- myFICO® Forums

- Types of Credit

- Credit Cards

- New MyFico Trend?? "Less is More?"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New MyFico Trend?? "Less is More?"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@Anonymous wrote:Remember, reducing credit is fun.

Your thread is an example of what I meant by "taking out the trash".

You closed a bunch of store cards and added Hyatt and Amex...but people who avoided Comenity in the first place aren't rushing in droves to simplify and close their existing Hyatt and Amex cards (unless it's part of stategic bonus hunting/churning).

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@galahad15 wrote:

@longtimelurker wrote:I understand the viewpoint, but two confounding factors:

1) In a "hostile" environment caused by a recession, having too many cards (or too big total CL) MIGHT make you more of a priority for AA than otherwise, i.e. in an effort to avoid it, you actually become more of a target.

2) If the recession is big enough, lenders will more or less move in lthe same direction: i.e. you won't get get to keep the 4.9% APR on one card for very long while your other cards go up to 22%, they will all go high.

Outside of extreme conditions though, some redundancy is worthwhile, then it's just a question of the degree needed!

As to the first bullet point, j/c do you recommend closing out some redundant cards that are no longer used much, to reduce one's risk footprint for AA? For example, I have several other low-APR cards not presently listed in my signature, such as my BoA TR VS at 9.74% V, and my Ring card, at 8.50% V, that I hardly ever actively use. I also rarely use my high-APR Chase Freedom and Slate cards. Do you think it might make sense to close out some or all of the above? Also is it ever a good idea to request an intentional CLD during a recession-like environment, on cards that one knows one wants to keep long-term?

No, I am not suggesting that you need to close those cards as we are not in an extreme recession where it might matter. And it might not matter even then. So I wouldn't worry, in a really bad recession, APRs might not be high up on the list of things to be concerned about......

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@wasCB14 wrote:

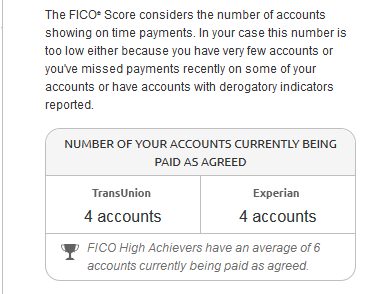

@FireMedic1 wrote:So they say 6?

6 may include car/student/mortgage loans....not just CCs.

I got the 4 cards seen below and an auto loan. Really 5 accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@Anonymous wrote:

@Gmood1 wrote:

@Not to be a smart @Anonymous. The only trend I see is the same members posting the same gripes about what others do. LolWith some famous words from Rodgers & Hammerstein:

"The farmer and the cowman should be friends,

Oh, the farmer and the cowman should be friends.

One man likes to push a plough, the other likes to chase a

cow,

But that's no reason why they cain't be friends!"

Love Oklahoma!! My mom and I watch it together often. Just introduced a friend to it last week. LOL!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

I used to post in the approvals when I was rebuilding. With the exception of the $16k Venture approval earlier this summer, I've kept my other 6-7 approvals to myself. ![]()

I think as long as every card you have (or have had) a purpose then all is good. I had a plan and I stuck to it for the most part. Every card has helped in my two year rebuild. Once I get all my cards situated (and the 0% APR cards paid off) and get comfortable with AAoA, I'll grab a card or two every year for bonuses and nothing more.

While I wouldn't mind having MORE cards, I don't want to keep smacking my AAoA down to the ground. Since 4/29/15, I've opened 14 of my 15 active CCs and have 95k worth of credit limits. I've pretty much got everything that I want/need.

Also, don't feel like stretching my points/awards over too many programs. I'm strictly MR pts, Starpoints, and Delta Skymiles. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

I believe that 'less is more' as long as your needs are met. I do not believe in keeping to an arbitrary number of cards "just because".

My cards are in my signature below, and I also have Belk, Lowe's and Care Credit as well. Each and every one of my cards serves a purpose; if and when any of them stop serving a purpose they will be closed - it's not rocket science. ![]()

I continue to post in the 'Approvals' section since I believe my data points might be helpful to others on the forum who might have a similar credit profile (my approval posts can be borderline 'wall of text' with the amount of detail I try to provide). Those who don't find my approval threads useful don't have to read them.

This being said, I'm not going to knock anybody who picks an arbitrary number and decides that's their personal 'optimal' number of credit accounts. Even though that approach isn't right for me personally, there is likely wisdom in their underlying reasoning - and I'm always open to a different way of looking at things. All I ask for is that same respect in return. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@UncleB wrote:I believe that 'less is more' as long as your needs are met. I do not believe in keeping to an arbitrary number of cards "just because".

My cards are in my signature below, and I also have Belk, Lowe's and Care Credit as well. Each and every one of my cards serves a purpose; if and when any of them stop serving a purpose they will be closed - it's not rocket science.

I continue to post in the 'Approvals' section since I believe my data points might be helpful to others on the forum who might have a similar credit profile (my approval posts can be borderline 'wall of text' with the amount of detail I try to provide). Those who don't find my approval threads useful don't have to read them.

This being said, I'm not going to knock anybody who picks an arbitrary number and decides that's their personal 'optimal' number of credit accounts. Even though that approach isn't right for me personally, there is likely wisdom in their underlying reasoning - and I'm always open to a different way of looking at things. All I ask for is that same respect in return.

I'm curious as to the purpose of the two QS cards and Delta.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@wasCB14 wrote:

@UncleB wrote:I believe that 'less is more' as long as your needs are met. I do not believe in keeping to an arbitrary number of cards "just because".

My cards are in my signature below, and I also have Belk, Lowe's and Care Credit as well. Each and every one of my cards serves a purpose; if and when any of them stop serving a purpose they will be closed - it's not rocket science.

I continue to post in the 'Approvals' section since I believe my data points might be helpful to others on the forum who might have a similar credit profile (my approval posts can be borderline 'wall of text' with the amount of detail I try to provide). Those who don't find my approval threads useful don't have to read them.

This being said, I'm not going to knock anybody who picks an arbitrary number and decides that's their personal 'optimal' number of credit accounts. Even though that approach isn't right for me personally, there is likely wisdom in their underlying reasoning - and I'm always open to a different way of looking at things. All I ask for is that same respect in return.

I'm curious as to the purpose of the two QS cards and Delta.

The QS MasterCard is my oldest bankcard so I'm keeping it around mostly for its age. My QS Visa is newer, but has better BT offers than the QS MasterCard. I do understand how FICO treats closed accounts, but since there are many years difference between my QS MasterCard and all of my other cards and it has no AF I'm keeping it around (the QS Visa has an 'OK' credit line so there's no pressing reason to combine).

I originally got the Delta to use as a 'donor' for my BCP (at the time I was unsure if they would ever give my BCP a much-needed CLI) but I was also able to 'bank' the 30k SkyMiles I got when opening it, and of course there's the baggage fee benefit if/when I decide to fly in the next year. If my plans change and I end up not taking a flight in the next 12 months I'll probably close it, but I don't regret opening it in any case.

I can literally write a paragraph for each card I have on how useful it is to me if anybody is truly interested. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

We are always on the same page Uncle B! First QS is the oldest, just 1 month shy of 10 years. Can't get rid of it... it's stuck in my wallet lol!

My wife actually asked me why I have that AF delta card in the drawer. I showed her the amount of baggage fees we didn't pay because of it and she said keep it forever ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New MyFico Trend?? "Less is More?"

@UncleB wrote:I continue to post in the 'Approvals' section since I believe my data points might be helpful to others on the forum who might have a similar credit profile (my approval posts can be borderline 'wall of text' with the amount of detail I try to provide). Those who don't find my approval threads useful don't have to read them.

Your data points are most useful. Data points is precisely the reason we are encouraged to make approval posts. There's been many times that I search the approval boards for specific data points on a specific credit product. Your posts are always useful.

This being said,

All I ask for is that same respect in return.

if anybody disrespects Uncle B, there going to have to deal with me!😠 Lol

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017