- myFICO® Forums

- Types of Credit

- Credit Cards

- PC CSP to Freedom Unlimited complete

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PC CSP to Freedom Unlimited complete

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

Makes sense as you have the ink, why not wipe out one AF(as you did) as you still can transfer from FU -> Ink -> partner

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

As the other member stated, you should app for the CSP to get the points. But for a point of reference.. I was able to PC my Slate to a CFU a couple months ago. I already had the original Freedom.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

Chase is a terrible bank IMO... Probably the first or second one that comes to mind whenn it comes to "breaking up" too big to fail companies like that.

I've had it with them on a couple of different ends... First the checking, and then the credit card.

I started out with a credit card with them about 4-5 years ago. Not ONCE did they lower the APR, even though I've asked them multiple times. I didn't realize it was hard to lower an APR from 21% and change to something lower... the reps and rep supervisor claimed it was "Chase policy." I threatened to cancel, still no dice. Not even an attempt to keep me as a customer, so I told them to close my account and I'll find another business partner to do credit card business with. Wanted to do a product change from a Chase Amazon to something else, nope, again, can't do me any favors even though I've been with them for 4-5 years. Chase has the worst group of customer service and card portfolios out there. It seems like Chase doesn't want to do their card customers any favors (notice how I didn't say card members, as you're just a number to them, not a partner of a money making system split between you and them). Chase doesn't care about you because they know they won't be able to go out of business no matter how much they spit on their customers, because we'll have to bail them out anyways if they screw up too much. Funny part is I'm 1/1 in asking Citi for a product change and an APR decrease, and I've never had a problem with them, and I've been a card member for 1/2 the time I've been with Chase. I won't miss Chase and their poor customer service in the slightest.

Second was the checking account. Opened a basic checking account for students---looked one day and it was closed because I hardly ever used it. I think they're the only bank that has closed an account without me asking them to, and usually I have one bank account with seldom activity because I always have a secondary account to my Citi checking. When I was looking for a bank around me with an ATM vesibule, Chase was only one of three banks... I tried to open an account with them, and of course they're the only ones that would never give me a checking account again, so I've moved to Keybank where I've had overdraft fees waived and a debit card rewards program (now I have an account that doesn't have overdraft fees).

If Chase wasn't "too big to fail," I have a feeling they wouldn't be in business anymore. They treat their customers like crap and don't offer anything advantagous over other banks. Other banks offer better service and better customer service.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

Redpat, did you request PC through regular customer service or did they transfer you to lending? Also, did they request a SP or HP to complete this transaction? Congrats on your successful PC!

@redpat wrote:I'm going to miss that blue metal card but getting 1.5 UR and no AF is just to good to pass up since I have Ink+.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

@Bowzer wrote:Redpat, did you request PC through regular customer service or did they transfer you to lending? Also, did they request a SP or HP to complete this transaction? Congrats on your successful PC!

@redpat wrote:I'm going to miss that blue metal card but getting 1.5 UR and no AF is just to good to pass up since I have Ink+.

Regular CSR no transfer. No SP or HP they told me I was eligible for the PC when CSR pulled my account up. I did take a HP earlier this week for my 10k increase before PC and that was also through a CSR. I had no transfers to lending, whew!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

Thank you for the data points.

@redpat wrote:

@Bowzer wrote:Redpat, did you request PC through regular customer service or did they transfer you to lending? Also, did they request a SP or HP to complete this transaction? Congrats on your successful PC!

@redpat wrote:I'm going to miss that blue metal card but getting 1.5 UR and no AF is just to good to pass up since I have Ink+.

Regular CSR no transfer. No SP or HP they told me I was eligible for the PC when CSR pulled my account up. I did take a HP earlier this week for my 10k increase before PC and that was also through a CSR. I had no transfers to lending, whew!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

@Anonymous wrote:Chase is a terrible bank IMO...

Came for the writing and stayed for the rant lol..but seriously you write very well. Who in your mind provides superior service? They are all pretty much -/+ in my mind. The only lender I have had contact with that really cared and wanted to correct a situation is penfed. Ax has their moments but has a script they pretty much follow. I sent a few SEs to chase and they always respond quickly, seemed helpful enough, had an unused freedom and pc'ed it to a fuvs without a fuss. nothing like great customer service

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

@omfgpart2 wrote:

@Anonymous wrote:Chase is a terrible bank IMO...

Came for the writing and stayed for the rant lol..but seriously you write very well. Who in your mind provides superior service? They are all pretty much -/+ in my mind. The only lender I have had contact with that really cared and wanted to correct a situation is penfed. Ax has their moments but has a script they pretty much follow. I sent a few SEs to chase and they always respond quickly, seemed helpful enough, had an unused freedom and pc'ed it to a fuvs without a fuss. nothing like great customer service

I have two cards remaining, and I've had a bunch. To be fair I'm a little picky with who I do business with, but I have my reasons for getting rid of cards and keeping others, as I'll explain a little below.

I had a 7.24% APR card through State Department Federal Credit Union. I got rid of them because the completely screwed up my dispute resolution on fraudulent charges from an online.merchant. When you promise to overnight a card and it takes a week to get to me, and when you're adding and subtracting multiple amounts every single day and screwing with my credit line, I was not a happy customer. The card was secured anyways so it's not a big deal.

I had a Chase Amazon Card -- My first card, which Chase started me out with a $400 limit, and then increased it to $800 (by request from me), and never even budged to lower my APR from the rate it was BEFORE I had any credit, to a lower rate when my score was like 710. Talk about ridiculous. Besides, they wouldn't let me product change my cards.

I had a BarclayCard -- My second overall credit card, although it was worthless as it had a $7,800 limit, wasn't a Visa Signature, offered no rewards, and had a 23.24% rate.

I had an Empower FCU card -- However, after telling me originally that my card woudl graduate after around 12 months, I was told it doesn't and that I'd have to re-apply instead. I don't do wishy-washy customer service.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

@Anonymous wrote:

@omfgpart2 wrote:

@Anonymous wrote:Chase is a terrible bank IMO...

Came for the writing and stayed for the rant lol..but seriously you write very well. Who in your mind provides superior service? They are all pretty much -/+ in my mind. The only lender I have had contact with that really cared and wanted to correct a situation is penfed. Ax has their moments but has a script they pretty much follow. I sent a few SEs to chase and they always respond quickly, seemed helpful enough, had an unused freedom and pc'ed it to a fuvs without a fuss. nothing like great customer service

I have two cards remaining, and I've had a bunch. To be fair I'm a little picky with who I do business with, but I have my reasons for getting rid of cards and keeping others, as I'll explain a little below.

I had a 7.24% APR card through State Department Federal Credit Union. I got rid of them because the completely screwed up my dispute resolution on fraudulent charges from an online.merchant. When you promise to overnight a card and it takes a week to get to me, and when you're adding and subtracting multiple amounts every single day and screwing with my credit line, I was not a happy customer. The card was secured anyways so it's not a big deal.

I had a Chase Amazon Card -- My first card, which Chase started me out with a $400 limit, and then increased it to $800 (by request from me), and never even budged to lower my APR from the rate it was BEFORE I had any credit, to a lower rate when my score was like 710. Talk about ridiculous. Besides, they wouldn't let me product change my cards.

I had a BarclayCard -- My second overall credit card, although it was worthless as it had a $7,800 limit, wasn't a Visa Signature, offered no rewards, and had a 23.24% rate.

I had an Empower FCU card -- However, after telling me originally that my card woudl graduate after around 12 months, I was told it doesn't and that I'd have to re-apply instead. I don't do wishy-washy customer service.

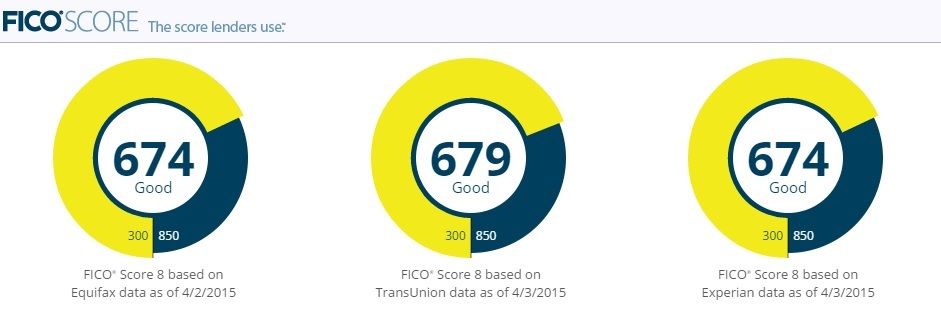

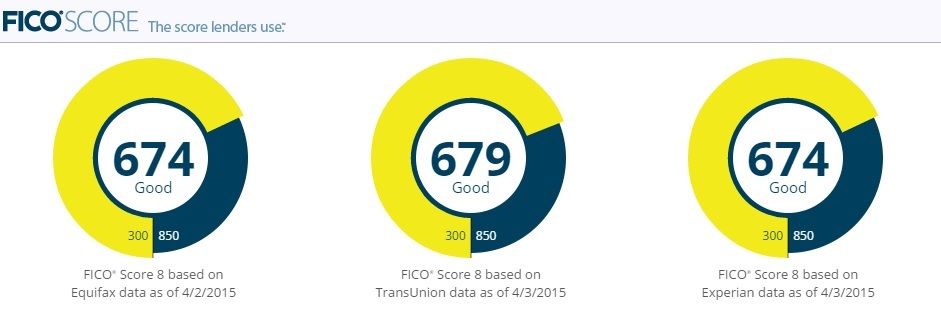

Er, 710 is not an excellent score. While you do list the cards with problems, you do not list the ones without. And in too big too fail, Chase was the most stable bank. ![]() . 710 is a good score when building or rebuilding. 760+ is a great score, just an FYI. If you want apr reductions, you need to wait like four years, again an FYI. Credit is not a race, it is a very slow journey, think tortouise and hare.

. 710 is a good score when building or rebuilding. 760+ is a great score, just an FYI. If you want apr reductions, you need to wait like four years, again an FYI. Credit is not a race, it is a very slow journey, think tortouise and hare.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PC CSP to Freedom Unlimited complete

Chase is my favorite with Citi closing the gap.