- myFICO® Forums

- Types of Credit

- Credit Cards

- Someone Plz Explain CLD!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Someone Plz Explain CLD!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@toi34 wrote:**UPDATE**

I've just read through ALL of your responses, and thanks for the brainstorming.

I called Discover this morning and they REINSTATED my full cli; turns-out it was a computer error; the agent SP my current credit report and saw nothing there of concern: like I said in my earlier post -- no lates/collections/charge-offs/minimum pays...nada! I was on and off the phone in a matter of minutes!

That is awesome news!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@toi34 wrote:**UPDATE**

I've just read through ALL of your responses, and thanks for the brainstorming.

I called Discover this morning and they REINSTATED my full cli; turns-out it was a computer error; the agent SP my current credit report and saw nothing there of concern: like I said in my earlier post -- no lates/collections/charge-offs/minimum pays...nada! I was on and off the phone in a matter of minutes!

YAY!!! Thank goodness!! So Happy it turned out for the better![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@navigatethis12 wrote:

@NRB525 wrote:

This is why I think it is a long term bad idea to have "all cards report zero but one": There's no history of handling a payment flow that the other CCC can read and get comfortable with. Combine that with carrying a bunch of high percentage balances at some low monthly payment rate and it's "Danger, Will Robinson!"

Good luck, hoping for the best with the call to find out what happened.

Even without letting balances report, they still show the high balance for the account. Experian reports payments and TransUnion does too, I believe. So, you don't have to let balances report for underwriters to see that you spend on the cards. The credit bureaus don't show history of balances anyway, so even if you do let a 20,000 balance report, two months later there will be no evidence that it ever existed unless it's the high balance.

Not necessarily true. I just checked my Amex in my reports. It shows a high balance of $21. That's the high reported balance. I put over $1000 on it in March.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

Congrats and thanks for letting us know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

Thanks everyone! I'm glad it worked-out too. I REALLY appreciated everyone's theories and queries. Hopefully one of these days I'll be able to get on that Discover 17-day gravy train, but for now, I'll just chill. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@toi34 wrote:**UPDATE**

I've just read through ALL of your responses, and thanks for the brainstorming.

I called Discover this morning and they REINSTATED my full cli; turns-out it was a computer error; the agent SP my current credit report and saw nothing there of concern: like I said in my earlier post -- no lates/collections/charge-offs/minimum pays...nada! I was on and off the phone in a matter of minutes!

Great News!

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pull

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pullLast app 03/12/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@Anonymous wrote:

@navigatethis12 wrote:

@NRB525 wrote:

This is why I think it is a long term bad idea to have "all cards report zero but one": There's no history of handling a payment flow that the other CCC can read and get comfortable with. Combine that with carrying a bunch of high percentage balances at some low monthly payment rate and it's "Danger, Will Robinson!"

Good luck, hoping for the best with the call to find out what happened.

Even without letting balances report, they still show the high balance for the account. Experian reports payments and TransUnion does too, I believe. So, you don't have to let balances report for underwriters to see that you spend on the cards. The credit bureaus don't show history of balances anyway, so even if you do let a 20,000 balance report, two months later there will be no evidence that it ever existed unless it's the high balance.

Not necessarily true. I just checked my Amex in my reports. It shows a high balance of $21. That's the high reported balance. I put over $1000 on it in March.

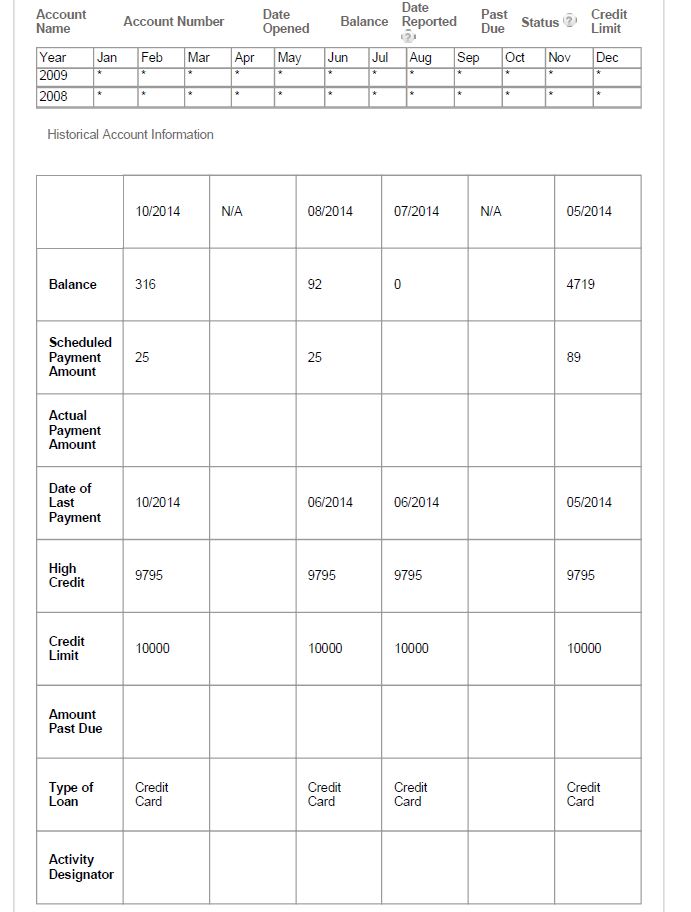

Here is a snip from my EQ report in October 2014. This is my Capital One Platinum MC. I had charged a transmission in January 2014, then BT that off in June, after the May statement. The High Credit amount is from years ago. Since I don't pay before statement cut on any of my prior months, I can't show any examples of that, but I doubt it will show any balance or PMT Due.

If someone has a CR image for an account which was paying before statement cut, that would be an interesting contribution.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

@toi34 wrote:Thanks everyone! I'm glad it worked-out too. I REALLY appreciated everyone's theories and queries. Hopefully one of these days I'll be able to get on that Discover 17-day gravy train, but for now, I'll just chill.

Congratulations on getting your CL restored!

A "computer glitch" is a rather vague term however. The computer makes many choices for our accounts, based on algorithms that the CSR may not recognize. The CSR, in looking manually at your file, didn't see any negatives, but doesn't have the same algorithm programmed into his/her mind ![]() The computer still made that change to your account, for some reason.

The computer still made that change to your account, for some reason.

I am still of the opinion that over-thinking and over-working the "all cards at zero but one" can lead to situations such as this, not always, not predictable, but I believe in showing activity on my accounts to communicate to all lenders that I'm using my cards and paying my debts.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Someone Plz Explain CLD!!!

Just as somewhat of a data point this is the second time I've read here about an Discover CLD of exactly $500 that was done and when calling in was able to be reversed citing the same computer glitch problem.