- myFICO® Forums

- Types of Credit

- Credit Cards

- Quad Apps - too much?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Quad Apps - too much?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@myjourney wrote:

@nj23 wrote:Next month I plan on applying for some additional cards. Expect EQ and EX to be around 700 and TU 750 (will pull before apps). I would like to apply for the following, but let me know if I'm being too...optimistic...and if four is too many pulls at once:

Discover IT (received offer) EQ TU

Sallie Mae Barclay TU

AMEX BCE (I prefer non-travel rewards) EX

Chase Freedom or Sapphire EX in most cases

Only baddie on all reports are a few lates on an auto loan nearly 7 years old. Will be at 1-2% util. Currently have quicksilver 2250 and target store card 200.

Thanks4 is not to many if your profile can handle it especially if you spread the INQ's accros CB's

IMHO

I agree with this.

Make sure you consider what it will do to your AAoA as well. If you are approved for all of these, depending on your profile, it may make your AAoA take a decent hit. Now, as long as you don't app for much in the next year or so, you should be alright.

Let us know what you do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Yes, maybe you're right about the Sallie Mae, It just seems like the most well-liked of the Barclay cards. Maybe I'll just do the Rewards one, although I'm not entirely against travel rewards - maybe I'd do more traveling if I had rewards. Well, I'll probably do all 4, and in case I'm denied one or two, I'll have (hopefully) at least two approved, and then in 6-12 mos I can ask for a CLI, wherever possible. I'm not planning on applying for any additional credit after these apps for awhile, although I may be looking for an apartment at some point before the inquiries drop off.

Thanks

I think what Revelate is saying is that usually the Sallie Mae gets you more money back in most scenarios than the BCE. They wonder what the choice of BCE is about? MSD? Backdating? Good sign up bonus? Just curious.

It is a great choice for a card, and I think it should be the first TU pull, then whatever card may be TU afterwards since Barclays is pretty INQ sensitive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

I would like to have a good variety of cards/processors, and AMEX cards seem to be well-liked, in general, plus they don't seem to be super stingy with credit lines and CLI...but if you can think of any other well liked cards that have non-travel rewards (not mentioned already), maybe I'll go for one of those instead. I end up doing a lot of food spending, i.e. groceries, restaurants, etc. My current AAoA is 7 years, so if I do get approved for 3-4 new cards, it will take a hit.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

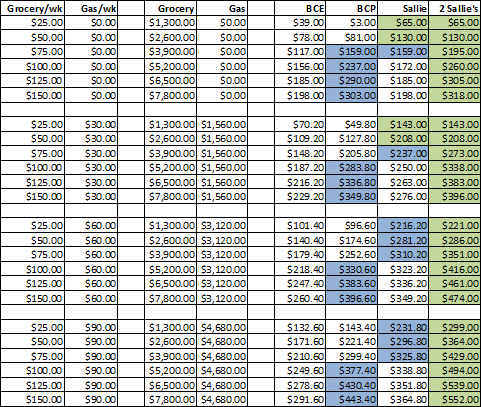

The Sallie Mae gets more rewards than a BCE, under all spending patterns. And if you consistently exceed $250 monthly spend on either Grocery or Gas Station purchases, you can always wait 6 months and apply for a second Sallie Mae card.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

And if your grocery spending is higher ($12K per year or so) get the Amex Blue Cash instead.

Note that TMWC's chart omits the select department store category, which is a slight advantage of the BCE/BCP. But this helps BCE only if most of the spending is in that category (and not on gas or groceries) AND is under $7,500 a year (when BCP becomes better) which is probably a very small group.

Similarly if drug stores are added, Blue Cash would be the choice at a slightly lower level.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@nj23 wrote:Next month I plan on applying for some additional cards. Expect EQ and EX to be around 700 and TU 750 (will pull before apps). I would like to apply for the following, but let me know if I'm being too...optimistic...and if four is too many pulls at once:

Discover IT (received offer)

Sallie Mae Barclay

AMEX BCE (I prefer non-travel rewards)

Chase Freedom or Sapphire

Only baddie on all reports are a few lates on an auto loan nearly 7 years old. Will be at 1-2% util. Currently have quicksilver 2250 and target store card 200. Oh, and all of the above "pre-qualify" checks have gone through except for Sallie Mae, which I couldn't find a pre-qualify check for.

Thanks

Given your profile, 4 apps is definitely reasonable.

Last month, I apped and was approved for the Sallie Mae, BCE, Delta Skymiles, Freedom and Lowe's, plus I PC'ed and CLI'ed my Capital One and US Bank and got a new car. My scores were right in the same range as yours (except your TU is much better than mine).

As others have said, do it all at once, take the temporary credit hit from the INQ and new TL's and in 6-12 months you'll be golden. One word of caution...be sure you're not plannng on apping on anything major (i.e. a mortgage) in the next year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

Hmm...The BankAmericard Cash Rewards card doesn't look too bad - $100 bonus if spend $500 in first 90 days isn't bad...but it appears to be a Signature Visa - So maybe it's not worth trying for with just average/good credit...

Discover sent me a second offer in two weeks...don't tempt me to app now!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

I have mediocre credit (670-680) and got the Bank Americard. It's a visa signature with a 3500 limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@SunriseEarth wrote:

@myjourney wrote:

@nj23 wrote:Next month I plan on applying for some additional cards. Expect EQ and EX to be around 700 and TU 750 (will pull before apps). I would like to apply for the following, but let me know if I'm being too...optimistic...and if four is too many pulls at once:

Discover IT (received offer) EQ TU

Sallie Mae Barclay TU

AMEX BCE (I prefer non-travel rewards) EX

Chase Freedom or Sapphire EX in most cases

Only baddie on all reports are a few lates on an auto loan nearly 7 years old. Will be at 1-2% util. Currently have quicksilver 2250 and target store card 200.

Thanks4 is not to many if your profile can handle it especially if you spread the INQ's accros CB's

IMHO

+1

I would count on double pulls for Chase and not attempt to get CSP for now. Stick to Freedom and wait 6-12 months and then app for CSP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Quad Apps - too much?

@Themanwhocan wrote:The Sallie Mae gets more rewards than a BCE, under all spending patterns. And if you consistently exceed $250 monthly spend on either Grocery or Gas Station purchases, you can always wait 6 months and apply for a second Sallie Mae card.

wow.... you can have two Sallie Mae cards ?? You really have done an excellent job with your cash back strategy ![]()