- myFICO® Forums

- Types of Credit

- Credit Cards

- Need a non-cobranded World MC with CB rewards...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Need a non-cobranded World MC with CB rewards...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@CreditDunce wrote:Doesn't your SM report as a flexible spend account? The only other MC I have that reports as a flexible spend is a local CU card. It isn't a true cash back card, though.

It sure does, but I'm looking for a non-cobranded card.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@thelethargicage wrote:

@TiggerDat wrote:How about the Voice card from Huntington? it's a WMC.

I don't live in their service area, plus I try to avoid smaller issuers/CUs. Thanks for your input, though.

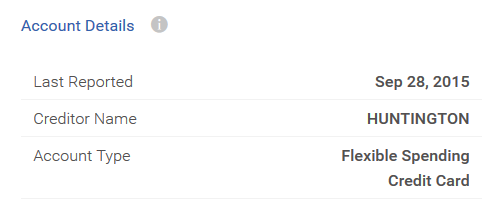

There is a work around to this by opening a checking account. You might get denied for not being in their service, as I did, but then you might also get an email or call from someone trying to retain/coax you into getting the account, as they did with me. There are times where they offer up to $250 for opening an account, without direct deposity, but with certain levels of deposits. I got $150 for opening an account and depositing $1000. Once you have a checking account with them, you are then allowed to apply for their credit card. The Voice card has 3% CB on a category you select each quarter. This can be good for something you spend a lot on without having a fallback card for or for use in conjunction with a rotating categories card! For example, you might not have a card with 5% year round for Restaurants, but you have a Discover IT card, so on the months you don't get the 5% with Discover you can get 3% with Huntington. I just checked my report and it does report as a Flexible Spending Limit card.

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@TiggerDat wrote:

@thelethargicage wrote:

@TiggerDat wrote:How about the Voice card from Huntington? it's a WMC.

I don't live in their service area, plus I try to avoid smaller issuers/CUs. Thanks for your input, though.

There is a work around to this by opening a checking account. You might get denied for not being in their service, as I did, but then you might also get an email or call from someone trying to retain/coax you into getting the account, as they did with me. There are times where they offer up to $250 for opening an account, without direct deposity, but with certain levels of deposits. I got $150 for opening an account and depositing $1000. Once you have a checking account with them, you are then allowed to apply for their credit card. The Voice card has 3% CB on a category you select each quarter. This can be good for something you spend a lot on without having a fallback card for or for use in conjunction with a rotating categories card! For example, you might not have a card with 5% year round for Restaurants, but you have a Discover IT card, so on the months you don't get the 5% with Discover you can get 3% with Huntington. I just checked my report and it does report as a Flexible Spending Limit card.

Awesome, thanks!

Does the grocery category include Target and Walmart? Or do they purposely exclude both of them?

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@thelethargicage wrote:

@TiggerDat wrote:

@thelethargicage wrote:

@TiggerDat wrote:How about the Voice card from Huntington? it's a WMC.

I don't live in their service area, plus I try to avoid smaller issuers/CUs. Thanks for your input, though.

There is a work around to this by opening a checking account. You might get denied for not being in their service, as I did, but then you might also get an email or call from someone trying to retain/coax you into getting the account, as they did with me. There are times where they offer up to $250 for opening an account, without direct deposity, but with certain levels of deposits. I got $150 for opening an account and depositing $1000. Once you have a checking account with them, you are then allowed to apply for their credit card. The Voice card has 3% CB on a category you select each quarter. This can be good for something you spend a lot on without having a fallback card for or for use in conjunction with a rotating categories card! For example, you might not have a card with 5% year round for Restaurants, but you have a Discover IT card, so on the months you don't get the 5% with Discover you can get 3% with Huntington. I just checked my report and it does report as a Flexible Spending Limit card.

Awesome, thanks!

Does the grocery category include Target and Walmart? Or do they purposely exclude both of them?

I think it depends on individual stores. I actually have never checked, I use my Target card at Target and my Discover card at Walmart. I don't buy food at Walmart, so.....

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@Anonymous wrote:I have the BoA Cash Rewards that I converted a couple months back from Visa Sig to WMC. Very happy and easy process.

The MLB card they offer is the same exact reward setup but is a MC so i would look into that. Mine is a WMC with a $10,000 limit but I havent checked my reports on that card to kno what it is on it.

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@thelethargicage wrote:

From what I've gathered, the only ones that report as "Flexible Spending" were PCd from other cards to DC. I've asked a couple posters thru PM, and both said ther DC WEMC cards reported as "Credit Card". I've asked a few others but never got a straight answer from them.

Why does it need to be a MC? My Thank you card is a Flexible spending card when it was a Visa and wasn't even a siggy. It still is i believe when i PC it to a MC

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@Closingracer99 wrote:

@thelethargicage wrote:

From what I've gathered, the only ones that report as "Flexible Spending" were PCd from other cards to DC. I've asked a couple posters thru PM, and both said ther DC WEMC cards reported as "Credit Card". I've asked a few others but never got a straight answer from them.Why does it need to be a MC? My Thank you card is a Flexible spending card when it was a Visa and wasn't even a siggy. It still is i believe when i PC it to a MC

I want to have the same number of Visas and MasterCards. If SM gets nerfed, I'll be cancelling it, but I still want a WMC that reports as flexible spending and is not cobranded. I'm just trying to move away from cobranded cards.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@thelethargicage wrote:

@Closingracer99 wrote:

@thelethargicage wrote:

From what I've gathered, the only ones that report as "Flexible Spending" were PCd from other cards to DC. I've asked a couple posters thru PM, and both said ther DC WEMC cards reported as "Credit Card". I've asked a few others but never got a straight answer from them.Why does it need to be a MC? My Thank you card is a Flexible spending card when it was a Visa and wasn't even a siggy. It still is i believe when i PC it to a MC

I want to have the same number of Visas and MasterCards. If SM gets nerfed, I'll be cancelling it, but I still want a WMC that reports as flexible spending and is not cobranded. I'm just trying to move away from cobranded cards.

once again why does it matter lol? I have so much more Visa's then MC. My only Mastercards is the Capital one GM card ( Oh I would look into that since its a WEMC ) , BoA MLB cash rewards, Citi Thank you and my Citi DC . My visa's are the Chase Freedom, Slate, Amazon visa, CS, Citi simplicity, Capital one Playstation card, and whatever else is in my sig that isn't an Amex or store card.

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

@Closingracer99 wrote:

@thelethargicage wrote:

@Closingracer99 wrote:

@thelethargicage wrote:

From what I've gathered, the only ones that report as "Flexible Spending" were PCd from other cards to DC. I've asked a couple posters thru PM, and both said ther DC WEMC cards reported as "Credit Card". I've asked a few others but never got a straight answer from them.Why does it need to be a MC? My Thank you card is a Flexible spending card when it was a Visa and wasn't even a siggy. It still is i believe when i PC it to a MC

I want to have the same number of Visas and MasterCards. If SM gets nerfed, I'll be cancelling it, but I still want a WMC that reports as flexible spending and is not cobranded. I'm just trying to move away from cobranded cards.

once again why does it matter lol? I have so much more Visa's then MC. My only Mastercards is the Capital one GM card ( Oh I would look into that since its a WEMC ) , BoA MLB cash rewards, Citi Thank you and my Citi DC . My visa's are the Chase Freedom, Slate, Amazon visa, CS, Citi simplicity, Capital one Playstation card, and whatever else is in my sig that isn't an Amex or store card.

I just want it to be a MC. No other reason.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Need a non-cobranded World MC with CB rewards...

Do you have GM Buy Power Card? It is WEMC. It is better than WMC.

Ron.