- myFICO® Forums

- Types of Credit

- Credit Cards

- Swipes leading to auto CLI?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Swipes leading to auto CLI?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

If we are talking Chase specifically what I have noticed is that during your first year of cardmembership they generally will give one auto CLI. As always, YMMV.

After that, auto CLIs from Chase are very rare. Also, keep in mind because of CARD Act, financial institutions have to obtain updated annual salary information after the first year. Most banks rely on the cardholder updating that information themselves. Chase allows cardmembers to update this information (by yourself or often by a pop up splash page when you log into your online account management) on their website. Updating income does not necessarily equate to an auto CLI of course.

I would not doubt that big spenders who update their income with Chase are more apt to receiving an auto CLI than the rest of us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

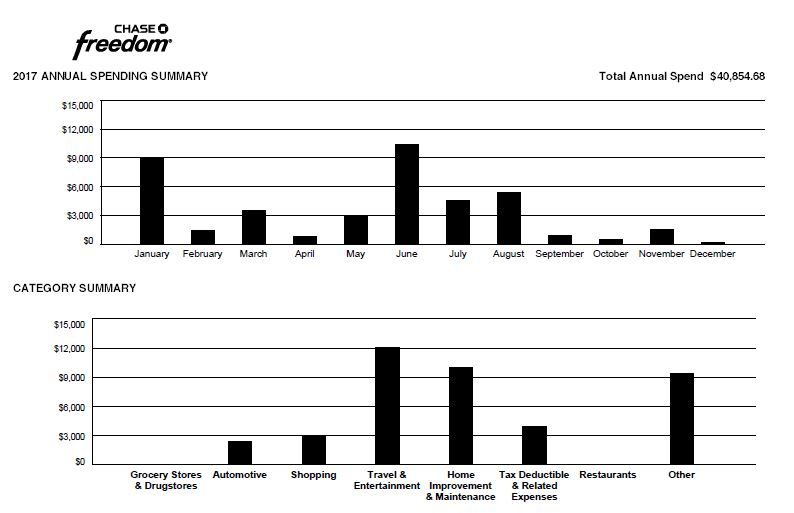

So I reviewed the detail section of my year end summary for my CFU and had 20 swipes for the entire year. Had a lot of spend but mostly online transactions. Card opened in July of 2016 @ $13,000. Around December last year I noticed an auto CLI to $19,400 ![]()

Current Revolving Personal CL: ~$466K

Current Revolving Business CL: ~$107K

Gardening Until Dec 2019 or Until All Scores are back above 800s

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

I consider online transactions to be swipes too. Nice auto cli!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

@SouthJamaica wrote:Here's my question, directed to those of you who have experience with Chase auto-CLI's:

In addition to my Chase Amazon Prime Visa, I have 2 other Chase accounts, 1 of which has a large credit limit of which I make little use.

If I do a lot of swipes with my Amazon card, will Chase -- for auto CLI purposes -- be looking at that account separately, or will it be looking at it in the context of my other 2 Chase accounts?

@SouthJamaica, I've wondered this as well.

I got the IHG MasterCard back in September 2016. The app was not auto-approved, which wasn't a surprise since I had an old Providian/Wamu card that was charged off 10+ years ago. I was mainly applying for it to see if I was black-listed... I was pleasantly surprised a couple of days later to be approved for $9k at the lowest APR.

Then a few months later (January 2017) when the Amazon Visa came out I applied for it. I expected a similar process as with the IHG but was auto-approved (which was actually a bigger surprise than my initial IHG approval), again at the lowest APR but with a credit line of $500. That definitely sent a mixed-signal, especially since there were people with BKs still reporting that were getting approvals with CL of $2k+. I joked at the time that I would have been better off without the auto-approval, that I probably would have done better with a manual review. I was approved, though, so I was a happy camper.

I used the card for all-things Amazon last year and often for fast-food, and twice I maxed it out (within $20 of the limit) and I even allowed it to report before PIF. I knew from the beginning that I could do a reallocation from the IHG, but I held-off thinking an auto-CLI might be in the cards (pun intended), but it never happened.

I have no idea if my previous history is an issue, if they think I have enough total exposure already, or if perhaps I've just not used enough of the $500 CL consistently to "earn" the elusive auto-CLI.

I've decided that once things cool off with my credit profile for another month or so I'm likely going to do the reallocation from the otherwise seldom-used IHG and call it a day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

@Time2letgo wrote:@Anonymous I reviewed the detail section of my year end summary for my CFU and had 20 swipes for the entire year. Had a lot of spend but mostly online transactions. Card opened in July of 2016 @ $13,000. Around December last year I noticed an auto CLI to $19,400

This is interesting to me. From reading this thread and many others regarding Chase auto-CLIs, it seems the auto CLIs more often than not come on accounts with 4-figure limits rather than 5-figure limits. Do you guys agree with that? This data point above from Time2letgo is an example that doesn't fit that mold however, which is interesting to see.

This spring I'll be hitting a year on my only 2 Chase accounts (Amazon, CSP) and it would be great to see an auto-CLI on at least one of them. They both have 5-figure SLs, though and I don't give either of them a significant spend. I do like the idea posed by this thread in going for a lot of swipes. I'll have to add my CSP and Amazon cards to my self-checkout swipe strategy. I use self checkouts all the time, basically any time a store has one... grocery store, Home Depot, Walmart, etc. When I pay, I use a bunch of different cards, starting with the ones I'm just looking to give small dollar swipes to. The total may be $85, for example. Swipe card #1, it says $85? You click no, then type in $3.00. Swipe card #2, it says $82? You click no, then type in $2.00. Repeat for as many cards as you want, giving the final balance to the card that you actually want the spend on for max rewards. I don't normally include my Chase cards in this process, but perhaps it's time to rethink that ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

I've had my CSP for 4 months now. I average about 6.5K per month in spend across 50-60 swipes. So far there has not been any auto-love.... we'll see after it turns 6 mo.

AMEX has been seeing about 1-2K per month in spend with about 30-40 swipes. (I have an EDP, so I need at least 30 swipes to meet the 50% bonus points.) I did get the full 3X CLI from 2K to 6K at the 3 mo mark.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

@RadioRob wrote:I've had my CSP for 4 months now. I average about 6.5K per month in spend across 50-60 swipes. So far there has not been any auto-love.... we'll see after it turns 6 mo.

AMEX has been seeing about 1-2K per month in spend with about 30-40 swipes. (I have an EDP, so I need at least 30 swipes to meet the 50% bonus points.) I did get the full 3X CLI from 2K to 6K at the 3 mo mark.

Interesting data points!

Is Chase your highest limit card? Curious what happens when you ask Amex for $18,000 CL and Chase sees that.

I just came across the EDP and it actually looks better than BCP if one values MRs high enough and can get 30 swipes a month to get that bonus. Added it to my wish list, after I get Chase Sapphire.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

Alliant 7500

Discover 8000

Capital One 3500

NFCU Cash Rewards 32000

Citi AAdvantage 13500

Amex 6000

NFCU NavChex 15000

Chase Saphire Pref 10000

My Chase card is my primary driver followed by AMEX. NFCU is also my lowest rate card at the moment (with the highest limit), so it is my BT/revolver if I need it. Everything else gets incidental love.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Swipes leading to auto CLI?

Most prime banks ignore credit union CC limits as those don't work as prybars, but I'm surprised Chase hasn't matched Citi yet. Is that Citi CL recent?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content