- myFICO® Forums

- Types of Credit

- Credit Cards

- One tip you would give to a young adult about thei...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

One tip you would give to a young adult about their first credit card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

2. Never, ever, let anything go to collection. A negative for 7 years on one’s credit report is not worth it and especially if it’s a negligible amount.

3. And what everybody else said — don’t spend more than you can afford to pay back. Now that I’m a baby boomer, I’m thrilled that I followed this piece of advice from my parents. It’s a wonderful feeling to be credit card/loan debt free!!! A good feeling indeed.

Oops, you said one tip. Sorry about that 😂

And OP you’re on the right path. Kudos to you.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

Don't open up accounts without a purpose. How many people do we see in the rebuilding forum that have 10-15 low limit store cards from places they don't shop at on a regular basis? Some store cards are worth it but make that determination before you apply.

Cap1 QS-$4,500 Chase Freedom Flex- $800 Chase Freedom Unlimited- $1,000 Victoria's Secret- $1,200 Citi DC- $800 Amazon Store Card- $3,500 AMEX Hilton Honors-$1,000 Discover It-$1,000 Wal-Mart MC $290 Chase Sapphire Preferred-$5,000 NFCU Flagship $13,800 AMEX BCE-$1,000 AMEX Gold-$5,000 AMEX Delta Blue $1,000 Lowe's $5,000 Navy Platinum $17,000 AMEX BBP $2,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

I would agree that for non-"credit geeks" i.e. average consumers who just want to build credit and not obsess about these things, the all zero except one is just unnecessary stress.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

Don't get a retail store card as your first card.

If Macy's goes out of business next year, your AoOA and AAoA will drop when the card falls off.

I guess theoretically discover, or amex, could go out of business too, but I feel like they won't?

Banks rarely go under, they just get bought out. But sometimes their cards get new numbers and birthdays, so might not be safer, unless big name bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

You chose very well for your first two cards. Both of those are cards that will still be in your wallet when you turn 60. The best pieces of advice I have seen are to maintain an emergency fund and to spend time choosing cards you can retire with. Neither of those cards are the most friendly for travel, so if you plan on doing much traveling you would likely be better served with one of the top tier Visa or MC with travel rewards. Then you would have access to the 3 card score boost, revolving Discover bonuses, the BCE bonus stack for groceries and fuel and a card to use for your hotels and flights. Getting 3 cards worth carrying forever by the time you are 20 will set up your AAoA for life. Having those cards and an emergency fund will keep you from ever needing to do more than one hard pull in any calendar year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

That's funny, I also started with Discover and then Amex BCE... You're not by any chance going to apply for Chase Freedom and Sapphire too are you?

As everyone have already mentioned, do not spend more than what you can afford. I have a system in my bank where I have two checking accounts: one is called "checking" and the other is called "bills". Everytime I make a purchase anywhere, I always transfer that amount from "checking" to "bills". That way, I will always know how much money I have left to spend (in "checking"). Not only that, all of my credit card bills would already have been taken care of by "bills".

Also, I pay right before or right after my statement cuts, NEVER close to payment due dates, EVER. Also pay in full.

My other advice is to apply for as many credit card as you can while you're still young. That way once you're done, you can let all of your cards grow together while all of the hard pulls fall off. Just make sure you apply for the right cards that will benefit you for as long as you have it.

One more thing and it is my favorite advice for young people: once you have a stable/higher-paying job, update your credit card info with your new salary, then SMASH that luv button like there's no tomorrow (just make sure it's a soft pull like your Discover and Amex).

Continue to come back to this forum to learn more about credit cards and what have you. Good luck and enjoy your cards!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

Read all the comments here and wanted to put in my two cents as someone who was your age 25 years ago.

Based on my investments since the age of 18 until now (age 43) -- the money I spent when I was 17 on a nice car, a bunch of concert/festivals, music purchases, etc, just the money I wasted at 17 would be worth $2.1 million today had I not blown it. That's a ton of cash in not THAT long of a time frame.

So look at credit card usage as what you use towards essential spend -- things you actually NEED to live and survive, not things you WANT. If you can cut your spending back by just a few hundred a month, you may lose $20 or $30 in "cashback rewards" but those few hundred of dollars a month you didn't spend will be worth hundreds of thousands or even millions in time just based on having a simple but effective investment portfolio.

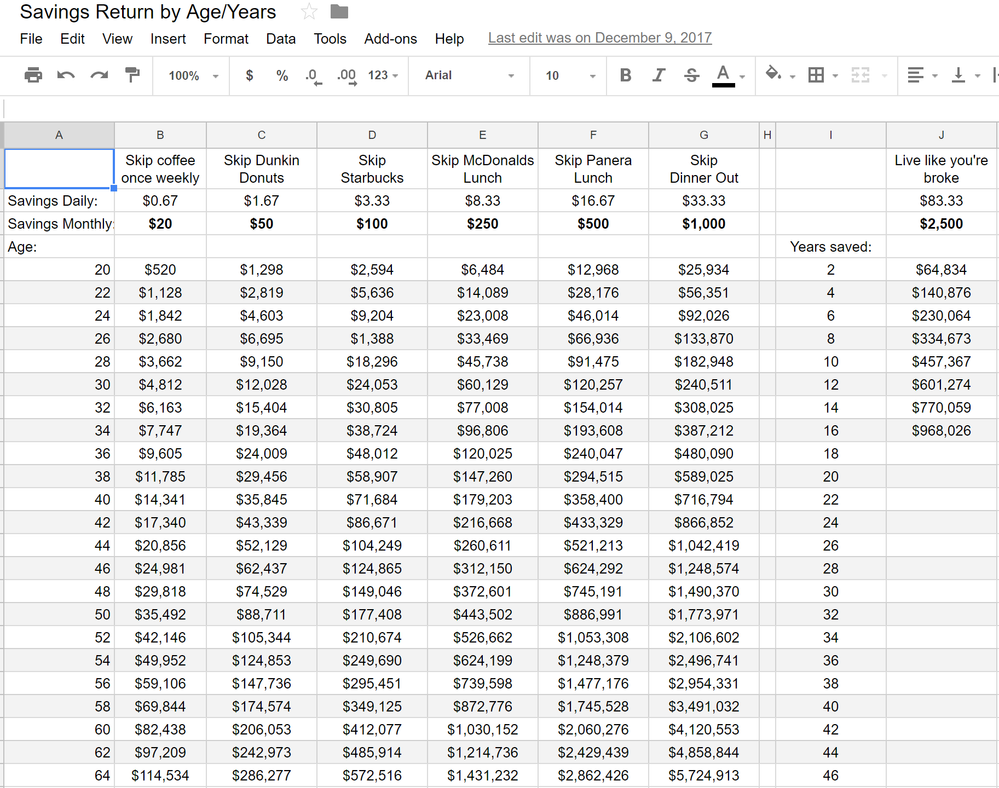

I share this chart with lots and lots of parents and "young adults" because it's proven valuable for a lot of people over the years. This assumes an 8% return on your savings (my return over 25 years is double that!):

You're 19 now...if you bag your lunches and skip eating that $9/day lunch at McDonalds, in 15 years it could be worth $100,000. Lots of credit card spenders will look at that $9/day and think "Hey I can make a 4% cashback reward on it worth $0.36!" but financially responsible folks see those McValue burgers as costing them $100,000 in 15 years.

So if you want to build a wealth-driven brain, don't just focus on credit for spending. Focus on credit SOLELY for maximizing your FICO score, and keep your spending as minimal as possible. Build wealth for 10 years and then spend extravagently on just the interest earned after 10 years. Save $6000 a year for 10 years and you'll have $120,000 or so earning you $10,000 a year in growth. You can just blow that $10,000 a year on extragences starting at the age of 30 and never hurt your principal balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: One tip you would give to a young adult about their first credit card?

Pay all your bills on time forever.