- myFICO® Forums

- Types of Credit

- Credit Cards

- Opinions on Cap One acct combo options?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Opinions on Cap One acct combo options?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Opinions on Cap One acct combo options?

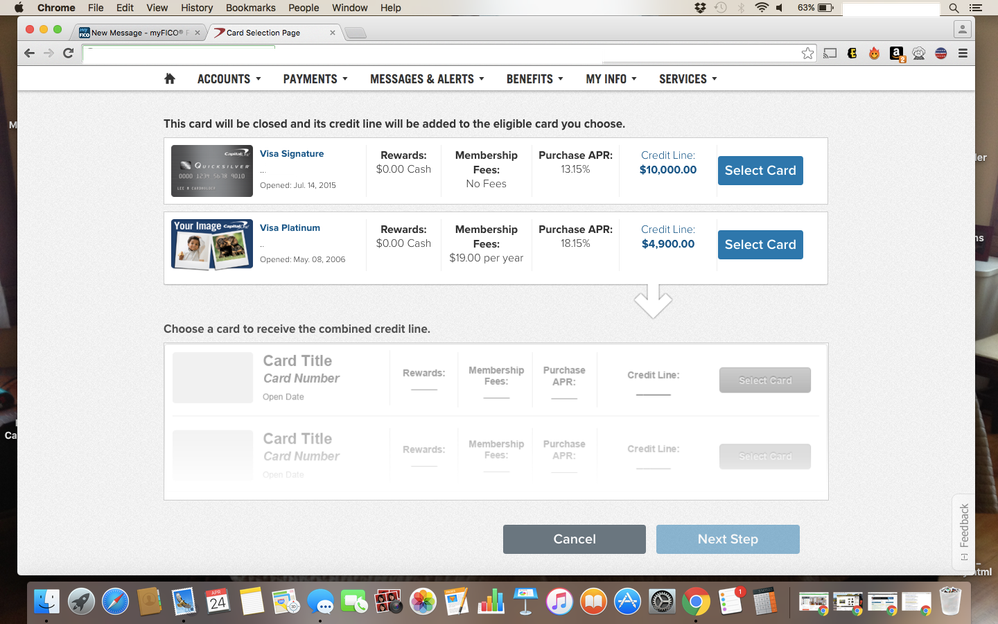

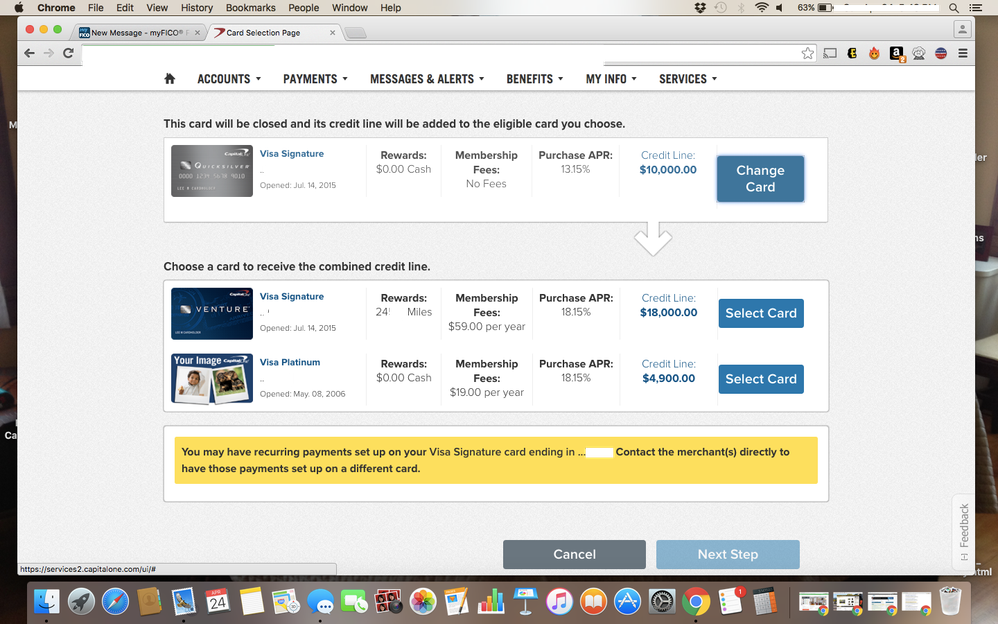

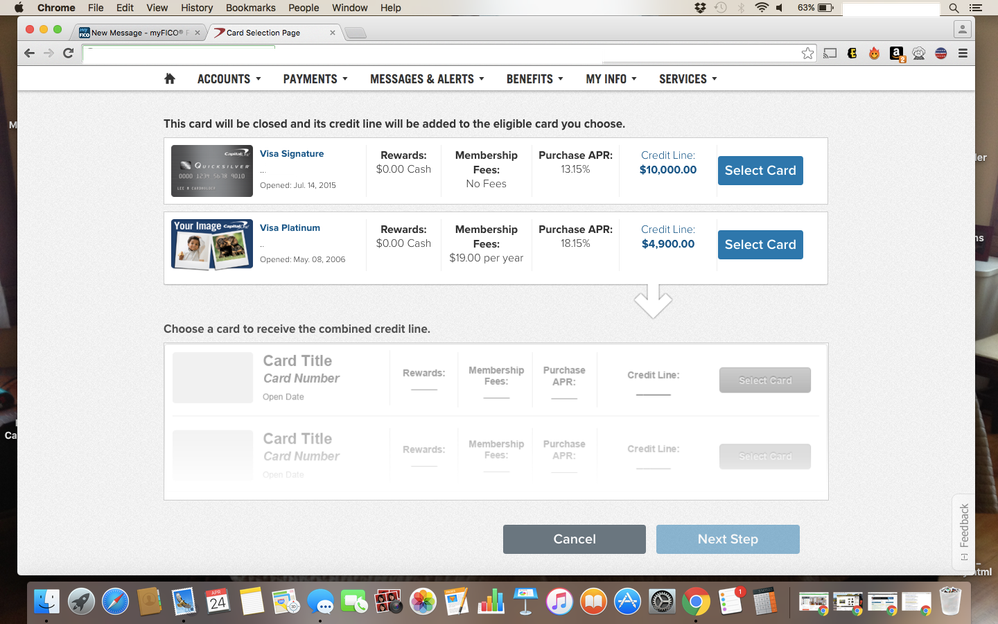

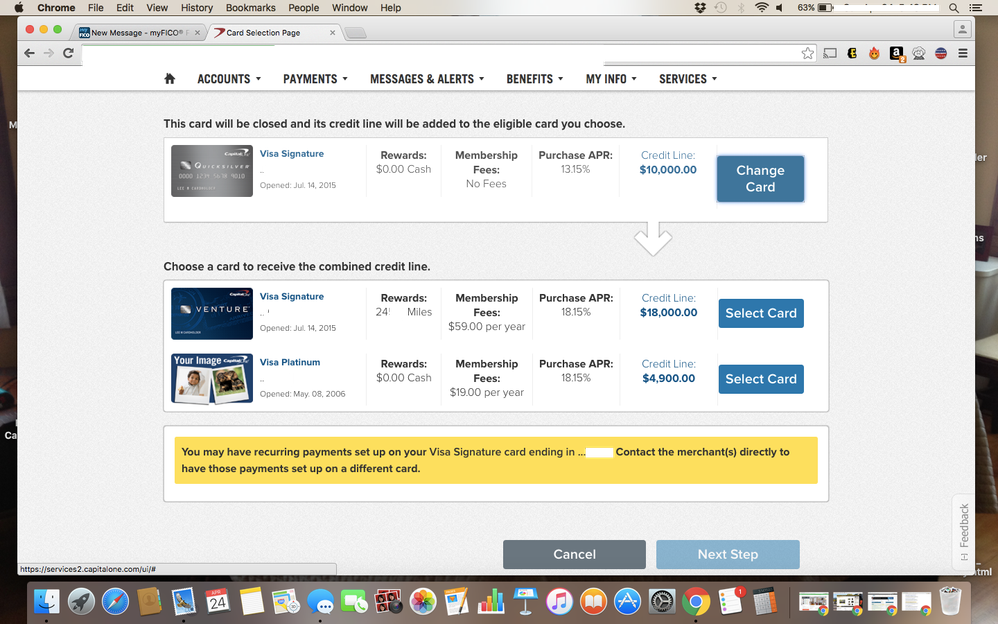

So, I've been considering combining my cap one accounts.

Ideally I'd like to combine the QS account into one of my two remaining accounts (either Venture or the the Visa Plat.) I use my Venture consistently for the rewards, but the Visa Plat. is one of my oldest CL's and I don't really want to lose that (NB: I do not use the Visa Plat at all, I just keep it bc of its AAoA). The QS does have a lower APR, so thats another consideration. Just looking for points/suggestions I may have missed in my considerations.

Thanks!

General info (according to CCT): AAoA = 6.8yrs, Util = 0-1%, Total Revolving CL = 130k.

FICO 8 = EX 810, TU 803, EQ 810

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

@Peanutbutter wrote:

So, I've been considering combining my cap one accounts.

Ideally I'd like to combine the QS account into one of my two remaining accounts (either Venture or the the Visa Plat.) I use my Venture consistently for the rewards, but the Visa Plat. is one of my oldest CL's and I don't really want to lose that (NB: I do not use the Visa Plat at all, I just keep it bc of its AAoA). The QS does have a lower APR, so thats another consideration. Just looking for points/suggestions I may have missed in my considerations.

Thanks!

General info (according to CCT): AAoA = 6.8yrs, Util = 0-1%, Total Revolving CL = 130k.

FICO 8 = EX 810, TU 803, EQ 810

I would definitely NOT lose the quicksilver... If you like the venture why not just PC the quicksilver to venture and combine after that so you dont lose the much better interest rate.

Make sure you use any unused miles on the venture before combining so you dont lose them. If your not traveling but giftcards thru Cap One to get full value.

Others might chime in and say doesnt matter if you pay in full, but I'm with the mentality of....you never know and might as well have the best you can get!

Your scores are very strong and I'm sure you could aquire another Cap One later with the same interest rate but why take the triple pull ![]()

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

Have you asked CapOne whether you can product change the Platinum into a Quicksilver? This gets you the same 1.5% rewards with no hassle.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

If it were me I would keep the lower-APR Quicksilver, and merge the Venture into it.

If the math works out (you charge more than $12k per year) you can always PC the Quicksilver to a Venture. If you charge less than $12k it would be cheaper to simply keep the card as a Quicksilver, and you'll have a good card with a low-APR, no-AF, and a nice credit line!

Something else to consider... your old Visa card might be eligible to be PC'd as well. You can see about PC'ing it to a Quicksilver Visa (would still be a Platinum) or you could PC it to a Venture One, get the credit line above $5k, then later PC to a Quicksilver and it will likely be a Signature. Several ways to work on that one... (I know that wasn't the purpose of this thread, but I'm just putting that out there...)

Hope this helps! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

Closing the oldest Platinum will still report as a positive account for 10 years so it won't hurt your AA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

Thank you, CA. I just wanted to make sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

@ Bone, NRB, UncleB....

Chatted with CS, here's the replay:

(VISA PLAT. PC CHANGE OPTIONS)

Hi, this is Stuart. Whom do I have the pleasure of chatting with today?

Stuart

Hi Peanutbutter

You

I'm interested in product change options for my visa platinum card

Stuart

Sure, I'll quickly access your account and check on available options to help you further.

Stuart

I see that you are currently having cash back card where you are earning 1.25% cash back.

You have an offer to upgrade then card to Quicksilver where you will receive 1.5% cash back on each dollar of your purchase with no annual fee.

You also have an offer to upgrade your card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee.

Currently, your account has annual fee of $19.00, after upgraded, there will be no annual fee charged.

You

if I upgrade to to either of those, do I lose my 05/2006 opened date?

Stuart

No. The account history along with the original terms of your account will remain the same.

One more great thing will be that upgrading the card to different product will not affect your credit score.

You

I see. If I changed to either of those options, what are the APRs and credit limits associated with those options?

Stuart

All terms of your account will remain the same. However, I will check on options for lowering the APR as well as increasing the credit limit as well.

I have an offer to lower your rate to a 15.15% variable for the next 07 months which will start saving you some money every time you use the card. After this offer expires, your interest rate will then be 18.15% which is a variable rate based on Prime plus 14.65%.

Would you like me to lower the APR?

Or would you like me to proceed with upgrade first then move to APR part?

(QS Product Change Options)

You

Are there product change options for my quicksilver card?

Stuart

As I have reviewed your account I see that you are having a quicksilver account where you are currently earning 1.5% cash back with no annual fee.

I am glad to inform you also have a product change offer to upgrade the card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee. However, the APR on this account will remain the same.

You

it'll stay at 13.15%?

Stuart

Yes, you got that correct. Upgrading the account will only change the account rewards type, the other terms remain the same. On this account, there is no offer to lower the APR, however, please keep in mind that Capital One reviews all the account periodically and you may receive an offer to lower the APR soon as well.

/END CHAT

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

@Peanutbutter wrote:@ Bone, NRB, UncleB....

Chatted with CS, here's the replay:

(VISA PLAT. PC CHANGE OPTIONS)

Hi, this is Stuart. Whom do I have the pleasure of chatting with today?

Stuart

Hi Peanutbutter

You

I'm interested in product change options for my visa platinum card

Stuart

Sure, I'll quickly access your account and check on available options to help you further.

Stuart

I see that you are currently having cash back card where you are earning 1.25% cash back.

You have an offer to upgrade then card to Quicksilver where you will receive 1.5% cash back on each dollar of your purchase with no annual fee.

You also have an offer to upgrade your card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee.

Currently, your account has annual fee of $19.00, after upgraded, there will be no annual fee charged.

You

if I upgrade to to either of those, do I lose my 05/2006 opened date?

Stuart

No. The account history along with the original terms of your account will remain the same.

One more great thing will be that upgrading the card to different product will not affect your credit score.

You

I see. If I changed to either of those options, what are the APRs and credit limits associated with those options?

Stuart

All terms of your account will remain the same. However, I will check on options for lowering the APR as well as increasing the credit limit as well.

I have an offer to lower your rate to a 15.15% variable for the next 07 months which will start saving you some money every time you use the card. After this offer expires, your interest rate will then be 18.15% which is a variable rate based on Prime plus 14.65%.

Would you like me to lower the APR?

Or would you like me to proceed with upgrade first then move to APR part?

(QS Product Change Options)

You

Are there product change options for my quicksilver card?

Stuart

As I have reviewed your account I see that you are having a quicksilver account where you are currently earning 1.5% cash back with no annual fee.

I am glad to inform you also have a product change offer to upgrade the card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee. However, the APR on this account will remain the same.

You

it'll stay at 13.15%?

Stuart

Yes, you got that correct. Upgrading the account will only change the account rewards type, the other terms remain the same. On this account, there is no offer to lower the APR, however, please keep in mind that Capital One reviews all the account periodically and you may receive an offer to lower the APR soon as well.

/END CHAT

Thoughts?

Looks like everything went well!

Id do all the upgrades imho. Plus you get to save the $19 annual fee on your platinum if you choose to keep it open.

The temp interest offer is a gimmick imo and I dont do them. (just eerks me that they wont do a permanent reduction) So I get great joy in saying thanks but no thanks everytime they offer it to me!..LOL

UncleB made a great point about keeping the venture if you dont spend over 12k a year on it. If your spend is over that then it makes sense to have it over another QS. If your spend isnt that high on the Venture than PC to QS so you can save the $59 annual fee.

Rest assure....All your open dates and interest rates will stay the same when you upgrade. I change them around all the time...ha!

Lastly......PLEASE make sure you hit the CLI Luv button BEFORE combining so you get whatever increases available. Once you combine...the 6month clock resets on the card.

If you dont get an increase...check your dates since last increase and if its close to the 6 month mark.... Id wait for an increase first before combining but thats just me ![]()

Keep us posted!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

Thanks guys for all the help. I think I'll contact them tomorrow to follow through. I'll keep you posted!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Opinions on Cap One acct combo options?

@Bone35 wrote:

@Peanutbutter wrote:@ Bone, NRB, UncleB....

Chatted with CS, here's the replay:

(VISA PLAT. PC CHANGE OPTIONS)

Hi, this is Stuart. Whom do I have the pleasure of chatting with today?

Stuart

Hi Peanutbutter

You

I'm interested in product change options for my visa platinum card

Stuart

Sure, I'll quickly access your account and check on available options to help you further.

Stuart

I see that you are currently having cash back card where you are earning 1.25% cash back.

You have an offer to upgrade then card to Quicksilver where you will receive 1.5% cash back on each dollar of your purchase with no annual fee.

You also have an offer to upgrade your card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee.

Currently, your account has annual fee of $19.00, after upgraded, there will be no annual fee charged.

You

if I upgrade to to either of those, do I lose my 05/2006 opened date?

Stuart

No. The account history along with the original terms of your account will remain the same.

One more great thing will be that upgrading the card to different product will not affect your credit score.

You

I see. If I changed to either of those options, what are the APRs and credit limits associated with those options?

Stuart

All terms of your account will remain the same. However, I will check on options for lowering the APR as well as increasing the credit limit as well.

I have an offer to lower your rate to a 15.15% variable for the next 07 months which will start saving you some money every time you use the card. After this offer expires, your interest rate will then be 18.15% which is a variable rate based on Prime plus 14.65%.

Would you like me to lower the APR?

Or would you like me to proceed with upgrade first then move to APR part?

(QS Product Change Options)

You

Are there product change options for my quicksilver card?

Stuart

As I have reviewed your account I see that you are having a quicksilver account where you are currently earning 1.5% cash back with no annual fee.

I am glad to inform you also have a product change offer to upgrade the card to Venture One where you will receive 1.25 miles per dollar of your purchase with no annual fee. However, the APR on this account will remain the same.

You

it'll stay at 13.15%?

Stuart

Yes, you got that correct. Upgrading the account will only change the account rewards type, the other terms remain the same. On this account, there is no offer to lower the APR, however, please keep in mind that Capital One reviews all the account periodically and you may receive an offer to lower the APR soon as well.

/END CHAT

Thoughts?

Looks like everything went well!

Id do all the upgrades imho. Plus you get to save the $19 annual fee on your platinum if you choose to keep it open.

The temp interest offer is a gimmick imo and I dont do them. (just eerks me that they wont do a permanent reduction) So I get great joy in saying thanks but no thanks everytime they offer it to me!..LOL

UncleB made a great point about keeping the venture if you dont spend over 12k a year on it. If your spend is over that then it makes sense to have it over another QS. If your spend isnt that high on the Venture than PC to QS so you can save the $59 annual fee.

Rest assure....All your open dates and interest rates will stay the same when you upgrade. I change them around all the time...ha!

Lastly......PLEASE make sure you hit the CLI Luv button BEFORE combining so you get whatever increases available. Once you combine...the 6month clock resets on the card.

If you dont get an increase...check your dates since last increase and if its close to the 6 month mark.... Id wait for an increase first before combining but thats just me

Keep us posted!

I have absolutely nothing to add to the above... it's spot-on!

Good luck with your upgrades, and let us know how it goes! ![]()