- myFICO® Forums

- Types of Credit

- Credit Cards

- Local Minnesota Credit Union offering 2% Cash Back...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

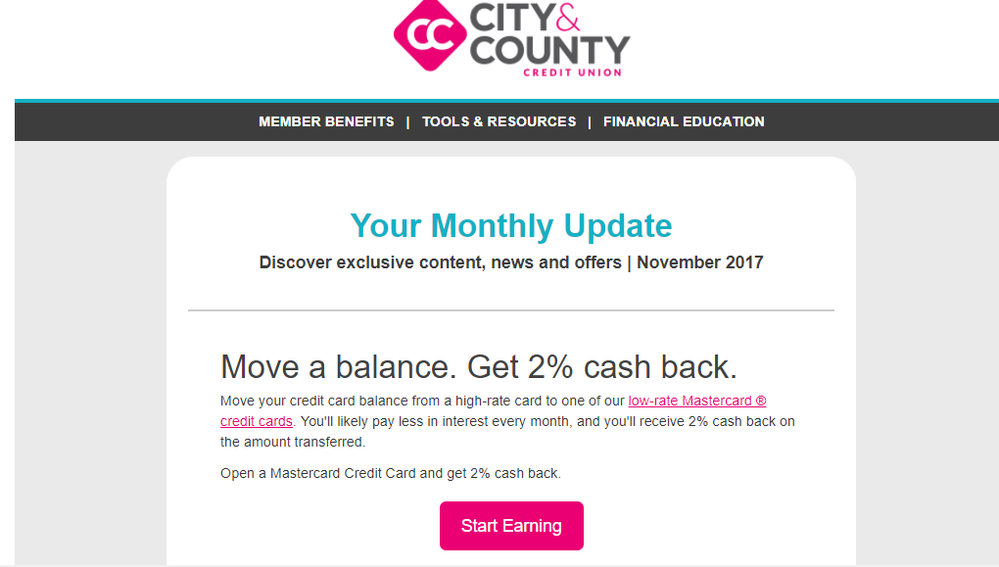

Local Minnesota Credit Union offering 2% Cash Back on all balance transfers!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Local Minnesota Credit Union offering 2% Cash Back on all balance transfers!

Credit Union offering 2% Cash Back on all balance transfers! I don't think i've really ever seen a lender offer cash back on a balance transfer before! Membership is limited to a handful of counties (Ramsey, Washington or Dakota County) and a few specific cities outside of those counties (Maple Grove, Osseo, and Plymouth) in the Minneapolis/St Paul metro area though and AFAIK there is no backdoor method or organization you can donate to become to eligible to join.

https://www.cccu.com/news-promotions

Kohl's Credit Card $3000 Limit (Opened October 2016) Survived Bankruptcy for whatever reason

Closed Capital One Venture One $3000 Limit (Opened December 2020, Closed by me September 2022 since I wanted the SavorOne and couldn't product change to it)

Capital One Auto Loan (Opened March 2021)

Capital One Cabela's $5000 Limit (Opened December 2021)

America First Credit Union Visa $1000 Limit (Opened December 2021)

Capital One SavorOne $5000 Limit (Opened September 2022)

Sam's Club Mastercard Synchrony Bank $2500 Limit (Opened March 30 2023) (Burned Synchrony in my CH7 BK, One card with a $745 balance)

Idaho Central Credit Union ICCU Visa $10,000 Limit (Opened April 2023)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Local Minnesota Credit Union offering 2% Cash Back on all balance transfers!

Except the small print says you willl lose no matter how you skin the cat:

So, you can't pay it off right away so you have to pay at least a month's interest starting at 10.99%...where's the deal?

APR= Annual Percentage Rate. 2% cash back promotion will apply to net purchases made between 10/1/17 through 12/31/17 for all new accounts opened from 10/1/17 to 12/31/17 or existing Platinum Reward cardholders that opt in, excludes regular Platinum cardholders. The cash back rate will return to 1% cash back on net purchases after 12/31/17. 2% Balance transfer promotion ends 12/31/17 and excludes transfers from CCCU Loan Accounts. Balance Transfer rebate will be deposited to the share account by 1/31/18 and any balance transfers paid in full by 12/31/17 will not be eligible. Cash advance fee is 2% or a $2.00 minimum. Foreign Transaction fee is 1% of each transaction in U.S. dollars. See MasterCard Credit Card Terms & Conditions for complete details. Excludes Business Credit Cards. Paid in full by 01/31/18 will not be eligible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Local Minnesota Credit Union offering 2% Cash Back on all balance transfers!

@Anonymous wrote:Except the small print says you willl lose no matter how you skin the cat:

So, you can't pay it off right away so you have to pay at least a month's interest starting at 10.99%...where's the deal?

APR= Annual Percentage Rate. 2% cash back promotion will apply to net purchases made between 10/1/17 through 12/31/17 for all new accounts opened from 10/1/17 to 12/31/17 or existing Platinum Reward cardholders that opt in, excludes regular Platinum cardholders. The cash back rate will return to 1% cash back on net purchases after 12/31/17. 2% Balance transfer promotion ends 12/31/17 and excludes transfers from CCCU Loan Accounts. Balance Transfer rebate will be deposited to the share account by 1/31/18 and any balance transfers paid in full by 12/31/17 will not be eligible. Cash advance fee is 2% or a $2.00 minimum. Foreign Transaction fee is 1% of each transaction in U.S. dollars. See MasterCard Credit Card Terms & Conditions for complete details. Excludes Business Credit Cards. Paid in full by 01/31/18 will not be eligible.

Awwww dang I missed that. Welp I suppose if your balance transferring from a higher APR card it could be somewhat of a win sort of (but not really, you'd be much better off finding a card with a 0% APR introductory offer on BTs like Chase Slate and BT'ing to that instead)

But not being able to pay it off immediately and avoid interest makes this SIGNIFICANTLY less of a good deal then I initially thought it was.

Kohl's Credit Card $3000 Limit (Opened October 2016) Survived Bankruptcy for whatever reason

Closed Capital One Venture One $3000 Limit (Opened December 2020, Closed by me September 2022 since I wanted the SavorOne and couldn't product change to it)

Capital One Auto Loan (Opened March 2021)

Capital One Cabela's $5000 Limit (Opened December 2021)

America First Credit Union Visa $1000 Limit (Opened December 2021)

Capital One SavorOne $5000 Limit (Opened September 2022)

Sam's Club Mastercard Synchrony Bank $2500 Limit (Opened March 30 2023) (Burned Synchrony in my CH7 BK, One card with a $745 balance)

Idaho Central Credit Union ICCU Visa $10,000 Limit (Opened April 2023)