- myFICO® Forums

- Types of Credit

- Credit Cards

- PIF does not hide credit card usage.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PIF does not hide credit card usage.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PIF does not hide credit card usage.

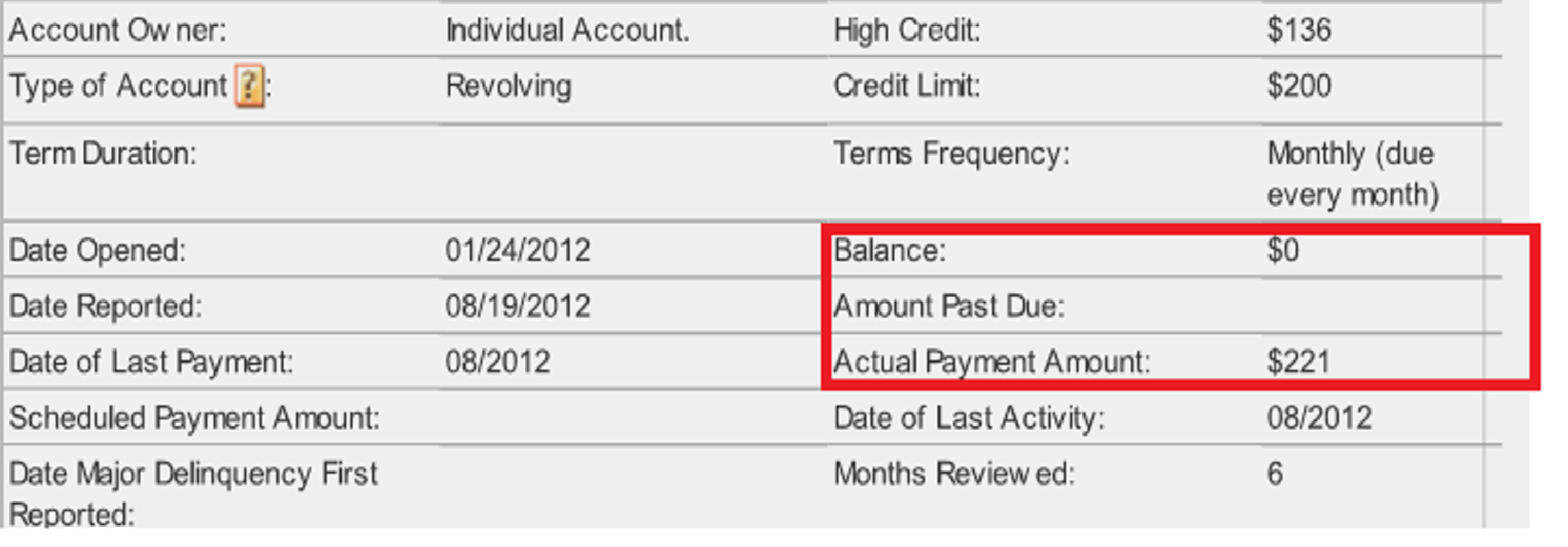

Lately people think that credit card companies can't see your actual card usage if you PIF before the statement cuts, but this isn't true at least on 2 of the 3 Credit Reports. Below is an insert from my EQ report, see it shows the actual payment for the month, even though the balance shows $0. So the card company knows that I either paid in full the balance or the balance from the previous month.

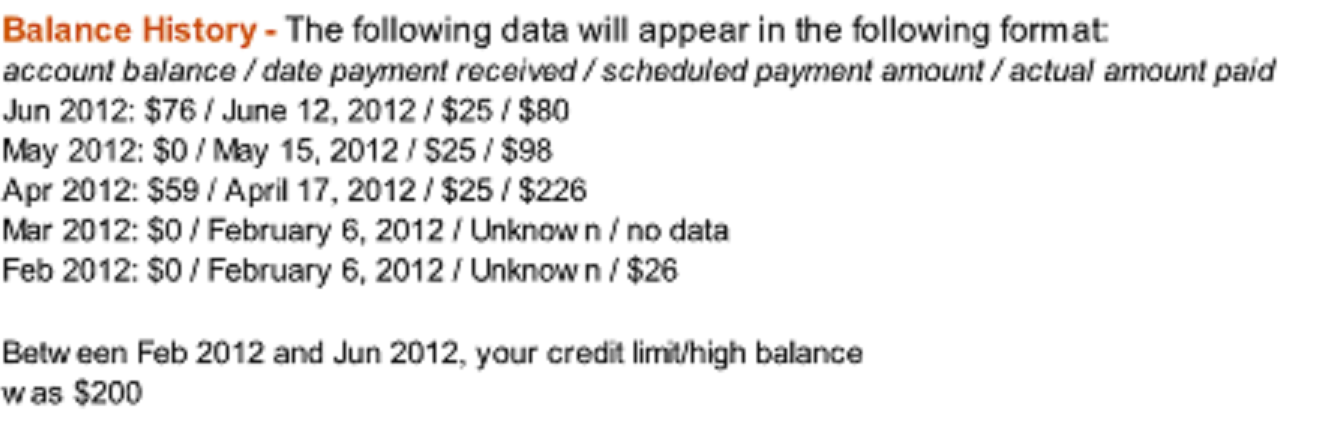

If the lender wants to see more details and to know for sure about my payment habits he can take a look at my EX report. The interesting details shown below. Where the lenders can see account balance, Payment date, minimum payment and actual payment. As you can see in Feb, I started with a zero balance and paid $26, so my total spend for the month was $26, PIF , in march the card wasn't used at all, started with no balance, and made no payments, in April I let a $59 balance report, but total spend was $226 for the month. On a card with a $200 limit.

To sum it up, if lenders are really interested they can see how much your total spend for the month, your total payments for the month, whether or not you let balances report for the last few months.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF does not hide credit card usage.

I am not interested in them not seeing it, just that it doesn't report with a balance. I am not sure if they can see all those details, except on a manual review, and most apps do not go through a manual review. Your credit score is computed (in part) by looking at how many cards total, and how many cards report with a balance, and also computing utilization including what amount is reported as of the date the report is pulled.

If the score could compute all of the info as shown, people would not get dings for "no recent use of revolving accounts" but this happens everyday for people who PIF and don't let any balances report.

CC's: AMEX (4), Alliant Visa, PenFed AMEX, Pen Fed Promise, Citi (3), Chase (5), US Bank Cash+, Huntington Voice, Nasa Plat Cash Visa, Barclay's Visa, Discover IT, Cap One QS, BOA (2), BMW Visa, 5/3 Real Life Rewards MC; FNBO Amex; Comenity Visa/MC (3), Ebates Visa Siggy, Nordstrom Visa, Walmart MC, Sam's Club MC; A few assorted store cards.

Current Scores (09/2017): EQ My Fico: 786; TU MyFico: 799; EX (My Fico): 797

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF does not hide credit card usage.

I agree with emptypockets. I have no problems with that. I want them to see, that I use the cards and pay them off. PIF before statement is only a matter of the utilization and a better score in my eyes.

FICO (TU/EX/EQ): 773/766/778 - Total CL 255+K