- myFICO® Forums

- Types of Credit

- Credit Cards

- Rewards VS Cash

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Rewards VS Cash

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rewards VS Cash

I've found some posts that discussed this very topic but I wanted to get some community feedback. My business spends about $350K a month on credit cards. Of that, about $100K goes through my AMEX Platinum Business and Chase Ink Plus. The rest of my transactions are on my personal cards, which are strictly used for the business so as to not comingle statements and create a headache. For the past 4 or 5 years I've just let points sit, thinking maybe one day I'll find a use. I use them as bonuses for employees, but that only goes so far.

From reading on ThePointsGuy and NerdWallet it seems like AMEX and Chase UR points are "worth" $0.02 each, but I've never even come close to that, usually because I don't ever fly, and just use the Chase UR points for hotel redemptions which seems to be worth about $0.0125 each. How are people seeing values like that outside of international or first class flights?

I used to let my statements cycle with a balance and then pay off right away but it was negatively impacting CLIs so now I pay right before statement cut and never carry a balance on any card and ask for CLIs as frequently as possible. Slowly I've worked the limits up. The main problem I run into is it seems like merchants always take at least 3+ days to settle a charge, and then the credit card company takes another day or two to apply my payment, meaning cards like Fidelity Rewards, I can only run like 4-5 times the limit per month and I have to cycle through cards - super annoying.

I've tried to shift a lot of spending over to 2% cash back cards like the DC and Fidelity cards, are there any other cards like this with unlimited cash back? It seems like a decent "Business" 2% cash back cards doesn't exist?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

@Anonymous wrote:I've found some posts that discussed this very topic but I wanted to get some community feedback. My business spends about $350K a month on credit cards. Of that, about $100K goes through my AMEX Platinum Business and Chase Ink Plus. The rest of my transactions are on my personal cards, which are strictly used for the business so as to not comingle statements and create a headache. For the past 4 or 5 years I've just let points sit, thinking maybe one day I'll find a use. I use them as bonuses for employees, but that only goes so far.

From reading on ThePointsGuy and NerdWallet it seems like AMEX and Chase UR points are "worth" $0.02 each, but I've never even come close to that, usually because I don't ever fly, and just use the Chase UR points for hotel redemptions which seems to be worth about $0.0125 each. How are people seeing values like that outside of international or first class flights?

I used to let my statements cycle with a balance and then pay off right away but it was negatively impacting CLIs so now I pay right before statement cut and never carry a balance on any card and ask for CLIs as frequently as possible. Slowly I've worked the limits up. The main problem I run into is it seems like merchants always take at least 3+ days to settle a charge, and then the credit card company takes another day or two to apply my payment, meaning cards like Fidelity Rewards, I can only run like 4-5 times the limit per month and I have to cycle through cards - super annoying.

I've tried to shift a lot of spending over to 2% cash back cards like the DC and Fidelity cards, are there any other cards like this with unlimited cash back? It seems like a decent "Business" 2% cash back cards doesn't exist?

Like you noted, miles/points really shine for international and first class flights. It's possible to get a good domestic/economy redemption but generally, if you are just casually traveling and/or domestic, cash back is probably better. You can still hold a points card for perks if you want, but for spend/rewards, cash back is best if you aren't otherwise going to travel international or do first class.

TPG and Nerdwallet are basically giving an optimistic "value" of the points if you redeem them for selected flights. While there's nothing wrong with their analysis, it's geared towards a heavy traveler. As you also noticed, hotel redemptions are generally less lucrative. To be honest, sounds like cash back may be better for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

But, at the end of the day, they're your points. Use them for what you want, and worry less about the value and more about the experience you're getting by travelling to new places.

With Hyatt you can pretty easily get around 2 cents per point on some redemptions (on the chase UR side)

Are you transferring the points to hotel partners, or booking directly through the chase UR portal and "paying with points"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

I haven't been transfering points for hotel redemptions, usally because the hotels my family stays at on vacation usually aren't part of any group (e.g. ski towns). UR seems to have the best redemption for hotels, but you can't book same day, and I always up end booking last minute (same day) because of work scheduling or weather.

I noticed you don't have the SPG card, but have the Ritz card. I've heard the SPG points are often times pretty valuable, especially at higher end hotels like Ritz, St Regis, etc?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

@Anonymous wrote:I haven't been transfering points for hotel redemptions, usally because the hotels my family stays at on vacation usually aren't part of any group (e.g. ski towns). UR seems to have the best redemption for hotels, but you can't book same day, and I always up end booking last minute (same day) because of work scheduling or weather.

I noticed you don't have the SPG card, but have the Ritz card. I've heard the SPG points are often times pretty valuable, especially at higher end hotels like Ritz, St Regis, etc?

SPG points are generally considered the 'best' for cents per point. However, their points are for Starwood hotels (like St. Regis and Westin) or for transfer to airlines but they can't be used for Ritz hotels as Ritz Carlton hotels are Marriott properties. That will change however once the acquisition of Starwood by Marriott is complete which could take several years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

@Anonymous wrote:I've found some posts that discussed this very topic but I wanted to get some community feedback. My business spends about $350K a month on credit cards. Of that, about $100K goes through my AMEX Platinum Business and Chase Ink Plus. The rest of my transactions are on my personal cards, which are strictly used for the business so as to not comingle statements and create a headache. For the past 4 or 5 years I've just let points sit, thinking maybe one day I'll find a use. I use them as bonuses for employees, but that only goes so far.

From reading on ThePointsGuy and NerdWallet it seems like AMEX and Chase UR points are "worth" $0.02 each, but I've never even come close to that, usually because I don't ever fly, and just use the Chase UR points for hotel redemptions which seems to be worth about $0.0125 each. How are people seeing values like that outside of international or first class flights?

I used to let my statements cycle with a balance and then pay off right away but it was negatively impacting CLIs so now I pay right before statement cut and never carry a balance on any card and ask for CLIs as frequently as possible. Slowly I've worked the limits up. The main problem I run into is it seems like merchants always take at least 3+ days to settle a charge, and then the credit card company takes another day or two to apply my payment, meaning cards like Fidelity Rewards, I can only run like 4-5 times the limit per month and I have to cycle through cards - super annoying.

I've tried to shift a lot of spending over to 2% cash back cards like the DC and Fidelity cards, are there any other cards like this with unlimited cash back? It seems like a decent "Business" 2% cash back cards doesn't exist?

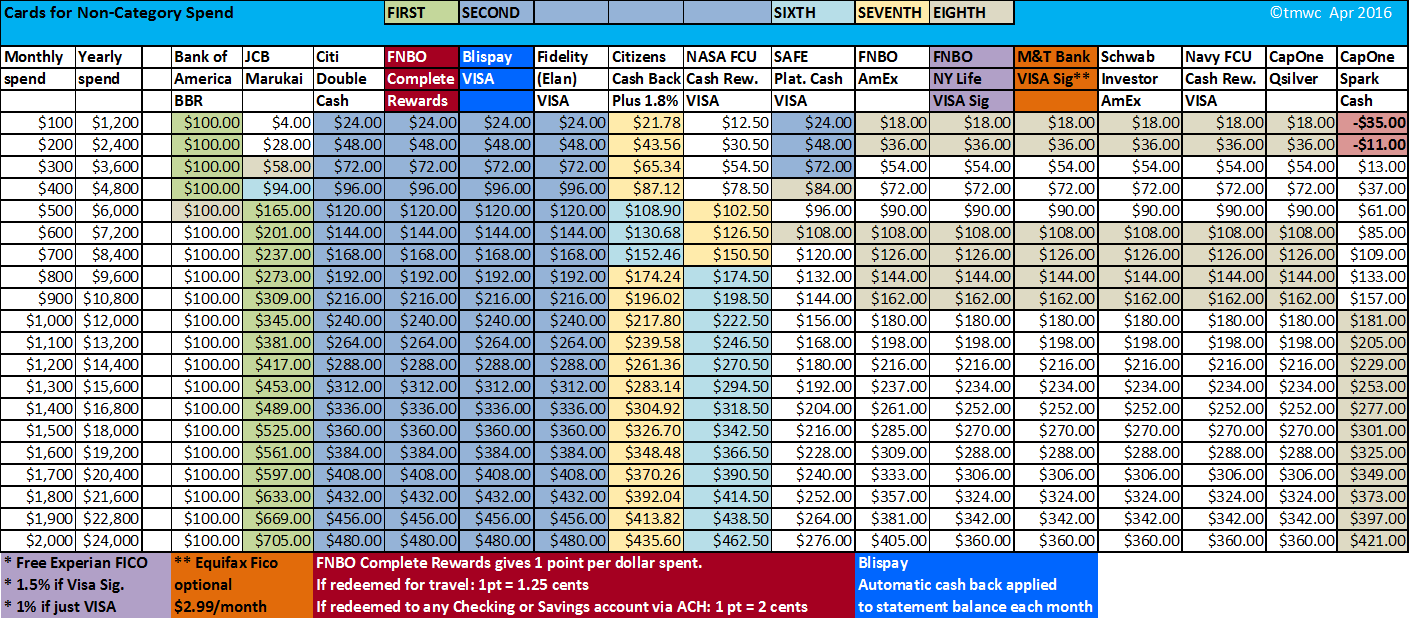

There are multiple 2% cash back cards, as well as those that are close to 2% like NASA FCU ( at high spend, it returns 2% minus $17.50 per year). Of course, JCB Marukai is close to 3% if you are in a state that can get that card.

Someone once obtained the CapitalOne Sparc Classic For Business and later called and convinced them that they had choosen the wrong card, and got it changed to a 2% cash back card, all with no annual fee. if that doesnt work, they do have a 2% business card with $59 annual fee.

You can also look at this thread for more specialised cash back cards: http://ficoforums.myfico.com/t5/Credit-Cards/Cash-Back-credit-card-charts/td-p/4004725

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

I don't redeem my flights for first class and I find miles to be way better than cash. Of course, your mileage may vary, but if I was spending that much on cards...I'd go with miles all the way, provided you have an interest in redeeming them. Cash back isn't really worth it for low spenders such as myself.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

@Anonymous wrote:

@Anonymous wrote:I haven't been transfering points for hotel redemptions, usally because the hotels my family stays at on vacation usually aren't part of any group (e.g. ski towns). UR seems to have the best redemption for hotels, but you can't book same day, and I always up end booking last minute (same day) because of work scheduling or weather.

I noticed you don't have the SPG card, but have the Ritz card. I've heard the SPG points are often times pretty valuable, especially at higher end hotels like Ritz, St Regis, etc?SPG points are generally considered the 'best' for cents per point. However, their points are for Starwood hotels (like St. Regis and Westin) or for transfer to airlines but they can't be used for Ritz hotels as Ritz Carlton hotels are Marriott properties. That will change however once the acquisition of Starwood by Marriott is complete which could take several years.

+1

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

In some loyalty programs, redemptions are substantially cheaper. Maybe only 10000 points for a pretty expensive hotel. But without elite status you may only earn 1 or 2 points per dollar spent. Where as with other programs that redemption might be 50k or 100k points, but you'll be earning a base 10 points per dollar.

It all equals out in the end.

Id say the two exception may be the Wyndham program where all hotels, regardless of price cost the same amount, and SPG when you're transferring to airlines, but not really for hotel stays.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Rewards VS Cash

Tackle your fear and start flying, see the country and world with the points you accumulated.

You only live once.