- myFICO® Forums

- Types of Credit

- Credit Cards

- Refinance or Balance Transfer ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Refinance or Balance Transfer ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refinance or Balance Transfer ?

I need help deciding whether i should refinance a $10,000 car loan which currently sits 6.9% for 36 months or do a balance transfer. (i am new to credit)

I am trying to build credit which i know having an installment loan on your credit report helps but i also want to try get the best deals and make the most i can.

The options are...

1. WellsFargo - $312 fixed monthly payments - for 36 months @ 6.9%.

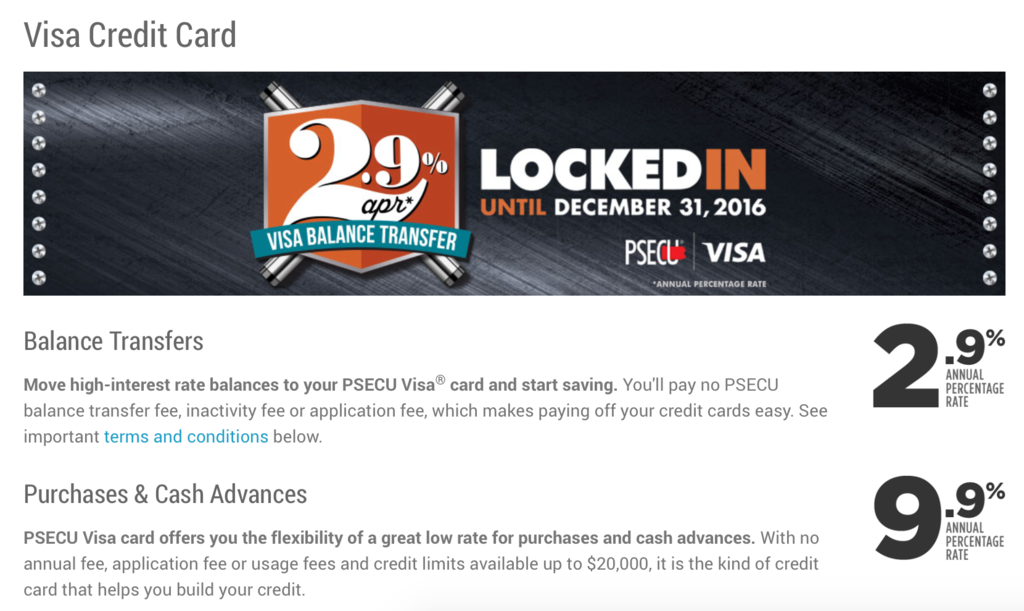

2. Pennsylvania State Employees Credit Union Balance Transfer - 15 months @ 2.9%.

Then it's 9.9% which i can then roll it over to Chase Slate 15 months. 0 fees. 0% APR.

3. just go straight to Chase Slate 15 months. 0 fees. 0% APR ?

not sure. 2.99% pretty much a 3% balance transfer fee i think.

Citi Simplicity 21 months 0% APR but has a 3% balance transfer fee

vs

PSECU 2.99% APR 15 months NO BALANCE TRANSFER FEE ....

isn't both the same ?

somebody else can do the math ![]()

thanks.

CURRENT OPTION

WellsFargo Dealer Services 6.9% APR

$10,000

36 monthly payments of $312

$1,232 in fees. (6.9% interest charged)

--------------------------------------------------------------------------------- 3 years carrying a balance (36 months total)

$1,232 total fees

OPTION 1

BARCLAY RING 8% APR

or NASA lifetime 8% APR

$10,000 balance transfer

24 monthly payments of $452

$855 in fees. (8% interest charged)

--------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$855 total fees

OPTION 2

DISCOVER IT 0% intro for 12 months

or FNBO 0% Intro for 12 months

$10,000 balance transfer

12 monthly payments of $416

$300 in fees. (3% balance transfer fee)

DISCOVER IT 0% intro for 12 months

or FNBO 0% Intro for 12 months

$5,008 balance transfer

12 monthly payments of $416

$150 in fees. (3% balance transfer fee)

----------------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$450 total fees.

OPTION 3

American Express Blue Cash 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$300 in fees. (3% balance transfer fee)

US Bank Cash+ 0% intro for 9 months

$3,760 balance transfer

9 monthly payments of $417

$112 in fees. (3% balance transfer fee)

----------------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$412 total fees.

OPTION 4

Chase Slate 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$0 in fees

American Heritage Credit Union 4.99% 24 months

or Valor Credit Union lifetime 5.99%

$3,760 balance transfer

24 monthly payments of $156

$184 in fees. (4.99% interest charged)

$184 total fees (American Heritage) $221 total fees (Valor)

OPTION 5

Chase Slate 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$0 in fees

Pennsylvania State Employees Credit Union 2.99% 15 months

$3,760 balance transfer

15 monthly payments of $250

$92 in fees. (2.99% interest charged)

$92 total fees

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

With that rate. Don't kniw why you are worrying of it. No BT is going yo last 36 months. Even if 0%. Also that's hoping you get a card with limit that high. Then maxing it with a bt. If your scores are outstanding even more than what it was when you got car will be tough to refinance for lower than you have on a used car. But does not hurt to try. But if you are raising your payments say on slate you coukd leave it alone. Pay the same amount now that you want to pay on slate. Which will go to principal. And be done in same amount of time. Without hurting score. But you have many options outlined. Either is fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

I'd lean towards refinancing the loan vs putting it on a credit card. Your utilization will skyrocket, which is going to lower your score. While this is temporary (as temporary as the high util, anyway), if you're just starting out, tanking your scores may not make you feel so great. There is no compelling advantage that I see to putting it on a credit card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

@kdm31091 wrote:I'd lean towards refinancing the loan vs putting it on a credit card. Your utilization will skyrocket, which is going to lower your score. While this is temporary (as temporary as the high util, anyway), if you're just starting out, tanking your scores may not make you feel so great. There is no compelling advantage that I see to putting it on a credit card.

the whole point of doing this was so i can be ready to sell the car at anytime. It's a 2005 vehicle. I could just give it to CarMax with a lien but i thought if I will have the title to the car that would give me negotiation power. Also if i decide to keep the car... the car insurance would be much cheaper costing me $50 a month instead of $115 i am paying now reqired by WellsFargo. Will no longer be required to have full coverage after Wells Fargo releases the lien to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

It's unclear to me (just had first sip of coffee) what you currently have available to you in credit lines to BT and special offers and what you'd need to be applying for.

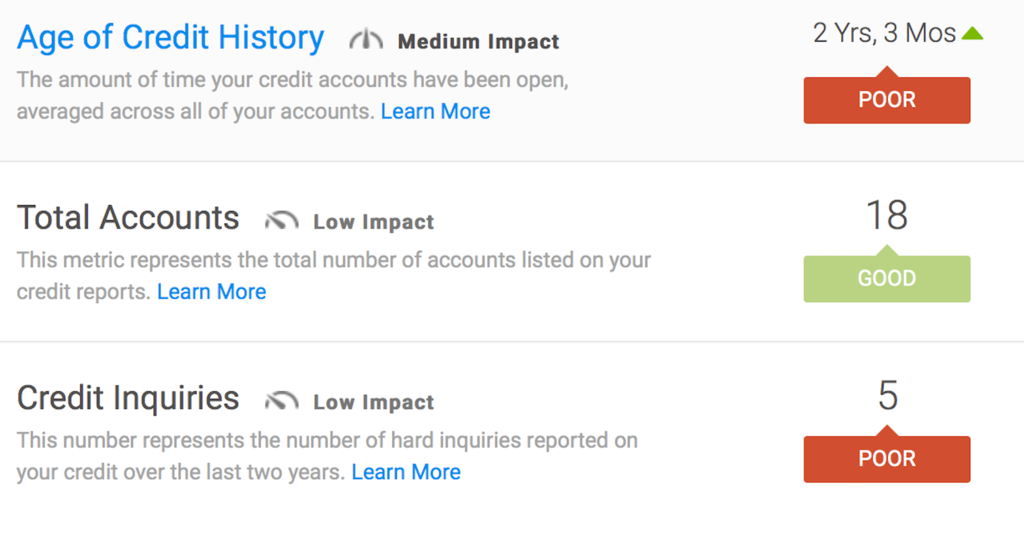

If you're wanting to positively impact your score, I wouldn't applying for anything new would be a good idea because it would hurt in the new inquiries, new accounts, AAoA AND I think it could be doubtful that you'd get a sufficient limit to BT the whole thing.

It seems you have an existing relationship with that credit union of both a Visa and PLOC. I see that the 2.9% offer is for a limited time. I'm unsure of the rate on the PLOC, but it seems you have one. I'm also unclear of it's limit. If you could do something beneficial with that existing CU relationship since it seems you may sell the car, that sounds pretty good. Sounds like it's a roll of the dice whether you'd sell the car in time to beat the end of the 2.9.

I'm confused by your option 2, again it's unclear what cards and limits you have available. The only card I could pick out from your sig that you listed in your options was Discover. If you have that, then I'd use that (no app'ing). If you're not doing anything else credit wise in the new future, I'd go ahead and go with high util on something existing. Will still hurt util, but not the other three mentioned above.

If I hadn't read your list of options, I'd recommend refi with DCU. You should be able to get 2.24 or 1.74 with a relationship. It would be two hard pulls, but with your score it seems like a pretty sure thing (best rate over 675).

That being said, if you're thinking of selling it soon, I wouldn't do anything. Not worth the trouble. I think it would have zero impact with carmax having the title or not. They're very formulaic, IME. Plug in the type of car, condition, spit out an offer. Done.

Finally, I would not risk not having full coverage on a car that I owe $10k on. If I owned it outright and it was worth $10k, I probably would still have full coverage. The way you phrase it, you make it sound like having full coverage is a crazy thing that the lender is making you have that you don't need. One strike of bad luck and you need it. Even if I put it on a CC, I'd still keep full coverage!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

@Anonymous wrote:It's unclear to me (just had first sip of coffee) what you currently have available to you in credit lines to BT and special offers and what you'd need to be applying for.

If you're wanting to positively impact your score, I wouldn't applying for anything new would be a good idea because it would hurt in the new inquiries, new accounts, AAoA AND I think it could be doubtful that you'd get a sufficient limit to BT the whole thing.

It seems you have an existing relationship with that credit union of both a Visa and PLOC. I see that the 2.9% offer is for a limited time. I'm unsure of the rate on the PLOC, but it seems you have one. I'm also unclear of it's limit. If you could do something beneficial with that existing CU relationship since it seems you may sell the car, that sounds pretty good. Sounds like it's a roll of the dice whether you'd sell the car in time to beat the end of the 2.9.

I'm confused by your option 2, again it's unclear what cards and limits you have available. The only card I could pick out from your sig that you listed in your options was Discover. If you have that, then I'd use that (no app'ing). If you're not doing anything else credit wise in the new future, I'd go ahead and go with high util on something existing. Will still hurt util, but not the other three mentioned above.

If I hadn't read your list of options, I'd recommend refi with DCU. You should be able to get 2.24 or 1.74 with a relationship. It would be two hard pulls, but with your score it seems like a pretty sure thing (best rate over 675).

That being said, if you're thinking of selling it soon, I wouldn't do anything. Not worth the trouble. I think it would have zero impact with carmax having the title or not. They're very formulaic, IME. Plug in the type of car, condition, spit out an offer. Done.

Finally, I would not risk not having full coverage on a car that I owe $10k on. If I owned it outright and it was worth $10k, I probably would still have full coverage. The way you phrase it, you make it sound like having full coverage is a crazy thing that the lender is making you have that you don't need. One strike of bad luck and you need it. Even if I put it on a CC, I'd still keep full coverage!

The current option is what i have. Option 1 (NASA, Barclay RING) Option 3 (American Express, US Bank) Option 4 (Chase Slate, American Heritage Credit Union) and Option 5 (PSE Credit Union PLOC or 2.9% ) i do not have. I would have to apply for their offer they're offering except gor optiom 2 (Discover limit $12,000, FNOB limit $6,500)

Based on caculations here are the options for $7,500 refinancing auto loan...

@Digitial Credit Union - $319 24 mos @ 1.74%

@Wells Fargo DS - $313 36 mos @ 6.99% (current option)

@Digitial Credit Union - $214 36 mos @ 1.74%

@PSE Credit Union - $213 36 mos @ 1.49%

@Digitial Credit Union - $162 48 mos @ 1.74%

@Digitial Credit Union - $131 60 mos @ 1.74%

OTHER OPTIONS

OPTION 1

BARCLAY RING 8% APR

or NASA lifetime 8% APR

$10,000 balance transfer

24 monthly payments of $452

$855 in fees. (8% interest charged)

--------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$855 total fees

OPTION 2

DISCOVER IT 0% intro for 12 months

or FNBO 0% Intro for 12 months

$10,000 balance transfer

12 monthly payments of $416

$300 in fees. (3% balance transfer fee)

DISCOVER IT 0% intro for 12 months

or FNBO 0% Intro for 12 months

$5,008 balance transfer

12 monthly payments of $416

$150 in fees. (3% balance transfer fee)

----------------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$450 total fees.

OPTION 3

American Express Blue Cash 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$300 in fees. (3% balance transfer fee)

US Bank Cash+ 0% intro for 9 months

$3,760 balance transfer

9 monthly payments of $417

$112 in fees. (3% balance transfer fee)

----------------------------------------------------------------------------------------- 2 years carrying a balance (24 months total)

$412 total fees.

OPTION 4

Chase Slate 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$0 in fees

American Heritage Credit Union 4.99% 24 months

or Valor Credit Union lifetime 5.99%

$3,760 balance transfer

24 monthly payments of $156

$184 in fees. (4.99% interest charged)

——————————————————————————— 3 years carrying a balance (39 months total)

$184 total fees (American Heritage) $221 total fees (Valor)

OPTION 5

Chase Slate 0% intro for 15 months

$10,000 balance transfer

15 monthly payments of $416

$0 in fees

Pennsylvania State Employees Credit Union 2.99% 15 months

$3,760 balance transfer

15 monthly payments of $250

$92 in fees. (2.99% interest charged)

——————————————————————————— 2.5 years carrying a balance (30 months total)

$92 total fees

the whole point of doing this was so i can be ready to sell the car at anytime. It's a 2005 vehicle. I could just give it to CarMax with a lien but i thought if I will have the title to the car that would give me negotiation power. Also if i decide to keep the car... the car insurance would be much cheaper costing me $50 a month instead of $115 i am paying now reqired by WellsFargo. Will no longer be required to have full coverage after Wells Fargo releases the lien to me.

Once i sold the car i go back and pay off the credit card i transferred the balance to. Though i would hate to put a tent on my credit even if its temporary as others have stated would not make me feel good at all. I don't think $5,000 would put much harm though. $10,000 would especially if i do not get a sufficient limit. They would have to give me $100,000 limit just to be at 10% utilization. I also like to make the most of my hard inquiries. So if i apply for Chase Slate i would apply for Chase Sapphire (2 cards for 1 inquiry). I also wanted the US Bank Cash+ ![]()

recent offers sitting on the table ...

18 months 0% cash rewards from WellsFargo

$150 cash back Blue Cash American Express. 0% 15 months

$250 cash back American Express Everyday (white card).

and 100,000 points bonus American Express Platinum.

Pennsylvania State Employeees Credit Union i hear to combine visa transfer card and Personal Line of Credit in which if i do not use my credit cards a PLOC will not close due to inactivity which may be good to keep my credit score from dropping (doormat) if i never use credit cards living abroad for a couple of years ? anything know about this ? Then maybe thats where i should maybe invest my hard inquires getting a PLOC instead ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

@taxi818 wrote:With that rate. Don't kniw why you are worrying of it. No BT is going yo last 36 months. Even if 0%. Also that's hoping you get a card with limit that high. Then maxing it with a bt. If your scores are outstanding even more than what it was when you got car will be tough to refinance for lower than you have on a used car. But does not hurt to try. But if you are raising your payments say on slate you coukd leave it alone. Pay the same amount now that you want to pay on slate. Which will go to principal. And be done in same amount of time. Without hurting score. But you have many options outlined. Either is fine.

+1

OP, you have all kinds of analysis going on here. I think you may be overthinking it. Pay the existing loan at a higher rate if you want. That keeps the installment loan on your credit file, maybe not as long, but it gets you to your pay off at the same time. And keeping the existing installment loan on your credit file is currently actually boosting your score. Go over to the Understanding FICO forum and search for "Paid off my installment loan and lost 20/30 points". There's a bunch of those. I would not be in any hurry to get rid of the installment loan.

Negotiating power if you have the title clear? Not really. The car would be sold at a price, the buyer or dealer cares not what you owe on it. The money from any sale needs to go to pay off that loan, so even if you BT, you should be planning on using any proceeds from the sale of the vehicle to pay that off, which takes all the fun out of doing the BT in the first place.

If you really insist on doing a BT to take advantage of that 2.9%, fine, transfer $2k and have fun with that.

The insurance thing? Insurance is an expense... until something happens.... and you lose your vehicle,... and you can't immediately pay off the $10k loan (or $10k balance transfer) to free up monthly payment amounts to get a new vehicle. Or pay for repairs.

You don't have Slate or Cash+ yet? I would not build in any presumptions about limits and availability if those are not in hand yet.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

Also agree no rush to pay off a loan. Installment loans in good standing absolutely help your score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

But than apply for the slate to see how much CL I qualify for and than go ahead and pay down as much as I can on the WF loan by writing off a check from slate..hopefully they would give me a high CL like 16k so I wouldn't have to use more than half to pay down a good deal of the car installment from wells, but that's just me.

I know for a fact that simplicity with citi does give convenience checks when you open it as I've helped a client/friend do this and when she couldn't find it they offered to cut a check to her for the amount she want made out to her..so she can go ahead and use it to pay down the loan.

But that's with a 3% fee..I guess about half is better than nothing

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Refinance or Balance Transfer ?

@NRB525 wrote:

@taxi818 wrote:With that rate. Don't kniw why you are worrying of it. No BT is going yo last 36 months. Even if 0%. Also that's hoping you get a card with limit that high. Then maxing it with a bt. If your scores are outstanding even more than what it was when you got car will be tough to refinance for lower than you have on a used car. But does not hurt to try. But if you are raising your payments say on slate you coukd leave it alone. Pay the same amount now that you want to pay on slate. Which will go to principal. And be done in same amount of time. Without hurting score. But you have many options outlined. Either is fine.

+1

OP, you have all kinds of analysis going on here. I think you may be overthinking it. Pay the existing loan at a higher rate if you want. That keeps the installment loan on your credit file, maybe not as long, but it gets you to your pay off at the same time. And keeping the existing installment loan on your credit file is currently actually boosting your score. Go over to the Understanding FICO forum and search for "Paid off my installment loan and lost 20/30 points". There's a bunch of those. I would not be in any hurry to get rid of the installment loan.

Negotiating power if you have the title clear? Not really. The car would be sold at a price, the buyer or dealer cares not what you owe on it. The money from any sale needs to go to pay off that loan, so even if you BT, you should be planning on using any proceeds from the sale of the vehicle to pay that off, which takes all the fun out of doing the BT in the first place.

If you really insist on doing a BT to take advantage of that 2.9%, fine, transfer $2k and have fun with that.

The insurance thing? Insurance is an expense... until something happens.... and you lose your vehicle,... and you can't immediately pay off the $10k loan (or $10k balance transfer) to free up monthly payment amounts to get a new vehicle. Or pay for repairs.

You don't have Slate or Cash+ yet? I would not build in any presumptions about limits and availability if those are not in hand yet.

No i dont have chase slate yet thats why if i were to take a hard inquiry i would apply 2 chase cards for 1 hard inquiry. My freedom only $6,000 limit and its my lowest besides $500 bank america (my first credit card) which Dying to raise it or turn it into a signature visa but they wont without a har d inquiry. My

months 0% on my freedom will be up march 2016 but charges 3% Fee. Same goes for Citi. I guess yoi right. The longer the loan the better it looks on my credit report. Its a 5 year wells fargo auto loan. I have 3 years left. Suze orman says a car loan longer than 36 months (3 years) is a waste of money and one of the biggest mistakes you could make when buying a car and says its a sign of financial irresponsible so i thought maybe i should try clear it up (avoid 2 more years of interest if not 3) and pay it off now.