- myFICO® Forums

- Types of Credit

- Credit Cards

- Paypal Mastercard what bureau do they pull?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Paypal Mastercard what bureau do they pull?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Mastercard what bureau do they pull?

@wacdenney wrote:

@iwant700fico wrote:I AM THINKING ABOUT APPLYING FOR PAYPAL MASTERCARD . IS IT A WORTHWHIILE CARD? I RECEIVE SOME PAYMENTS THERE FOR MY BUSINESS AND MY SCORES RECENTLY WENT OVER 700, SO I THOUGHT MIGHT HAVE SHOT AT IT. I HAVE 2 RECENT INQ ON MY EX AND NONE WITHIN LAST 6 MNTH WITH TU AND SAME WITH EQ.

ANYONE KNOW WHICH BUREAY THEY PULL?, I AM IN CALIFORNIA.

THANKS IN ADVANCE.

I honestly do not remember which report they pulled, but I can say that I have been thrilled with the card. My initial CL in January after calling in for security verification was $1500. That was doubled to $3000 at some point and just last week I recieved an auto CLI again to $5100. I use the card primarily for Ebay for 2X points and for dining for 3X points. Dining is really the best reward the card has to offer for me at ~2.5% cash back. It is the best card in my wallet for fast food and eating out in general.

Just don't let the 3X points thing fool you. 3X point =/= 3%. Each point is only worth .083 cents. It works out roughly to 2.5% cash back.

I love my PayPal Extras MC. GECRB has been really good to me with CLIs and a good Mastercard is getting harder and harder to come by. The card is currently my second highest limit. Untill I am able to get a Cash+ card or someone else can beat 2.5% on dining, the PayPal Extras will be keeping its spot in my wallet!

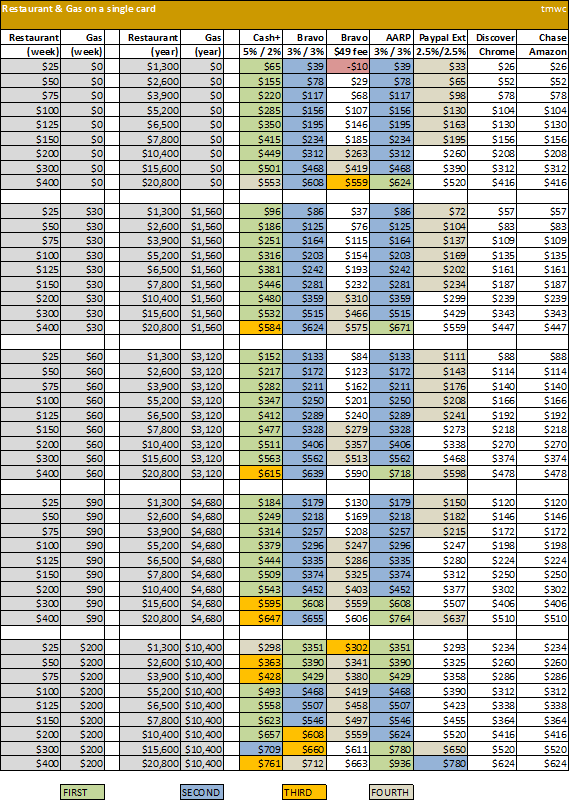

Chase AARP at 3% is better than Paypal Extras. Someone applied and just left the AARP membership field blank, and was still granted the card by Chase.

If you spend $500 a month on Restaurants, thats about $125 a week, so the Chase AARP card would give about $32 more cash back per year. Of course, Cash+ would give $187 more per year.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Mastercard what bureau do they pull?

@Themanwhocan wrote:

@wacdenney wrote:

@iwant700fico wrote:I AM THINKING ABOUT APPLYING FOR PAYPAL MASTERCARD . IS IT A WORTHWHIILE CARD? I RECEIVE SOME PAYMENTS THERE FOR MY BUSINESS AND MY SCORES RECENTLY WENT OVER 700, SO I THOUGHT MIGHT HAVE SHOT AT IT. I HAVE 2 RECENT INQ ON MY EX AND NONE WITHIN LAST 6 MNTH WITH TU AND SAME WITH EQ.

ANYONE KNOW WHICH BUREAY THEY PULL?, I AM IN CALIFORNIA.

THANKS IN ADVANCE.

I honestly do not remember which report they pulled, but I can say that I have been thrilled with the card. My initial CL in January after calling in for security verification was $1500. That was doubled to $3000 at some point and just last week I recieved an auto CLI again to $5100. I use the card primarily for Ebay for 2X points and for dining for 3X points. Dining is really the best reward the card has to offer for me at ~2.5% cash back. It is the best card in my wallet for fast food and eating out in general.

Just don't let the 3X points thing fool you. 3X point =/= 3%. Each point is only worth .083 cents. It works out roughly to 2.5% cash back.

I love my PayPal Extras MC. GECRB has been really good to me with CLIs and a good Mastercard is getting harder and harder to come by. The card is currently my second highest limit. Untill I am able to get a Cash+ card or someone else can beat 2.5% on dining, the PayPal Extras will be keeping its spot in my wallet!

Chase AARP at 3% is better than Paypal Extras. Someone applied and just left the AARP membership field blank, and was still granted the card by Chase.

If you spend $500 a month on Restaurants, thats about $125 a week, so the Chase AARP card would give about $32 more cash back per year. Of course, Cash+ would give $187 more per year.

But the Paypal card is easier to get then the US bank card and with the AARP card they could just close it if chase decided to and not worth the risk imo

My Cards: Amex BCE: $9,000, Amex Hilton HHonors: $2,000, Amex ED: $12,000, Barclays NFL extra points: $3,000, Bank of America MLB cash rewards: $17,000, BBVA compass NBA Amex triple double rewards: $17,000, Chase Amazon: $1,000, Chase Freedom: $9,000, Chase Sapphire: $5,000, Chase Slate: $5,000, Chase Disney: $4,000, Citi Double Cash: $5,400, Citi AA plat: $5,500, Citi Simplicity: $3,000, Citi Thank you preferred: $8,800, Capital one GM: $2,000, Capital one PlayStation: $3,000, Gamestop: $1,150, Amazon Store: $5,000, Ebay MasterCard: $5,000, American Eagle Storecard: $750, Macy's: $500

EX: 744, TU:750, EQ: 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Paypal Mastercard what bureau do they pull?

I actually remember checking the AARP card out at one point, but had forgotten all about it. I could actually replace PayPal for dining and BofA for gas and get 2 more cards out of my wallet with this one.

Right now I'm working on meeting my spend on Marriott and I need some CLIs and stuff to report, but I'm definately going to add this to my wish list.

Another thing to consider is that it would be yet another Chase card. I'm not sure how I feel about having so many eggs in one basket.

I would really like to know why US Bank seems to hate me. Oh well, thank you for the suggestion! Definately something to think about.