- myFICO® Forums

- Types of Credit

- Credit Cards

- Replacement card for US Bank Cash+ for Restaurant ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Replacement card for US Bank Cash+ for Restaurant Spending?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

@Anonymous wrote:

@mongstradamus wrote:

@Anonymous wrote:Does anyone have any good suggestions/hear of any potential new cards that will be able to replace the 5% offered by cash+ on restaurants? (in particular cash back not travel rewards) About 60% of my spending monthly is on restaurants/fastfood.

3% chase aarp i think is best option, there are an bunch of other 2% you could use for restaurants double cash or fidelity amex 2% on everything, or 2% only restaurant cards like amex te or chase sapphire ?

I used my CSP today for 3X.

FYI, 3X points is just for the first Friday of each month.

https://creditcards.chase.com/sapphire/Disclosures

First Friday Reward Bonus

You will earn an additional 1 bonus point for each $1 of net purchases made with your credit card in the dining category – when you use your card at restaurants on January 3, February 7, March 7, April 4, May 2, June 6, July 4, August 1, September 5, October 3, November 7, and December 5, 2014 before midnight in the time zone where the purchase is made. The bonus point earned is in addition to the standard two points earned in the dining category for a total of 3 points, which may be stated in marketing material as 3X in dining – when you use your card at restaurants. Merchants who accept Visa/MasterCard credit cards are assigned a merchant code based on the kinds of products and services they sell. Chase groups similar merchant codes into categories for purposes of making rewards offers to you. Chase makes every effort to include all relevant merchant codes in its listed categories. However, even though a merchant or the items that it sells may appear to fit within a listed category, the merchant may not have a merchant code that falls within that category. Therefore, purchases with that merchant will not qualify for the stated rewards offer on category purchases. Please allow 6 to 8 weeks after qualifying transactions for bonus point to post to your account. There is no maximum bonus point accumulation for this promotional offer. Credit card product changes during the promotional period will forfeit this bonus offer. To qualify for this promotional offer, account must be open and not in default at the time of fulfillment. This promotional offer is non-transferable. This is a limited time offer. For more information about Chase rewards categories, see www.Chase.com/RewardsFAQs or your Rewards Program Rules and Regulations.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

I'm considering the new FlexPerks Amex as restaurants are an additional bonus separate from gas, grocery, airfare (up to 4% airfare or close to 3% hotels).

FlexPerks isn't for everyone, the redemption tiers are extraordinarily complicated but I've had excellent luck redeeming airfare/hotels right at the max value many times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

Chase Sapphire or Ink Cash at 2%.

Too bad US Bank has decided to "nerf" the restaurant 5%! Far and away the most useful category for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

@weehoo wrote:Does AARP card countfast food as 3% as well?

I to am looking for a Cash+ replacement , but not sure its worth the hassle for an extra 1% over using Fidelity Amex

The AARP does indeed count fast food. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

@Anonymous wrote:

@mongstradamus wrote:

@Anonymous wrote:Does anyone have any good suggestions/hear of any potential new cards that will be able to replace the 5% offered by cash+ on restaurants? (in particular cash back not travel rewards) About 60% of my spending monthly is on restaurants/fastfood.

3% chase aarp i think is best option, there are an bunch of other 2% you could use for restaurants double cash or fidelity amex 2% on everything, or 2% only restaurant cards like amex te or chase sapphire ?

I used my CSP today for 3X.

i thought its 2x ? does it include starbucks and mc donalds ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

@Anonymous wrote:

I'm 27 and got the Aarp card. Age ain't nothing but a number

WOW! Tell my body that ![]() Where's Nixon on this...?

Where's Nixon on this...?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

@Anonymous wrote:i thought its 2x ?

See kevinjjc's reply above.

@Open123 wrote:Chase Sapphire or Ink Cash at 2%.

At 2% they're equivalent to the cards in the far right column in Themanwhocans chart posted earlier in this thread. However, 2% assumes 1%/point which applies for statement credits. If one is transferring then points may have slightly higher value.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

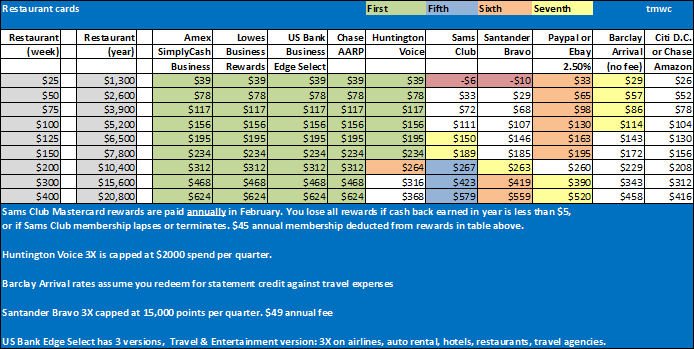

@Themanwhocan wrote:Best restaurant cash back cards, where Restaurant is defined as both Fast Food Restaurants and, er, slow food Restaurants.

This is fantastic!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Replacement card for US Bank Cash+ for Restaurant Spending?

This is NOT fantastic:

Chase Freedom Visa: 11/2009, $4,700 CL

Chase Sapphire Preferred Visa Signature: 11/2013, $15,000 CL

U.S. Bank Cash+ Visa Signature: 11/2013, $15,700 CL