- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Sallie Mae Future card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sallie Mae Future card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sallie Mae Future card

So in thinking of going for the SM next prob 6 months. What kind of a limit can i expect with a 36k income? Id like to get this card for the Amazon 5% as well as gas when it is not a 5% cat on discover. How is redeming the CB if i dont have a student loan?

Age: 22 Scores ~710 across the board

Future Cards Sallie Mae, US Bank Cash+, Freedom

Goal increase CLs by 20k in 2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

@twist7d7 wrote:So in thinking of going for the SM next prob 6 months. What kind of a limit can i expect with a 36k income? Id like to get this card for the Amazon 5% as well as gas when it is not a 5% cat on discover. How is redeming the CB if i dont have a student loan?

Once you have at least 2500 points, you can redeem for $25 or more as a statement credit.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

@Themanwhocan wrote:

@twist7d7 wrote:So in thinking of going for the SM next prob 6 months. What kind of a limit can i expect with a 36k income? Id like to get this card for the Amazon 5% as well as gas when it is not a 5% cat on discover. How is redeming the CB if i dont have a student loan?

Once you have at least 2500 points, you can redeem for $25 or more as a statement credit.

I see that you have US bank and sallie Mae. Which card was harder to get? Id like to get both and i know that they both dont like inqs. i think i have 7 on TU

Age: 22 Scores ~710 across the board

Future Cards Sallie Mae, US Bank Cash+, Freedom

Goal increase CLs by 20k in 2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

@twist7d7 wrote:So in thinking of going for the SM next prob 6 months. What kind of a limit can i expect with a 36k income? Id like to get this card for the Amazon 5% as well as gas when it is not a 5% cat on discover. How is redeming the CB if i dont have a student loan?

same income and I was given $3800. But I app for new cards prob every 3 months which may be why it is a little lower.

Credit Lines: Diners Club 20k | Penfed Plat Rewards 7k | SDFCU 5k | Amex BCE - 10.5k | Chase Freedom 4.5k | CSP - 10.6k | Discover IT - 9k | Sallie Mae 3.8k | BofA 123 - 4.9k | CITI Double Cash 9.1k | Total Rewards 3.25k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

@Anonymous wrote:

My experience was a CL of $3,300 and then I reconned it to $10K. The card was originally set up for college students. Since you have a US Bank Cash+ VS which is one of the hardest cards to obtain, you may find the Sallie Mae MC easier. No one can guarantee approvals. Strange things can deny but Barclays is very fair on reconned denials.

I dont have that card yet. its on my list of cards to get. What CR does usbank pull and how would they be with 7-8 inqs?? also when i apply i will have 3 accounts that are 6 months old.

Age: 22 Scores ~710 across the board

Future Cards Sallie Mae, US Bank Cash+, Freedom

Goal increase CLs by 20k in 2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Sallie Mae Future card

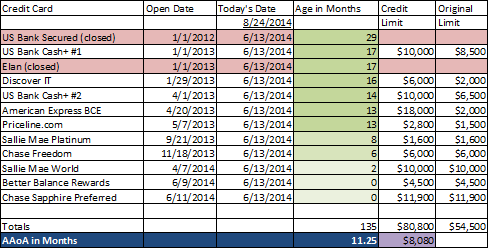

In my case, US Bank pulls EQ if I apply in the bank, and pulls TU if I ask for CLI online or via telephone (I assume those get routed to Elan in Fargo).

I started with a US Bank secured, and waited a full year, so I had a good credit score and no other cards or inquiries to hold me back. So I got very good starting credit limits.

When I applied for Barclays (priceline, sallie mae and sallie mae) I got low limits probably because of all the recent credit cards, though the last card I waited 6 months since the previous Barclay card and had only one other card obtained 4.5 months earlier, and had lots of heavy usage of Barclay cards, That resulted in a $10,000 initial limit on my 3rd card. Barclays always pulls TU, except the last time when I tried for 2 barclay cards atthe same time, and they pulled EQ a couple weeks later (and still denied me a second (well, fourth) card even though that EQ pull was a 749).

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800