- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: My Balances - Thoughts?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My Balances - Thoughts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Balances - Thoughts?

Hi all,

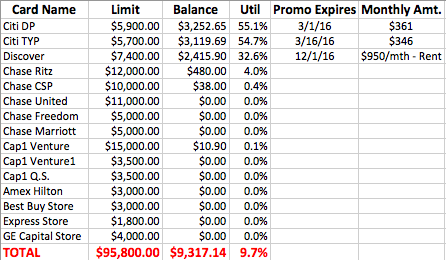

I wanted to share my current credit card balances to get your opinions.

I'm scared that having such high utilization on my citi cards might spook Chase? Especially with all the current chatter going on with them.

What are your thoughts on my utilization?

**The discover balance I put 3 months worth of rent a bit ago on it - thus I just pay what I normally would on the discover. (Had to meet a spend requirement on the Marriott - and BT'd at 4% the amount on this card for 3 months)

Anyways - your opinions are greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Balances - Thoughts?

@Jansroom726 wrote:Hi all,

I wanted to share my current credit card balances to get your opinions.

I'm scared that having such high utilization on my citi cards might spook Chase? Especially with all the current chatter going on with them.

What are your thoughts on my utilization?

**The discover balance I put 3 months worth of rent a bit ago on it - thus I just pay what I normally would on the discover. (Had to meet a spend requirement on the Marriott - and BT'd at 4% the amount on this card for 3 months)

Anyways - your opinions are greatly appreciated.

10% overall. You are fine. No sweet.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Balances - Thoughts?

The Citi balances are pretty high - but you're paying almost $400 a month toward each one? That should go down pretty fast, I wouldn't worry in that case. If you were just paying the minimum, Chase might start to notice you. Other than that, my thoughts are just that $9k is probably as high as you want to go in revolving debt. It can start to get problematic to pay off, leading to minimum payments or ballooning balances.

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Balances - Thoughts?

@Bman70 wrote:

The Citi balances are pretty high - but you're paying almost $400 a month toward each one? That should go down pretty fast, I wouldn't worry in that case. If you were just paying the minimum, Chase might start to notice you. Other than that, my thoughts are just that $9k is probably as high as you want to go in revolving debt. It can start to get problematic to pay off, leading to minimum payments or ballooning balances.

+1

Also it looks like you are going to have some high AF coming up. Ritz not waived the first year $395.

45K income and $700+ in AFs don't make much sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My Balances - Thoughts?

if you keep over three times the minimum payment, for each bill, you should be safe for a little while. Try to avoid adding any more balances to other cards.