- myFICO® Forums

- Types of Credit

- Credit Cards

- Path to City National Bank's Crystal Visa Infinite...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

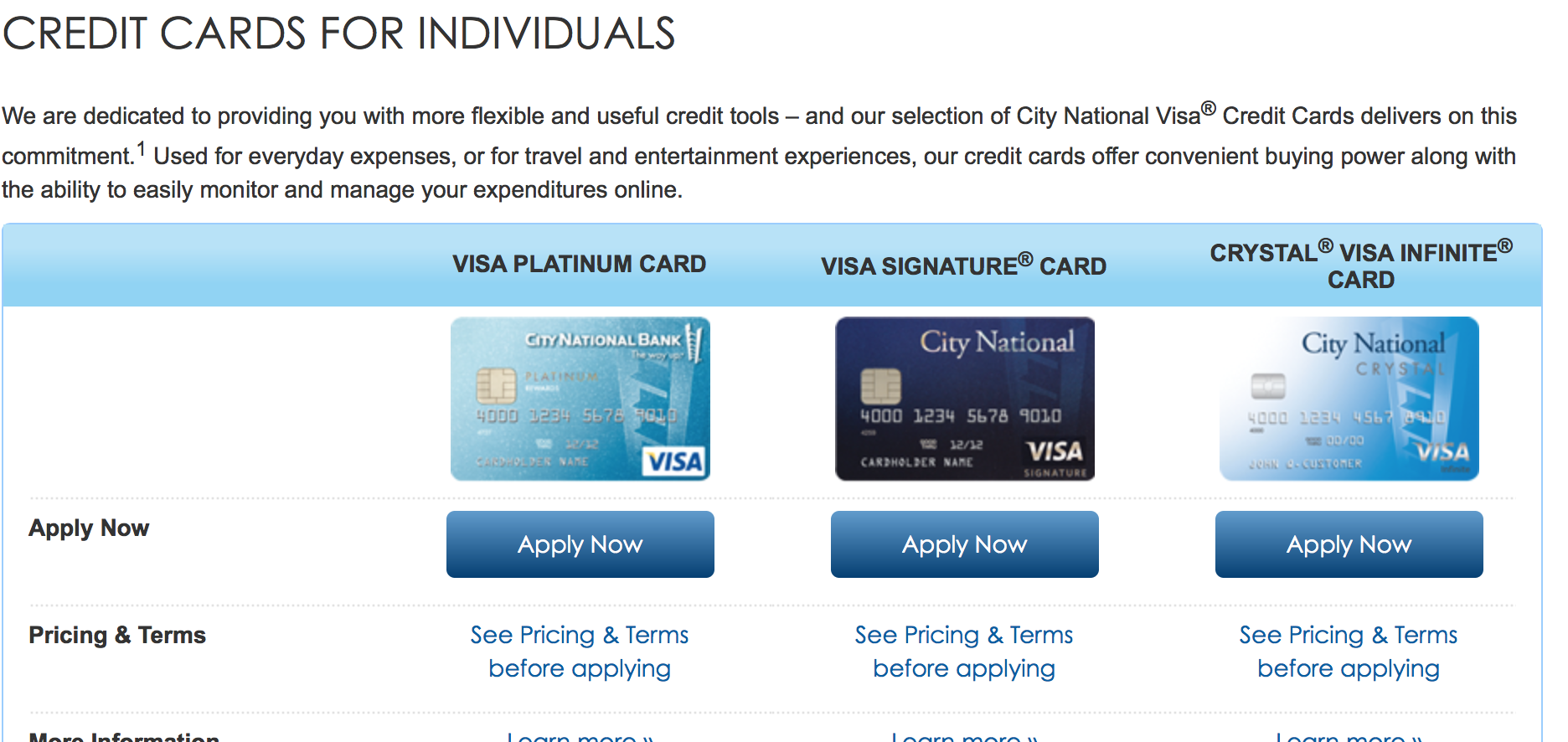

The perception is that the only way to apply for this card is to go into a branch, but with only a handful that exist in the following states: NY, DE, GA, TN, NV & CA. The card can be had even if you live outside these states, if you are able to get around the applying issue. So I recently got this card by appyling in branch but a friend, who is no where near these states, was interested and found that there is an online application! You basically have to apply for a personal checking account, set up an online account, and the option to apply for credit cards, including the crystal visa infinite, pops up. Hope this info finds to be useful to anyone out there. Here's some notable benefits of the card:

- Unlimited Priority Pass Select lounge access for two and their guests (e.g. one primary and one authorized user card + guests)

- $250 airline credit for eligible incidental charges per card per calendar year; each authorized user also gets the $250 benefit separately, up to three AUs.

- $100 companion fair discount, this can be repeated

- $100 Global Entry Credit

- Crystal Card Concierge service

- Visit Infinite Benefits

- 12 free Gogo passes annually

- 3 points for every dollar spent on airline, hotel, taxi, limousine, rental car, train, bus, gas, restaurant, fast food and takeout food dining establishment purchases

- 1 point for every dollar spent on all other purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

How many points, miles, or cash can you earn when you use this card for spending? Without that information, it's impossible to calculate the value proposition of this card.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

@UpperNwGuy wrote:How many points, miles, or cash can you earn when you use this card for spending? Without that information, it's impossible to calculate the value proposition of this card.

Added, sorry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

Thanks for adding that information. What are the redemption options? Need to know what a point is worth.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

I just read both Doctor of Credit articles about this credit card, and the most recent comment is that gift cards are specifically excluded from the airline incidentals credit in the brochure that comes with the card. It would be interesting to know if that rule is strictly enforced, or whether it varies by airline like it does with Amex Platinum.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

http://frequentmiler.boardingarea.com/2015/12/18/how-much-are-those-100000-crystal-visa-infinite-poi...

It's legit. Points are worth about 1 cent per point, sometimes more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

@MrDisco99 wrote:

Frequent Miler did a pretty comprehensive analysis of the point value for this card.

http://frequentmiler.boardingarea.com/2015/12/18/how-much-are-those-100000-crystal-visa-infinite-poi...

It's legit. Points are worth about 1 cent per point, sometimes more.

I'll try to grab this card if I book a trip to NY Time Square. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

Signup bonus is the same as CSR. Points earning rates and categories are approximately the same as CSR. Redemptions are definitely poorer than the CSR. Travel credit is definitely poorer than the CSR. Perks are better than the CSR. Overall, I think the CSR is the better card.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Path to City National Bank's Crystal Visa Infinite Card w/o Going in Branch

Seems to be on par with the CSR.

Better signup bonus (if you include the $400 waived AF at 1cpp = 90K points) and the AU's look kinda like free money.

Rewards program likely unquestionably better on hte CSR, but if travel credit is per AU, offsetting the AF and then some is trivial and you aren't hardcore travelling anyway, this card looks nice.

That said CNB traditionally is a LOT stricter on UW from what little I've seen of them on the consumer side.