- myFICO® Forums

- Types of Credit

- Credit Cards

- New MyFico Trend?? "Less is More?"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New MyFico Trend?? "Less is More?"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@longtimelurker wrote:

@galahad15 wrote:I hate to be the contrarian here lol, but I tend to err on the side of "more is more", and "more is better"

Why? Easy answer: you never know when another dot.com bust, 2008 housing crisis, and recession / depression(?) is around the corner. I learned my lesson during the Great Recession of 2008, when lenders started RJ'ing and closing out my very best card accounts with super-low fixed (preferred) or variable APRs, leaving me with everything other than the best cards I had previously had still open. As a result, I have learned that it is important to have built-in card redundancy, and backups. That way, you automatically have protection built-in against lenders taking AA on you, or closing out your accounts. There's a reason why I have been acquiring multiple, single-digit APR cards, and more specifically 3 single-digit, fixed-rate cards, some of which have rewards as well. It was only until very recently this year in 2016 that I was finally able to built a card portfolio and collection anywhere close to the one I had before the Great Recession and before CARD Act.

Moral of the story: backups are good, both for computers and credit cards alike

YMMV of course

ETA: edits / adds

I understand the viewpoint, but two confounding factors:

1) In a "hostile" environment caused by a recession, having too many cards (or too big total CL) MIGHT make you more of a priority for AA than otherwise, i.e. in an effort to avoid it, you actually become more of a target.

2) If the recession is big enough, lenders will more or less move in lthe same direction: i.e. you won't get get to keep the 4.9% APR on one card for very long while your other cards go up to 22%, they will all go high.

Outside of extreme conditions though, some redundancy is worthwhile, then it's just a question of the degree needed!

One case of AA can fuel panic on here. Panic fuels the urge to diversify and app aggressively. Aggressive credit growth can increase the chance of AA, both by appearing riskier to some lenders and having more lenders that can potentially take AA.

People may drift to one extreme or another...having few cards and not worrying about AA...or hoarding in preparation for the credit apocalypse, startled perhaps by a little AA along the way.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

Now with Chase 5/24, Of course less-is-more. Happy holidays all :]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

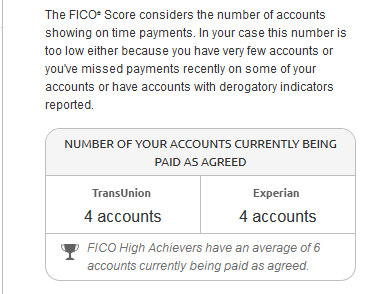

This is from my last FICO 3B report.

So they say 6?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

More the merrirer was definitley the trend when I joined up until about 2014. The economy was recovering from 2008 and lenders were starting to get more lax in lending. Those that apped heavily as I did have all the major cards out there now and are satisfied.

The CC market is so saturated and any perks (especially manufactured spend related) where real money could be earned have all been eliminated. Good cards (Citi Forward, Cash+, and now Sallie Mae) have been nerfed. MF spend (i.e., vanilla reloads, amazon payments) are gone. Sign up bonuses are either non-existent or not worth a new tradeline, especially in the era of 5/24 (which was the final dagger, imo).

As for me, I have an extensive card portfolio (40 or so tradelines). I know some will close due to inactivity, which I am ok with. For now I just use two cards; an AMEX and Visa. It's not worth it anymore for me to chase $2-$5 dollars extra every three months by rotating cards as I did before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@FireMedic1 wrote:So they say 6?

6 may include car/student/mortgage loans....not just CCs.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@CreditCuriousity wrote:I know alot of people personally don't post their approvals anymore just due to the reason of certain people on this forum going off on a soap box and their way is the only correct way. So alot of people simply don't post anymore about approvals or find no need to "brag" or need to share it with the general forum.. Typically it is the rebuilders the post the approvals, but that isnt always the case. I talk to alot of people through PM on this forum and they are constantly getting new cards for spend bonuses or what not, but just dont bother posting in the approval section most of the time. So I personally don't think anything has changed. Just my 2 cents for what it is worth.

I am one of the first to admit I will open a card for 500-1k+ bonus as it is money I am spending anyways and in no shape not spending money I wouldnt be spending anyways and get a good chunk of change back. With that said I usually close out a card when a new card is open as I like to not overexpose myself so future approvals keep coming without the excuse to much available credit. I must admit it is harder to do now though as I have pretty much most of my dream cards other than the CSR, but there will always be new "dream" card that come out. So it is rinse and repeat for me along with many others

Then these people need to be brought to the attention of the moderators so they can be dealt with its what we are here for but if no one lets us know, as we cannot read every thread then they get away with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

Just out of curiosity, which AMEX and Visa cards?

@eagle2013 wrote:. For now I just use two cards; an AMEX and Visa. It's not worth it anymore for me to chase $2-$5 dollars extra every three months by rotating cards as I did before.

Amex Blue Business Plus

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

Do you have a mortgage or other loan?

@FireMedic1 wrote:This is from my last FICO 3B report.

So they say 6?

Amex Blue Business Plus

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@gdale6 wrote:

@CreditCuriousity wrote:I know alot of people personally don't post their approvals anymore just due to the reason of certain people on this forum going off on a soap box and their way is the only correct way. So alot of people simply don't post anymore about approvals or find no need to "brag" or need to share it with the general forum.. Typically it is the rebuilders the post the approvals, but that isnt always the case. I talk to alot of people through PM on this forum and they are constantly getting new cards for spend bonuses or what not, but just dont bother posting in the approval section most of the time. So I personally don't think anything has changed. Just my 2 cents for what it is worth.

I am one of the first to admit I will open a card for 500-1k+ bonus as it is money I am spending anyways and in no shape not spending money I wouldnt be spending anyways and get a good chunk of change back. With that said I usually close out a card when a new card is open as I like to not overexpose myself so future approvals keep coming without the excuse to much available credit. I must admit it is harder to do now though as I have pretty much most of my dream cards other than the CSR, but there will always be new "dream" card that come out. So it is rinse and repeat for me along with many others

Then these people need to be brought to the attention of the moderators so they can be dealt with its what we are here for but if no one lets us know, as we cannot read every thread then they get away with it.

Preach brother; I put down my stick but I wielded it with alacrity to stamp that sort of crap out when it occurred... utterly against the community that we are trying to engender and actually crosses lines with the TOS too viewed without a strict constitutional interpretation.

Anyway it's stickied still but for review, this sort of thing is what it's here for:

On a personal level I sort of wondered where some of those posts had gone, and I for one am saddened at the loss of information and datapoints in addition to the loss of community.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@driftless wrote:Just out of curiosity, which AMEX and Visa cards?

@eagle2013 wrote:. For now I just use two cards; an AMEX and Visa. It's not worth it anymore for me to chase $2-$5 dollars extra every three months by rotating cards as I did before.

I use the AMEX BCP for groceries/giftcards and Citi Double Cash for non-category spend. I noticed I spend a ton of money eating out so it helps when I buy giftcards for the week to keep me on budget.

Edit: Noticed the DC is a mastercard, not visa