- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Squaring off with Cap 1

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Squaring off with Cap 1 **EO comes through again**

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Squaring off with Cap 1 **EO comes through again**

So, a few years ago I started being a bit more aggressive about rebuilding/building my credit. I wasn't a member of this forum at the the time, and made a few mistakes along the way but nothing that affected my score negatively(but there were things I definitely would've done differently). This community is a fantastic database for credit related information and I wish I'd followed MyFICO from the start.

About 2.5 years ago I applied for and received an unsecured Cap 1 Plat MC. I remember being happy to be able to get a card(my second one at the time) and began using it to make small purchases. No problems, and I was given an auto CLI from 500-750 a few months later. I gardened. About a year after the CLI I began asking for credit increases via Cap1s "chat" feature, with no luck. I also began asking about upgrades, also without luck. At the beginning of this year I managed to get them to waive the AF and then a little later reduce the APR temporarily. Fast forward to last month.

I had a short list of CLI/ cc apps that I planned on running through before heading back into the garden for awhile. Managed a nice CLI on a UFCU Visa and acquired an Amex and a CSP. Right along that same time people were having luck hitting the luv button with Cap1. While I was pretty much convinced this card was going to remain in the sock drawer, I hit the button. $500 increase! Huzzah!

Well, then I thought, I wonder if I can get an upgrade? Nope, nothing on the website. A member here was nice enough to give me customer support number(not the fabled exec backdoor number) that they'd gotten lucky with and I decided to give it a try last Friday.

What a @&&%#(@!! nightmare that turned into. We ended our call after an hour with 2 CSRs and a supervisor, a verbal that I could upgrade to a no-AF QS once I spoke with yet another CSR and a possible CLI after I go through their "automated service". I didn't have time for that, so I asked them to note my account and I'd get back with them. I was pretty hacked off. While courteous, the CSRs were clueless to the point of offending me by pointing out all of the lates I've had this year.... I've had no lates with them, ever.

I decided to pm them on FB yesterday morning versus trying to call them out. I received an email promising they'd contact me and included a link on how to check for upgrades on my account... which still shows no offers(I didn't expect it to).

Average credit scores 775-800, 5%util, 6years AAoA

We'll see whether the FB trick works. Shooting for a $3750 CLI and a move to a Plat Priority Card MC...

I can't believe you like money too. We should hang out.

FICO(Barclay1\22\15) TU: 798 | FICO EX: 780 | FICO EQ(2\12\15):808 | In the Garden from 5/8/14 until ???

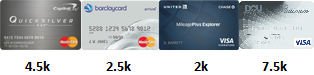

UFCU Visa $5k | Cap1 QS $10K | Jetblue Amex $18K | CSP $6.5K | Amex Green (NPSL) | Chase Freedom $18k | Sallie Mae WMC $15.5k| BoA 1-2-3 Visa $7.5k | Amex Everyday $16k | Amex Fidelity $10k |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Squaring off with Cap 1

Received a nice call from the Cap1 EO a couple of hours ago. Moved to the no fee QS rather than the card I was hoping for:

http://www.capitalonepriorityclub.ca/Platinum_MasterCard_Details.html

The rep was not familiar with. I'm not sure whether thats BS or not since its hard to find info on the card. Either way the QS is a step up. Waiting on the requested CLI, hoping to hear from them by Thursday.

I can't believe you like money too. We should hang out.

FICO(Barclay1\22\15) TU: 798 | FICO EX: 780 | FICO EQ(2\12\15):808 | In the Garden from 5/8/14 until ???

UFCU Visa $5k | Cap1 QS $10K | Jetblue Amex $18K | CSP $6.5K | Amex Green (NPSL) | Chase Freedom $18k | Sallie Mae WMC $15.5k| BoA 1-2-3 Visa $7.5k | Amex Everyday $16k | Amex Fidelity $10k |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Squaring off with Cap 1

Starting Score: 620 Current Score: 709 Goal Score: 720

Gardening from 9/28/2013. Target: March 2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Squaring off with Cap 1

Thanks! Just checked the account and the CL has increased to $5k!

I guess the old adage is still true, the squeaky wheel gets the grease.

I can't believe you like money too. We should hang out.

FICO(Barclay1\22\15) TU: 798 | FICO EX: 780 | FICO EQ(2\12\15):808 | In the Garden from 5/8/14 until ???

UFCU Visa $5k | Cap1 QS $10K | Jetblue Amex $18K | CSP $6.5K | Amex Green (NPSL) | Chase Freedom $18k | Sallie Mae WMC $15.5k| BoA 1-2-3 Visa $7.5k | Amex Everyday $16k | Amex Fidelity $10k |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Squaring off with Cap 1

Congrats

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?