- myFICO® Forums

- Types of Credit

- Credit Cards

- NFCU Amex Master thread. All posts go here

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU Amex Master thread. All posts go here

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@nelg727 wrote:I wonder if we can do a product change to the new AMEX card?

Someone reported in a different thread that product changes will not be allowed to this card. Guess we will find out for sure today because undoubtedly someone will want to do exactly that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@MrDisco99 wrote:

@CreditCuriousity wrote:Understand some people are excited for this card, especially if you can't get in with Centurion bank.. To me the card is MEH at best. Other peoples thoughts?

Full available for me to apply for on their site showing up just fine, just no reason for me to grab it at this time or possibly ever

I can understand wanting to get in with Centurion bank, but what's the draw of just being on the Amex network? If anything that's a disadvantage vs. V/MC, no?

So I don't have to borrow my Mom's Amex when I want Amex presale tickets to a concert. LOL.

I want this card but I was really hoping for some kind of bonus or BT offer :-/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@Anonymous wrote:

@MrDisco99 wrote:

@CreditCuriousity wrote:Understand some people are excited for this card, especially if you can't get in with Centurion bank.. To me the card is MEH at best. Other peoples thoughts?

Full available for me to apply for on their site showing up just fine, just no reason for me to grab it at this time or possibly ever

I can understand wanting to get in with Centurion bank, but what's the draw of just being on the Amex network? If anything that's a disadvantage vs. V/MC, no?

It makes the Amex offers that give discounts and extra MR points available to you. The offers are open for any Amex card.

So you can get Amex offers and MR points on non-Centurion cards!? I did not know that...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@MrDisco99 wrote:

@Anonymous wrote:

@MrDisco99 wrote:

@CreditCuriousity wrote:Understand some people are excited for this card, especially if you can't get in with Centurion bank.. To me the card is MEH at best. Other peoples thoughts?

Full available for me to apply for on their site showing up just fine, just no reason for me to grab it at this time or possibly ever

I can understand wanting to get in with Centurion bank, but what's the draw of just being on the Amex network? If anything that's a disadvantage vs. V/MC, no?

It makes the Amex offers that give discounts and extra MR points available to you. The offers are open for any Amex card.

So you can get Amex offers and MR points on non-Centurion cards!? I did not know that...

No, I was incorrect in my post. You can get the savings offer such as spend $50/get $15 credit at XYZ, but not the MR earning ones as only Centurion issued cards earn MR points. Sorry for the mistake and I will edit my prior post.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

My quick assessment of the new NFCU More Rewards:

-- I wish it were Visa instead of Amex. It will be mostly useless overseas.

-- I wish it had a signup bonus. It doesn't, even though NFCU has offered signup bonuses on other cards recently.

-- I am disappointed to see that the rewards program is being run by TSYS, the same vendor who runs the Flagship Rewards and Go Rewards programs. I had hoped that part of the NFCU-Amex deal would be to use Amex's LoyaltyEdge subsidiary to design a new and innovative rewards program for NFCU. That didn't happen.

-- The 3% for both groceries and gas is a wee bit better than the Amex BCE which gives 3% for groceries and 2% for gas.

-- The new card has a high minimum redemption, $50. At my rate of spending, $3000 groceries and $300 gas per year, I would only be able to redeem once every 6 or 7 months. High minimum redemptions are what soured me on both Go Rewards ($50) and Amex BCE ($25) last year. I prefer the NFCU cashRewards redemption policy of any amount any time.

-- Rewards are based on "points" which can be devalued. The points can't be combined across other NFCU cards.

-- The overall rewards redemption scheme (travel, merchandise, gift cards, pay with points, cash back) is every bit as complicated as Go Rewards, despite the bold press release in May 2017 that this card would have a simple, easy to understand rewards program. In fact, More Rewards looks like almost a carbon copy of Go Rewards with groceries substituted for dining as the lead bonus category.

My verdict: I'm going to pass on the More Rewards card. I'll continue to use PenFed Power Cash Rewards for groceries and gas. Although I'll earn 2% on Power Cash vice 3% on More Rewards, the dollar difference will only be $33 a year, too low an amount to endure the hassle of managing More Rewards.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@CreditCuriousity wrote:

@UpperNwGuy wrote:

@mrldp40 wrote:Anyone been approved yet?

I may be mistaken, but if I remember correctly, NFCU never gives same day approvals.

Mistaken.. Many instant approvals with NFCU

INSTANT DENIALS TOO![]()

![]() ............I will try for this one down the road..just approved for CLI and new Plat card 8-18....TILLING THE GARDEN

............I will try for this one down the road..just approved for CLI and new Plat card 8-18....TILLING THE GARDEN

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New NFCU Amex

@Anonymous wrote:

@jacetx wrote:It's live guys! Too bad there is no sign up bonus

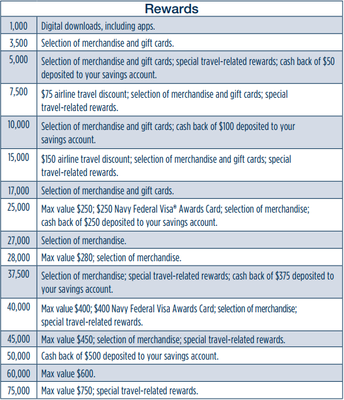

Below are the redemption options.

I read that there is a 25000 point bonus after $3000 spend in first three months. For new cards before 12/31/17 I believe it was.

I saw the same sign up bonus in the mobile app but can't find it now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU Amex Master thread. All posts go here

@UpperNwGuy wrote:My quick assessment of the new NFCU More Rewards:

-- I wish it were Visa instead of Amex. It will be mostly useless overseas.

-- I wish it had a signup bonus. It doesn't, even though NFCU has offered signup bonuses on other cards recently.

-- I am disappointed to see that the rewards program is being run by TSYS, the same vendor who runs the Flagship Rewards and Go Rewards programs. I had hoped that part of the NFCU-Amex deal would be to use Amex's LoyaltyEdge subsidiary to design a new and innovative rewards program for NFCU. That didn't happen.

-- The 3% for both groceries and gas is a wee bit better than the Amex BCE which gives 3% for groceries and 2% for gas.

-- The new card has a high minimum redemption, $50. At my rate of spending, $3000 groceries and $300 gas per year, i would only be able to redeem once every 6 or 7 months. High minimum redemptions are what soured me on both Go Rewards ($50) and Amex BCE ($25) last year. I prefer the NFCU cashRewards redemption policy of any amount any time.

-- Rewards are based on "points" which can be devalued. The points can't be combined across other NFCU cards.

-- The overall rewards redemption scheme (travel, merchandise, gift cards, pay with points, cash back) is every bit as complicated as Go Rewards, despite the bold press release in May 2017 that this card would have a simple, easy to understand rewards program. In fact, More Rewards looks like almost a carbon copy of Go Rewards with groceries substituted for dining as the lead bonus category.

My verdict: I'm going to pass on the More Rewards card. I'll continue to use PenFed Power Cash Rewards for groceries and gas. Although I'll earn 2% on Power Cash vice 3% on More Rewards, the dollar difference will only be $33 a year, too low an amount to endure the hassle of managing More Rewards.

+1!!

I already get 3% groceries with BCE hitting the $25 threshold only spending $834 with NFCU would have to spend $1,667.

Plus I get 5% on gas with USAA Amex.

Plus I get 2.5% on everything else with my other USAA card.

This card will be attractive to some, but it is a dud for me.

I really wished it had been (1) a Cash Back card because understanding points and their cash equivalent value is difficult for me, and (2) competitive with the USAA Limitless.