance transfer?

It amazes me how much some of you guys make... I work 40 hours a week and care a ton more about my job and the clients I have than most of my managers, yet I get paid 25% what they do. Funny how they get paid well and not fired because I pull their butts out of the fire on a very regular basis...

In fact one left some money unlocked last night, but the other managers make us just lock it up and stay quiet about it. Kinda annoying. Last time I left money in the wrong LOCKED drawer I got written up. LOL

(1200 a month, 14400 a year income)

| Current: EQ FICO 0, TU FICO 0, EX FICO 0 | Starting Score: 0 (08/21/2013) Starting total revolving credit: $0 | Current total revolving credit: $1600.00 Inquiries (12 Months): EQ 3-4 TU Unsure EX Unsure | Most Recent: 8/19/2013 | Mechanically Sound Car | Fifth Third $300 U.S. Bank Harley Davidson $300 Capital One Platinum $500 2nd Capital One Platinum $500 |