- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Synchrony Bank Requested 4056T !!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synchrony Bank Requested 4056T !!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Other threads have had this debate already, with each side firmly entrenched with their opinion.

I'll only mention here that I wouldn't be willing to provide my dependent children's social security number to any of my lenders for a credit card, which is what you are in fact doing when you consent to a 4506-T. I wouldn't be willing to provide a spouses, either, but at least a spouse can provide consent, which is more than a child can do.

If there is a data breach (which isn't an unreasonable concern) it's also unclear what responsibility the parties would have to any dependent children/spouses who's information might be stolen/leaked, since they aren't customers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Likely some credit seekers do run a bluff ... others may see it as their right to not share and that does not mean they are running a "bluff"!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@UncleB wrote:

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Other threads have had this debate already, with each side firmly entrenched with their opinion.

I'll only mention here that I wouldn't be willing to provide my dependent children's social security number to any of my lenders for a credit card, which is what you are in fact doing when you consent to a 4506-T. I wouldn't be willing to provide a spouses, either, but at least a spouse can provide consent, which is more than a child can do.

If there is a data breach (which isn't an unreasonable concern) it's also unclear what responsibility the parties would have to any dependent children/spouses who's information might be stolen/leaked, since they aren't customers.

Not sure my position is entirely coherent, but here it is anyway!

1) I understand privacy concerns. So, if someone says that they will not provide 4506-T information to any lender (with the exception of mortgage for which there is really no alternative), that makes sense.

2) But here various posters constantly mention LN selling the info. This gives me the impression that if synchrony kept it in house, that would OK (or at least a less automatic no). So since some privacy would already be gone, I want to know what people think the additional harm in selling it is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@longtimelurker wrote:

@UncleB wrote:

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Other threads have had this debate already, with each side firmly entrenched with their opinion.

I'll only mention here that I wouldn't be willing to provide my dependent children's social security number to any of my lenders for a credit card, which is what you are in fact doing when you consent to a 4506-T. I wouldn't be willing to provide a spouses, either, but at least a spouse can provide consent, which is more than a child can do.

If there is a data breach (which isn't an unreasonable concern) it's also unclear what responsibility the parties would have to any dependent children/spouses who's information might be stolen/leaked, since they aren't customers.

Not sure my position is entirely coherent, but here it is anyway!

1) I understand privacy concerns. So, if someone says that they will not provide 4506-T information to any lender (with the exception of mortgage for which there is really no alternative), that makes sense.

2) But here various posters constantly mention LN selling the info. This gives me the impression that if synchrony kept it in house, that would OK (or at least a less automatic no). So since some privacy would already be gone, I want to know what people think the additional harm in selling it is.

I'm certainly not an expert on what info LN sells to other companies but given the almost daily reports of this or that company having their sites hacked and exposing customers personal info, you could argue that by selling the info LN increases the chance of your biographical/credit info ending up in the hands of some Russian hacker and upping the chances of identity theft.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@longtimelurker wrote:

@UncleB wrote:

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Other threads have had this debate already, with each side firmly entrenched with their opinion.

I'll only mention here that I wouldn't be willing to provide my dependent children's social security number to any of my lenders for a credit card, which is what you are in fact doing when you consent to a 4506-T. I wouldn't be willing to provide a spouses, either, but at least a spouse can provide consent, which is more than a child can do.

If there is a data breach (which isn't an unreasonable concern) it's also unclear what responsibility the parties would have to any dependent children/spouses who's information might be stolen/leaked, since they aren't customers.

Not sure my position is entirely coherent, but here it is anyway!

1) I understand privacy concerns. So, if someone says that they will not provide 4506-T information to any lender (with the exception of mortgage for which there is really no alternative), that makes sense.

2) But here various posters constantly mention LN selling the info. This gives me the impression that if synchrony kept it in house, that would OK (or at least a less automatic no). So since some privacy would already be gone, I want to know what people think the additional harm in selling it is.

I'm not so much personally hung-up on the 'selling' aspect as I am providing information that simply has nothing to do with the credit process and the lack of protection that data likely has. (Especially the lack of protection part... if there is a data breach, is free credit monitoring provided to minor children who's data is lost? Even if the answer is 'yes', is that required or is it voluntary?)

I've successfully been through the mortgage process four times, and so far I've never been required to provide a 4506-T; perhaps the process varies depending on the broker and/or the individual loan program one applies for (in my case, they were only concerned with what I was making at the time of the application, not in the past.) In any case, if it was required I would come much closer to agreeing if it was for a mortgage than for a credit card.

It's easy to go 'down the rabbit hole' with this issue... I simply say that each of us will have to decide what's best for us, and move forward appropriately. I won't be critical in either case... what's right for one might not be right for somebody else.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@pip3man wrote:I'll never understand the paranoia people feel by consenting to provide their tax transcript. I mean what more do we really have to loose?! Banks already monitor our everyday activities and have a wealth of information about us at their fingertips. What extra can we provide that they don't already have? Updated income, number of dependent, business profits/losses, employment, marital status, household size maybe?! So ironical that we feel VERY comfortable providing our SSN and stated income when applying for credit but become very defensive when they request proof of the same info we supplied them initially. Really?! I think this Lexis Nexis concern is way too overrated and SOME people are using it as a cover up for whatever bluff they did. For over $50k in exposure, we don't think it's only fair that banks take precautionary measures by requesting these documents to mitigate against lending risk and losses. After all they are lending us their money! Not to mention, as Americans do we even have a real sense of privacy... they know everything about us, what more can we protect or prevent them from knowing. Oh well I digress but to each his own...

Have to agree here.

There is no such thing as privacy anymore, your information is out there.

I don't think it's unreasonable for a financial institution to ask for tax verification especially if you have a lot of exposure with them. They're protecting the credit which THEY extended you! Of course you have every right not to comply if you don't want to -- but like lurker I'm not sure what the huge consequence is.

I don't doubt that some people are/were dishonest on applications and thus don't want to furnish the proof. Others just don't want to provide it for various reasons. Again, that's fine, but the bank has every right to want verification when extending any kind of credit, especially for those with abnormal amounts of exposure.

Everyone has to do what they feel is right for them but acting like it's crazy for a bank to ask for tax forms just makes no sense to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

I know im beating a dead horse here. But If it weren't for my willingness to just sign the document and not care I wouldn't have the limits I do have on most of my accounts. Chase and Amex both asked me to document. I had no problem with this. Now that I have done it with AMEX they don't question approving new limits since I'm over the 35k exposure with them. I also had to prove income to Mercedes-Benz financial to lease my new s class, oddly enough they preferred bank statements to tax returns, even with my scores they just said since I had opened a lot of accounts recently they wanted to be extra sure, 10 min later I walked into the back room, signed documents and drove away, IM not going to deny myself something I want just because I fear what "might" happen. The only reason I can see someone not wanting to submit is because they were not truthful on the app, to each is own. But Seriously, I have life lock, I'm not worried about identity theft. I know that my investment accounts and bank accounts require me to visit in person to do anything catastrophic, and my credit cards all have fraud protection. So why should I care? That being said I haven't received a 1040 from GE/Synchrony. Curious to see if I do, Since its in my company name with me as a PG it may be different who knows. Happy to show business tax returns too.

Amex Biz Platinum NPSL I Lowes Business 42k I Amex Simply Cash + $22,500 I Chase Ink 21K I B of A World Points $20,500 I B of A Bus MasterCard 16k I Amex SPG 3K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@awp317 wrote:I know im beating a dead horse here. But If it weren't for my willingness to just sign the document and not care I wouldn't have the limits I do have on most of my accounts. Chase and Amex both asked me to document. I had no problem with this. Now that I have done it with AMEX they don't question approving new limits since I'm over the 35k exposure with them. I also had to prove income to Mercedes-Benz financial to lease my new s class, oddly enough they preferred bank statements to tax returns, even with my scores they just said since I had opened a lot of accounts recently they wanted to be extra sure, 10 min later I walked into the back room, signed documents and drove away, IM not going to deny myself something I want just because I fear what "might" happen. The only reason I can see someone not wanting to submit is because they were not truthful on the app, to each is own. But Seriously, I have life lock, I'm not worried about identity theft. I know that my investment accounts and bank accounts require me to visit in person to do anything catastrophic, and my credit cards all have fraud protection. So why should I care? That being said I haven't received a 1040 from GE/Synchrony. Curious to see if I do, Since its in my company name with me as a PG it may be different who knows. Happy to show business tax returns too.

UncleB mentioned a number of very excellent reasons above that a person would not want to submit a 4506-T, including children's tax data and sensitive medical expense information. They've been mentioned repeatedly in several other threads also, which I would suggest as reading material. ![]()

LexisNexis has a large number of class-action lawsuits against them for violating the FCRA many times. I'd trust a homeless stranger with my information more so than I would them.

Plus, as we have seen with all of the data sharing services (LexisNexis, Innovis and others) not only do you lose control of your personal information once they get hold of it, but they often share very incorrect information as well.

We don't know them and have never agreed to do business with them, so we would not want to share our sensitive tax and financial information with them.

You also may not care about your personal finanical information residing in some random database of an information sharing service, but most of us would have a problem with that.

I also don't know why anyone would not do their best to minimize the number of sources that have this sensitive data.

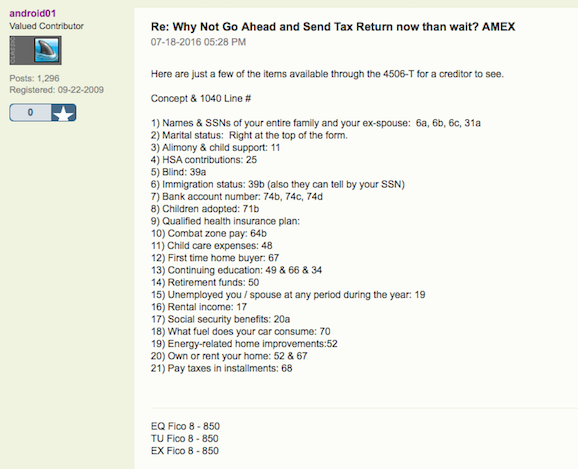

Here is a post that someone made in a different thread that I think clarifies quite a bit: (and these are just a few of the items provided on a 4506-T; this is not a complete list)

You can certainly feel free to trust a company you don't do any business with with your child's sensitive information on your tax return, or your own sensitive medical expense information. Most of us don't plan to do that.

My response would be no thanks to sharing it all with third-party information collection services if asked.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

So, this so-called 4506-T form is what made AmEx infamous for their "FINANCIAL REVIEW". Seems like AmEx does it more frequently than other institutions. I haven't heard of this practice since I began to rebuild my credit in 2015 and in April 2016, I started getting credit lines from major credit card companies like AmEx, Chase, WF, etc. The day I received my 4th AmEx card in June 2016, the Platinum Card, used it once and next thing I saw when I logged on was SUSPENDED ACCOUNTS. A warning letter like Synchrony would've been preferrable, but it is what it is. I had to scramble at 11 pm (I work nights, 7p-7a) going through all my automatic payment bills coming out of my AmEx cards and switching them back to my debit card. Called them up right away, and of course, they requested the 4506-T. I signed the form, faxed it back, and within 10 days, the suspension was lifted and accounts restored.

I know most everyone disagrees and very firmly refuse to release this and that's their right. But my thought is, if they are going to trust me with their money, I guess it's just logical that I earn their trust as well. It's a two way process of building a trusting relationship, I think. I need them to strengthen my financial satus, I will make sure I get their trust and I'll provide what they want to earn that.

Sorry to hear you went through this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

GTC471 wrote:

The day I received my 4th AmEx card in June 2016, the Platinum Card, used it once and next thing I saw when I logged on was SUSPENDED ACCOUNTS.

A warning letter like Synchrony would've been preferrable, but it is what it is.

I had to scramble at 11 pm (I work nights, 7p-7a) going through all my automatic payment bills coming out of my AmEx cards and switching them back to my debit card. Called them up right away, and of course, they requested the 4506-T. I signed the form, faxed it back,

and within 10 days, the suspension was lifted and accounts restored.

humuhumunukunukuapua'a wrote:

I would most definitely sever the relationship with any institution at which I had to scramble to rearrange many scheduled automatic payments (and hope I changed everything over in time so no problems occurred), and that took a full TEN days to restore my access after I did all of that scrambling. No, thank you.

Glad it worked out for you, though.