- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: PIF or multiple monthly pmts on your credit ca...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PIF or multiple monthly pmts on your credit cards? Does it really matter?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@Anonymous wrote:PIF when statement cuts if you're just in normal mode.

PIF before statement cut on all but one in case you're in new account mode.

This is my general strategy also.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

I usually pay weekly to achieve a low reported util; the one time I let one card report a >30% util my scores dropped by an average of 17 points. Regardless of when you pay (before or after the statement cut) CRs are going to show how much you're running through the cards. If you max out a card but pay in full before the cut it will show how much you paid on that card that month even if the reported util is 0%. This lets creditors determine if you're a revolver or a transactor and also gives them an insight to how much you spend on your cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

When I got my prime cards. I used some to pay about 400/500 monthly for the first 5 months. Just so they see I can pay either way. Now, I PIF & just have one reporting. I think it looks better on your report also. Especially if you have more credit plus other loans. Mtg, auto, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@Anonymous wrote:I usually pay weekly to achieve a low reported util; the one time I let one card report a >30% util my scores dropped by an average of 17 points. Regardless of when you pay (before or after the statement cut) CRs are going to show how much you're running through the cards. If you max out a card but pay in full before the cut it will show how much you paid on that card that month even if the reported util is 0%. This lets creditors determine if you're a revolver or a transactor and also gives them an insight to how much you spend on your cards.

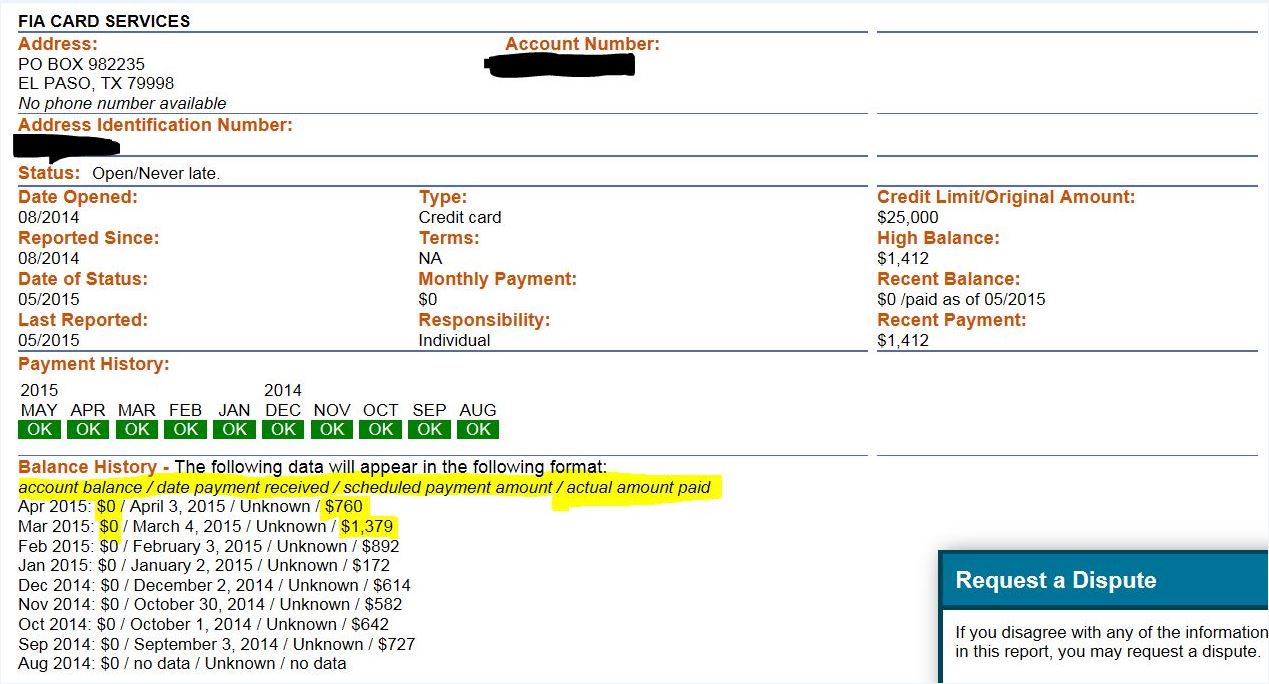

Could you do me a big favor and post a picture from your credit report of how your credit card looks when you are paying in full before the statement cuts? This would be several months where they list out the Statement Amount, Amount Due, Amount Paid, etc. and you have been hitting those months with usage on the card, but have paid each month in full prior to statement print. And I don't mean from the credit card statement but actually from the credit bureau report.

Thanks

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@Anonymous wrote:I usually pay weekly to achieve a low reported util; the one time I let one card report a >30% util my scores dropped by an average of 17 points. Regardless of when you pay (before or after the statement cut) CRs are going to show how much you're running through the cards. If you max out a card but pay in full before the cut it will show how much you paid on that card that month even if the reported util is 0%. This lets creditors determine if you're a revolver or a transactor and also gives them an insight to how much you spend on your cards.

I have never seen on my how much I spent on my cc on a credit report. I have seen a "high balance" but that in itself does not say how much I spent that month. That is why you leave a small balance on you cc to show that it is active.

I do make weekly payments on my cards. Mainly because it makes me happy to keep low balance and my cc can never get out of control. Since I've been rebuilding and found these forms I have not paid any interest and that make me happy too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

Then again, a low balance may tempt you to go spending all over. That's why restaurants are so eager to take away dirty dishes on our table; your sense of accomplishment is gone, and you feel like filling up. Dessert please - and lots of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@Anonymous-own-fico wrote:Then again, a low balance may tempt you to go spending all over. That's why restaurants are so eager to take away dirty dishes on our table; your sense of accomplishment is gone, and you feel like filling up. Dessert please - and lots of it!

Interesting analogy, the alternative dining experience being a little messy... shrimp cocktail with lasagne sauce and ice cream... mmmmmm! ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@NRB525 wrote:

@Anonymous wrote:I usually pay weekly to achieve a low reported util; the one time I let one card report a >30% util my scores dropped by an average of 17 points. Regardless of when you pay (before or after the statement cut) CRs are going to show how much you're running through the cards. If you max out a card but pay in full before the cut it will show how much you paid on that card that month even if the reported util is 0%. This lets creditors determine if you're a revolver or a transactor and also gives them an insight to how much you spend on your cards.

Could you do me a big favor and post a picture from your credit report of how your credit card looks when you are paying in full before the statement cuts? This would be several months where they list out the Statement Amount, Amount Due, Amount Paid, etc. and you have been hitting those months with usage on the card, but have paid each month in full prior to statement print. And I don't mean from the credit card statement but actually from the credit bureau report.

Thanks

I will grant your favor. ![]()

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

i try to pay in full whenever it is possible, but i do have a card or two reporting with a balance every month... those its usually my 0% promo apr cards that i let report... though i make multiple payments to the creditor during the month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF or multiple monthly pmts on your credit cards? Does it really matter?

@CribDuchess wrote:

@NRB525 wrote:

@Anonymous wrote:I usually pay weekly to achieve a low reported util; the one time I let one card report a >30% util my scores dropped by an average of 17 points. Regardless of when you pay (before or after the statement cut) CRs are going to show how much you're running through the cards. If you max out a card but pay in full before the cut it will show how much you paid on that card that month even if the reported util is 0%. This lets creditors determine if you're a revolver or a transactor and also gives them an insight to how much you spend on your cards.

Could you do me a big favor and post a picture from your credit report of how your credit card looks when you are paying in full before the statement cuts? This would be several months where they list out the Statement Amount, Amount Due, Amount Paid, etc. and you have been hitting those months with usage on the card, but have paid each month in full prior to statement print. And I don't mean from the credit card statement but actually from the credit bureau report.

Thanks

I will grant your favor.

Hey Duchess! Just quoting you for the hello hah!

More generally, while UW's can see this when they pull a credit report, not all creditors report this currently and FICO doesn't make use of it at least in FICO 8 at any rate... and probably not FICO 9 either since there are major lenders who aren't reporting this last time I looked at a base report a couple months ago.

Hopefully at some point this gets integrated into FICO as far as use goes and perhaps the $0 balances penalty can be whacked. I get that $0's across the board led to a different statistical analytics result but we should be able to do better for determining card non-use imo, even if that was just a more consistent implementation of date of last update / reported activity.