- myFICO® Forums

- Types of Credit

- Credit Cards

- Pre-approvals

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Pre-approvals

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

They do base their pre-approval offers on a soft inquiry.

Whether they do it periodically or every time you press the button may vary by company I would assume.

Scores: 760-770 | Inquiries: 0-1 | Utilization: 0-10% | AAoA: 3yrs | Bank: Ally | CU's: Navy & Pentagon

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

@jesseh wrote:They do base their pre-approval offers on a soft inquiry.

Whether they do it periodically or every time you press the button may vary by company I would assume.

Double check that it states on there someplace "this will not hurt your credit" or similar; was an amusing (for me at any rate, I was in the middle of a credit sadist streak, sowwy!) event when Orchard changed their pre-approval page to a HP from a SP after Cap One bought them... people howled as they had been using the pre-qual site as a substitute for application approval euphoria.

That said most pre-qual sites I've seen lately have this verbiage, but check so you don't get a nasty surprise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

@Revelate wrote:

@jesseh wrote:They do base their pre-approval offers on a soft inquiry.

Whether they do it periodically or every time you press the button may vary by company I would assume.

Double check that it states on there someplace "this will not hurt your credit" or similar; was an amusing (for me at any rate, I was in the middle of a credit sadist streak, sowwy!) event when Orchard changed their pre-approval page to a HP from a SP after Cap One bought them... people howled as they had been using the pre-qual site as a substitute for application approval euphoria.

That said most pre-qual sites I've seen lately have this verbiage, but check so you don't get a nasty surprise.

+1

BOA UNC-CH Alumni $6k I Hawaiian WEMC $3k I Arrival $6.5k I IT $1.5k | Merrill+ $2k | Lowes $12k | Apple $2k | +23more

Scores: EQ:671 (FICO ↑ 11) EX:686 (FICO ↔ N/C) TU:686 (FICO ↑ N/C) *8-5-14*

Overall UTIL: 14% *Gardening Since: 1/20/16*

------------------------------------------------------------

Need to stay out of trouble.... Go Heels!!! ... GC Watchlist ( #1 since 12-12-13)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

Source : I have checked all of them and none have SP me yet (except AMEX and this was months after I checked via website)

I think credit one does SP when submitted though.

Current FICO Scores EX: 715 EQ: 756 TU: 762

Last APP April 21, 2015.

Victim of The great AMEX HP heist of Dec 1st, 2nd and 3rd of 2014.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

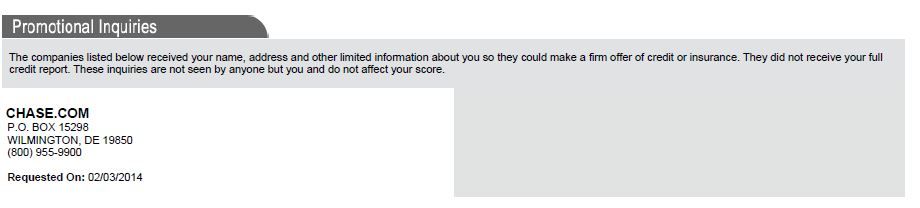

Chase and Citi do SP's when you check for preapprovals. I can vouch with my TU and EX reports. They both show "PRM" which stands for promotional offers, or in better terms, to make a "firm offer of credit". The three most highly regarded as accurate (in this order IMO) are Chase, Amex, Citi then all others. "Your card offers" with an APR range like 13.99 to 22.99 is not a preapproval.

Every single time I check Citi's website, a SP shows up a while later on EX. Same goes for Chase and my TU report. I'm not sure that AMEX shows on EX and there's one of two reasons. Either they simply take forever to show or they are buying bulk candidates from EX and have you prepopulated in their system. US Bank, BofA, Barclay and Discover have never shown up so I'm not sure how they offer cards.

Here's the kicker (and what folks need to look for on preapprovals). A specific APR offered and the opt out prescreen notice. Essentially, the opt out prescreen notice says "this offer is based on information contained in your credit report", therefore, proving they looked. It's never a guarantee but it's definitely a very good sign.

Hope this helps.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

On citi's pre aproval site. Are you only pre approved for the card they have selected or are you also approved for the 4 other offer cards?

Amex PRG, Barclays Arrival+ $5000, US Bank Kroger Visa $1000, Cap One Union Plus $1300, Cap One QS $2250, Amazon Store Card $1200, Belk $600, JCP $800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

@sky_king03 wrote:On citi's pre aproval site. Are you only pre approved for the card they have selected or are you also approved for the 4 other offer cards?

I think the other 4 are just generic items that have no basis on the item you chose (like rewards, cash back, etc. from the drop down box) The one that they've chosen for you may or may not be easier to be approved for you. (If that makes sense.) I don't know that this pre-approval check is an amazingly accurate way of saying you should app for this card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

@axledobe wrote:Chase and Citi do SP's when you check for preapprovals. I can vouch with my TU and EX reports. They both show "PRM" which stands for promotional offers, or in better terms, to make a "firm offer of credit". The three most highly regarded as accurate (in this order IMO) are Chase, Amex, Citi then all others. "Your card offers" with an APR range like 13.99 to 22.99 is not a preapproval.

Every single time I check Citi's website, a SP shows up a while later on EX. Same goes for Chase and my TU report. I'm not sure that AMEX shows on EX and there's one of two reasons. Either they simply take forever to show or they are buying bulk candidates from EX and have you prepopulated in their system. US Bank, BofA, Barclay and Discover have never shown up so I'm not sure how they offer cards.

Here's the kicker (and what folks need to look for on preapprovals). A specific APR offered and the opt out prescreen notice. Essentially, the opt out prescreen notice says "this offer is based on information contained in your credit report", therefore, proving they looked. It's never a guarantee but it's definitely a very good sign.

Hope this helps.

Thanks for the info.

On another note, where do you find your information on SP on EX and TU? I have been able to find the info on EQ, but I can't find where it shows up on TU and EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Pre-approvals

It shows up as a brand new tab/section between HP's and Account Reviews on TU. I still haven't seen PRM's on EX to date. Here's what it looks like on TU:

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***