- myFICO® Forums

- Types of Credit

- Credit Cards

- PenFed Cash Rewards. New annual fee.....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed Cash Rewards. New annual fee.....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PenFed Cash Rewards. New annual fee.....

Looks like PenFed is going to charge a $25 yearly fee on the cash rewards Visa.

HOW YOU CAN AVOID THESES CHANGES

To avoid an annual fee, you can obtain a qualifying PenFed product:

- Active checking account with direct deposit ($250 min.)

- Money Market Certificate or IRA Certificate

- Mortgage

- Installment loan*

- Equity Loan or Equity Line of Credit with a balance

This came to me via email over night.

While it bothers me that they are making this change, I am going to suck it up and pay it as I make much more then that with the 5% on gas...

Sorry if this has been posted already.

** Every Card has a Job, and Every Card does its Job **

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

@RockinRay wrote:Looks like PenFed is going to charge a $25 yearly fee on the cash rewards Visa.

HOW YOU CAN AVOID THESES CHANGES

To avoid an annual fee, you can obtain a qualifying PenFed product:

- Active checking account with direct deposit ($250 min.)

- Money Market Certificate or IRA Certificate

- Mortgage

- Installment loan*

- Equity Loan or Equity Line of Credit with a balance

This came to me via email over night.

While it bothers me that they are making this change, I am going to suck it up and pay it as I make much more then that with the 5% on gas...

Sorry if this has been posted already.

Interesting. Looks like something they had briefly on the Sig Rewards card as a way to get the 5/3/1 structure each month.

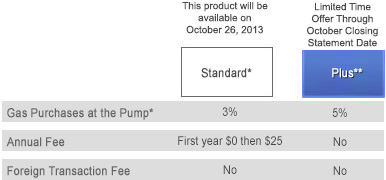

Is this fee in addition to the reward reduction (to 3% after Oct)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

@RockinRay wrote:Looks like PenFed is going to charge a $25 yearly fee on the cash rewards Visa.

HOW YOU CAN AVOID THESES CHANGES

To avoid an annual fee, you can obtain a qualifying PenFed product:

- Active checking account with direct deposit ($250 min.)

- Money Market Certificate or IRA Certificate

- Mortgage

- Installment loan*

- Equity Loan or Equity Line of Credit with a balance

This came to me via email over night.

While it bothers me that they are making this change, I am going to suck it up and pay it as I make much more then that with the 5% on gas...

Sorry if this has been posted already.

Ray,

Sorry to hear. I just checked my emai. I haven't gotten the notice yet. I heard from other forum. Some people also got the AF email. Do you have any checking with them? What are you going to do? Are you going to change into Penfed Rewards Visa?

Ron.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

darnit PenFed......well, I could always set an allotment for the $250 since I spend about $200 in gas a month anyway. But not looking good...a rewards card with an AF....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

Didn't get the email, may be because I already have an auto loan with them. I don't like where Penfed is going...Do you guys think it's because people are abusing the rewards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

@yellowcake wrote:Didn't get the email, may be because I already have an auto loan with them. I don't like where Penfed is going...Do you guys think it's because people are abusing the rewards?

I have the 5/3/1 Platinum Rewards card, and have been following this situation.

I expect that people are abusing the rewards. However, if an issuer offers a card with a 5/0.25 reward structure, then it's fair to say that people are being pointed very strongly in a particular direction -- use the card for gas only. Since the merchant fee on Visa is around 2%, I would think that this setup almost guarantees a loss for Penfed. If a person has the gas card already, and puts $1000 into a CD to keep the 5% rate grandfathered, then I'm not sure this will help the situation.

The BCP also pays out generously, but the supermarket rewards are capped, and there's a $75 fee, and both of these things tend to slow people down. It seems like Amex is shrewd about these kinds of issues.

I also think that Penfed has set up a bit of a high-wire act with their credit cards, and it's not sustainable. For example, if a person gets the new 3/2/1 Signature card, and the points are worth 5/6 of a cent, then the card is no longer competitive. This is especially so given that the underwriting requirements are so strict.

I wish that Penfed would lighten up just a tad and try to offer a more balanced package of products and services.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

@RockinRay wrote:Sorry if this has been posted already.

I haven't seen this posted or received an email from PenFed yet. Thanks for posting.

@yellowcake wrote:

Do you guys think it's because people are abusing the rewards?

How are people abusing 5% on gas (at the pump) and 0.25% on everything else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

@takeshi74 wrote:

@RockinRay wrote:Sorry if this has been posted already.

I haven't seen this posted or received an email from PenFed yet. Thanks for posting.

@yellowcake wrote:

Do you guys think it's because people are abusing the rewards?

How are people abusing 5% on gas (at the pump) and 0.25% on everything else?

This certainly doesn't sound like a card that is easy to "abuse" (scare quotes because one person's abuse is another's reward maximization).

Because it uses the automated fuel dispensor MCC, you can't do things like buy gift cards at 5% at a gas station with this card (well,one person on FT says that they did, but others are skeptical)

Probably just too many people buying too much gas (and boat/plane gas is meant to be only 1%). As has been noted, the structure of the rewards almost forces it to be unprofitable, almost no-one will use the "other" category at 0.25%

So my guess is that it is unprofitable for Penfed with just normal use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

PenFed Platinum Cash Rewards Visa® Card

****** Last HP & New TL was March 6th 2014 *** GOAL: No HP's or New TL's for 2 + years and 840's Scores ******

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Cash Rewards. New annual fee.....

Its very said. I think its the end of an era as far as great rewards credit cards go. For those interested, penfed has 584,423 people who have their credit cards. They have a liabilty of 1.559 billion, or an average of 2,668. (data as of June 30th.) I wonder how many people are going to abandon ship in the next year or so. I don't think the number of cards will decrease too much, since a lot of people will just use it less and not cancel, but I bet the liabilites will go down if people start using the card a lot less.