- myFICO® Forums

- Types of Credit

- Credit Cards

- More Capital One Negativity

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

More Capital One Negativity

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

I just posted an interested story about CapOne. I am a "new" member here. Have been reading for months but just signed up today. I couldn't figure out how to quote/share my post, so I am linking to the post. It's long and near the bottom of page 3 ![]()

http://ficoforums.myfico.com/t5/Credit-Cards/Next-step-Capital-One-CLI/td-p/2693067/page/3

Long story short I have 12 months of credit history and CapOne just soft pulled a CLI on my Platinum card from $1800 to $4800!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@One7 wrote:

@wacdenney wrote:Capital One is the best sub-prime lender in the business, but I think there comes a time when it just makes sense to move on. When I closed my first Cap1 card I struggled with the descision because I wanted to give back to the company that had been there for me, but the bottom line is that they just don't care so I don't think we should either. It's just business and their business model works for them and you have to make your business model work for you. I think that simply means once you are out of sub-prime territory you drop the sub-prime lenders and move on.

+1

I have to disagree. Cap One is not sub prime. Please do not put them on the level of first premier, credit one, merrick bank. I'm not 100% sure but like 99% sure all of those lenders only have af cards. They don't offer intro promo rates. Their websites suck and the cards have little to almost no rewards. Yes it's 3 hp for cap one but no hp for cli so it evens out overtime.

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@mikedboh wrote:I just posted an interested story about CapOne. I am a "new" member here. Have been reading for months but just signed up today. I couldn't figure out how to quote/share my post, so I am linking to the post. It's long and near the bottom of page 3

http://ficoforums.myfico.com/t5/Credit-Cards/Next-step-Capital-One-CLI/td-p/2693067/page/3

Long story short I have 12 months of credit history and CapOne just soft pulled a CLI on my Platinum card from $1800 to $4800!

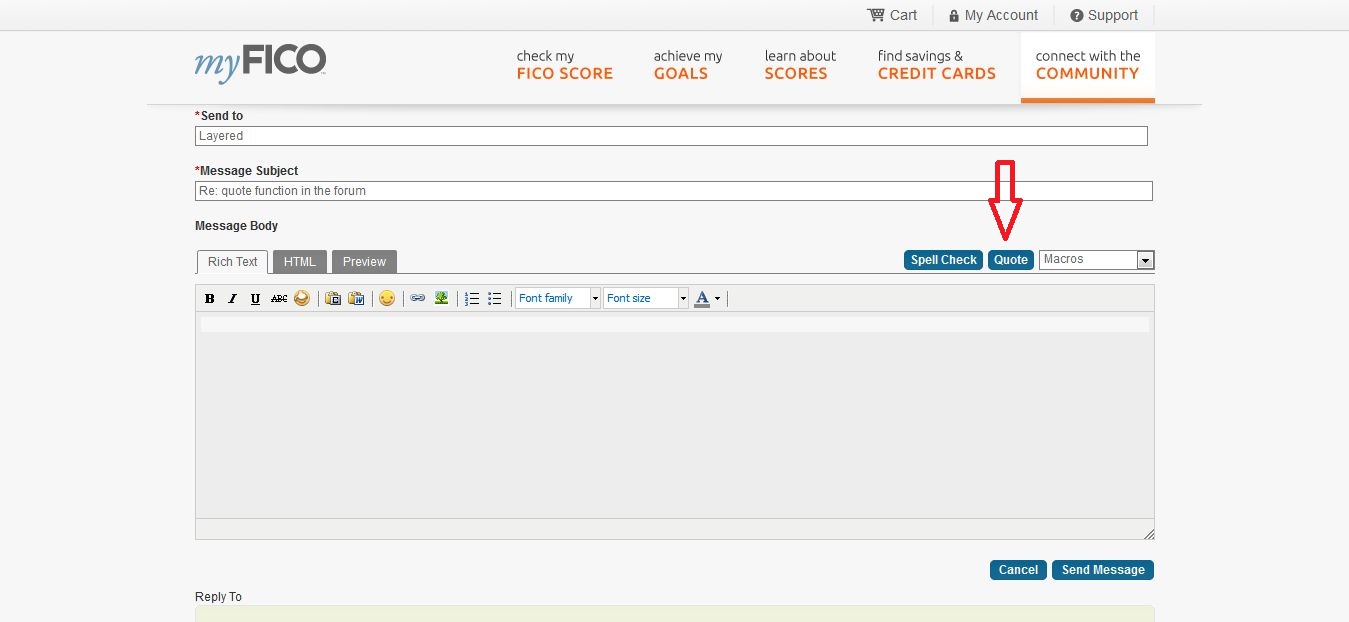

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar near the macro button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@keithB wrote:I plan on keeping Capital One around, even if I only get a "meagar" CL. Capital One was instrumental in getting me restarted on my return to good credit - for that I'm grateful. But loyalty is a rare thing these days. Most are into "what have you done for me lately". There is plenty of room in my sock drawer if Capital One can't find a home in my wallet. Just my 2¢.

How is sock drawring Cap one showing Loyality? lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@bigblue7722 wrote:

@One7 wrote:

@wacdenney wrote:Capital One is the best sub-prime lender in the business, but I think there comes a time when it just makes sense to move on. When I closed my first Cap1 card I struggled with the descision because I wanted to give back to the company that had been there for me, but the bottom line is that they just don't care so I don't think we should either. It's just business and their business model works for them and you have to make your business model work for you. I think that simply means once you are out of sub-prime territory you drop the sub-prime lenders and move on.

+1

I have to disagree. Cap One is not sub prime. Please do not put them on the level of first premier, credit one, merrick bank. I'm not 100% sure but like 99% sure all of those lenders only have af cards. They don't offer intro promo rates. Their websites suck and the cards have little to almost no rewards. Yes it's 3 hp for cap one but no hp for cli so it evens out overtime.

Hmm Maybe we should call Cap One Semi Prime..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@fot1 wrote:

@bigblue7722 wrote:

@One7 wrote:

@wacdenney wrote:Capital One is the best sub-prime lender in the business, but I think there comes a time when it just makes sense to move on. When I closed my first Cap1 card I struggled with the descision because I wanted to give back to the company that had been there for me, but the bottom line is that they just don't care so I don't think we should either. It's just business and their business model works for them and you have to make your business model work for you. I think that simply means once you are out of sub-prime territory you drop the sub-prime lenders and move on.

+1

I have to disagree. Cap One is not sub prime. Please do not put them on the level of first premier, credit one, merrick bank. I'm not 100% sure but like 99% sure all of those lenders only have af cards. They don't offer intro promo rates. Their websites suck and the cards have little to almost no rewards. Yes it's 3 hp for cap one but no hp for cli so it evens out overtime.

Hmm Maybe we should call Cap One Semi Prime..

Definition of 'Subprime Lender'

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

This is why i never apped for a Capital one card even though they would probably taken me where Chase, Bank of America , and City has declined me. They have been sending me pre-screened apps for the quicksilver card like one or 2 every week and just shred them every time lol

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

They're not in business to keep us happy. If anything, we keep them in business. I agree with others - if it doesn't suit your needs, shut it down I'm now a former CapOne card holder for many of the same CLI issues that have been mentioned in this thread. They gave me my rebuild start like many others and I'm grateful for them as a company and they do serve a purpose. However, it's safe to say that some outgrow their offerings. Me leaving was not a personal matter as much as I felt it was, just smart business when it comes to not wanting to pay them an annual fee to keep them in my wallet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

@wacdenney wrote:

@fot1 wrote:

@bigblue7722 wrote:

@One7 wrote:

@wacdenney wrote:Capital One is the best sub-prime lender in the business, but I think there comes a time when it just makes sense to move on. When I closed my first Cap1 card I struggled with the descision because I wanted to give back to the company that had been there for me, but the bottom line is that they just don't care so I don't think we should either. It's just business and their business model works for them and you have to make your business model work for you. I think that simply means once you are out of sub-prime territory you drop the sub-prime lenders and move on.

+1

I have to disagree. Cap One is not sub prime. Please do not put them on the level of first premier, credit one, merrick bank. I'm not 100% sure but like 99% sure all of those lenders only have af cards. They don't offer intro promo rates. Their websites suck and the cards have little to almost no rewards. Yes it's 3 hp for cap one but no hp for cli so it evens out overtime.

Hmm Maybe we should call Cap One Semi Prime..

Definition of 'Subprime Lender'

A type of lender that specializes in lending to borrowers with a tainted or limited credit history. Subprime lending is more concentrated in a smaller number of large lenders than prime lending. The subprime loan market is more tiered compared to the prime loan market, where terms and rates vary little between borrowers.There is nothing wrong with servicing this market and Capital One has been VERY successful in doing so. They have clearly helped soo many, including myself, in the quest to restore our tainted credit histories. I do not use the term in a derogatory manner and I do not deny that there are cases where they do attempt to cross over with prime products. That just isn't their speciality.I do think the term "subprime" is fitting as I struggled with the descision to close my first card with them. I wanted desperately to do my part. They had been there and helped me claw my way up out of the gutter and I wanted to give back. I honestly felt a sentimental attachment to the card. It had been in my wallet for years and it was an important part of my life.I think the problem I had was in trying to assign human characteristics to a billion dollar corporation. Capital One does not experience feelings. You are an account number to them, not a relationship. Their interactions with you have nothing to do with any sense of loyalty. It is about dollars and cents and statistics. They do what works for them to meet their financial goals and we have to look at it in the same way.Once I started getting 3% on gas, 2% on dining, 5% in rotating categories, 1% on everything, etc... The QS1 simply no longer makes sense for my financial situation. I start out $39.00 in the hole and with the amount of spending I do on "everything else" that means the card costs me money to carry. Yes, I can jump through hoops for the EO every year and get that waived for one more year but with my busy lifestyle it's simply not worth it to me. You simply have to decide what works for your financial plan and your life and look at it objectivly. They do NOT bend over backwards to maintain relationships and you shouldn't either. If the card works for you and fits into your plan then use it like most all of us have at one point or another. Then when it no longer serves you, drop it.

I have gotten mine removed for good with one phone call.

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: More Capital One Negativity

I have gotten mine removed for good with one phone call.

I intend to try one last time this year in December right before the AF hits. The last one I closed after the third try but it was a former Orchard card and I just finally gave up trying. I am hoping that since I have lessened my exposure to them I can get a real CLI when my 6 months hits next month. That will likely determine how seriously I take the effort in December.

I am honestly going to hate it if I am forced to close it. I have 3+ years of perfect payment history behind it and it was my first card back in the "game". But oh well, year after year I have tried and remained loyal after they refused to remove it and now it's their turn to step up to the plate. I simply am not willing to jump through their hoops anymore and starting out $35.00 in the hole simply doesn't work for me.

I MAY even come back and reapply at some point but I seriously doubt it. I simply don't spend enough on "everything else" to make 1.5% worth the hassle it takes to deal with them. Now if I could keep the card I have I would certainly use it when needed, but I can't imagine what situation would cause me to justify 3 HPs for the card.