- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Synchrony Bank Requested 4056T !!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synchrony Bank Requested 4056T !!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@awp317 wrote:

@Anonymous wrote:

@awp317 wrote:I know im beating a dead horse here. But If it weren't for my willingness to just sign the document and not care I wouldn't have the limits I do have on most of my accounts. Chase and Amex both asked me to document. I had no problem with this. Now that I have done it with AMEX they don't question approving new limits since I'm over the 35k exposure with them. I also had to prove income to Mercedes-Benz financial to lease my new s class, oddly enough they preferred bank statements to tax returns, even with my scores they just said since I had opened a lot of accounts recently they wanted to be extra sure, 10 min later I walked into the back room, signed documents and drove away, IM not going to deny myself something I want just because I fear what "might" happen. The only reason I can see someone not wanting to submit is because they were not truthful on the app, to each is own. But Seriously, I have life lock, I'm not worried about identity theft. I know that my investment accounts and bank accounts require me to visit in person to do anything catastrophic, and my credit cards all have fraud protection. So why should I care? That being said I haven't received a 1040 from GE/Synchrony. Curious to see if I do, Since its in my company name with me as a PG it may be different who knows. Happy to show business tax returns too.

UncleB mentioned a number of very excellent reasons above that a person would not want to submit a 4506-T, including children's tax data and sensitive medical expense information. They've been mentioned repeatedly in several other threads also, which I would suggest as reading material.

LexisNexis has a large number of class-action lawsuits against them for violating the FCRA many times. I'd trust a homeless stranger with my information more so than I would them.

Plus, as we have seen with all of the data sharing services (LexisNexis, Innovis and others) not only do you lose control of your personal information once they get hold of it, but they often share very incorrect information as well.

We don't know them and have never agreed to do business with them, so we would not want to share our sensitive tax and financial information with them.

You also may not care about your personal finanical information residing in some random database of an information sharing service, but most of us would have a problem with that.

I also don't know why anyone would not do their best to minimize the number of sources that have this sensitive data.

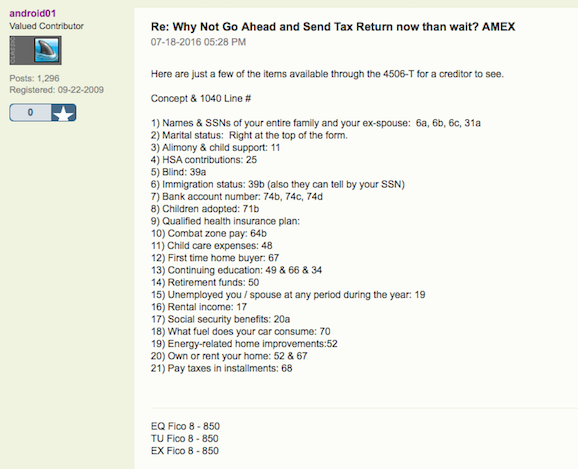

Here is a post that someone made in a different thread that I think clarifies quite a bit: (and these are just a few of the items provided on a 4506-T; this is not a complete list)

You can certainly feel free to trust a company you don't do any business with with your child's sensitive information on your tax return, or your own sensitive medical expense information. Most of us don't plan to do that.

My response would be no thanks to sharing it all with third-party information collection services if asked.

Honestly, I still don't see a problem with sharing any of that info. Most likely out there anyway, we trust the government with it. If the company is extending you credit do you really think they should just take your word for it? Unfortunately in 2016 a mans word doesn't mean jack. It comes down to this for me. A creditor is perfectly within their right to ask you for proof of income and financials when extending credit, and you are within your right to refrain from handing over said info. But you can't be mad then when the creditor who is still well within its rights decides to not do business with you and close your accounts.

Sure you can.

If "x" credit card company requires said information to OPEN an account, then so beit. Provide the information and open the account, or choose not to.

I think that a LARGE part of the anger is that some of these accounts have been open and in good standing for years, and NOW the CC issuer is requesting access to more/different information under a threat of closing EXISTING accounts.

They are certainly still within their rights, but it feels a bit shady to those on the receiving end. I get it.

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4056T Debate

@austinguy907 wrote:Has anyone on here even pulled their LN report? I did recently because I got a notice after getting a quote with AAA for auto. It's not hard to get and it's comprehensive information provided for risk assessments whether for insurance, financial, or whatever you want to think it applies to.

You can get a copy from www.consumerdisclosure.com for free. Fill out the info on the request page and it should hit your mailbox within about a week. When they sent me mine the following reports were in the envelope:

Credit i.e. normal prinited CR including addresses, previous work / slsary info if provided, all credit accounts open/closed, inquiries, etc. (Experian)

CLUE report i.e. previous claims for vehicles

"Current Carrier" report i.e. current auto insurance and previous insurance policy information including held limits for liability

MVR / Driving Record

If we think about this in a different view of a Google for Public Records information all in one place which it is when you look at the data they provide in the report it's not that big brother / 1984 feel that everyone seems to make it out to be.

Now, I've made it very clear previously that I have no issue with providing a 4506-T, either directly to a lender, or via a processor like LN.

But... just to be clear, LN processes far more data than just the C.L.U.E. reports and various public records. As most of this is either paid analysis of third-party data, or a pass-through service from suppliers to requesters rather than technically "maintaining a consumer report", it does seem to escape the FACTA disclosure requirements. (One of the reasons I have so little issue with LN data processing is that so much of it is contractual for lenders/insurers, and as such is siloed and not cross-shared... although some people refuse to believe that.)

A previous poster on this thread mentioned not worrying about LN data loss because they had LifeLock... how aware is everyone here that LifeLock owns ID Analytics, who owns SageStream? (Two of the biggest bogeymen/"monsters under the bed" for the twitchier crowd in these parts.)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4056T Debate

I smell a conspiracy theory brewing in here! JK

Unlike someone else mentioned I don't have to worry about other people's information being disclosed when providing the information for further validation when requesting additional CL's or to process a mortgage. This so far has been somewhat enlightening though as we pass information back and forth regarding both a 4506 and LexusNexus. It's a glimmer of insight though that if someone does pull your LN report it's going to be based on Experian data if it comes down to a recon for denial your source is known. In the past I figured LN was more of a repository or search registry of sorts for public records and finding people since someone I know is a process server and uses it (or something similar) for tracking people down that need to be served legal papers. I suppose with the 4506 though now knowing a bit more about the line by line feature it may expose some issues for people in states with community property clauses you see on applications mostly for WI applicants but others as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 4056T Debate

I'm not sure why they need THAT much information, especially if it's been open for a while and in good standing. I don't understand why a payment stub wouldn't suffice. But then, I don't understand these kinds of things at all. In my entire life, I've never had a problem with a credit card company. They've never asked me for anything extra. They've never AAed my account for no reason. It wasn't until I got on these boards that I've heard of crazy things happening with people's cards. I guess it comes with the territory.

But I don't think a credit card company has the right to all of that information. All they need is my income (which they can verify through other means) and my credit score. That's all they have a right to, in my opinion. If they can't make a decision based on that, then I can't help them.

To the OP - I would have done the same thing. If I'm using their cards and paying them off every month and being responsible, and they decide they need an extra form from me all of a sudden, they can close the account. I don't care. I'm not giving myself a headache trying to fill that thing out to keep my account open. The best part of my Marvel card is the way it looks, and they don't confiscate my card when the account is closed - I just can't use it anymore, and really, I'm not using it anyway because I don't like how long it takes a payment to post to my account. I've discovered these last couple of months that I'm extremely picky about all aspects of my finances. I never write checks. I wrote two checks this month, and they haven't cleared yet, and I'm really mad about it (on a random note).

Now, if Citi asked me for an extra form I would do it. They wouldn't ask though.

Apple Card MC $10,000

BofA Cash Rewards VS $10,000

5/3 Cash/Back WEMC $10,000

Discover IT $7,500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@UncleB wrote:

@austinguy907 wrote:Now to the 4506 debate:

That one screenshot in other posts/replies shows a bit more than I thought it would for a "transcript" request. I figured it would be a more abbreviated version of a 1040 request back from the IRS.

I think this is a common misconception. By the very virtue of the term 'transcript', it will be the information you provide... line by line.

I'll again stress that my own issue with is with dependent children's information (and spouses) being provided. Like I mentioned before, at least a spouse can consent... but a child can't.

If you want to see a sample for yourself, here's one link (there are many):

https://www.accuverify.com/1040-tax-transcript-sample.pdf

To me, protecting a child's private information would be worth more than any credit card, but like I mentioned before, that's a decision we each have to make for ourselves. It really comes down to your priorities.

+1000. Outstanding example, Uncle B! Well done. ![]()

And for those very rare one or two people who think LexisNexis is your buddy, feel free to share. The rest of us don't trust them as far as we can throw them with our children's and family members personal data and also sensitive medical expense information.

Most of us also have no desire to deal with companies who repeatedly break the law.

The certainly don't have any business knowing whether a cardmember's spouse is blind, whether a cardmember is disabled, their children's social security information, or about very large sensitive (and very private) medical expenses, among many other things.

No one here thinks there are conspiracies or anything ridiculous of that nature. We just don't like sharing our children's private information with bottom feeder companies whose reputation is in the toilet. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

It's probably worthwhile for everyone to look at there own transcript. IRS provides it instantly online for free once you create an account:

https://www.irs.gov/individuals/get-transcript

As for:

Most of us also have no desire to deal with companies who repeatedly break the law

Mmmmm. Amex, which the poster has no concerns about:

($85M for breaking FCRA, EEOA, Equal Opportunities Credit Act)

http://www.reuters.com/article/us-financial-amex-idUSN0644580020070807 $65M for money laundering

http://www.exportlawblog.com/archives/5325 $5M for violating sanctions etc

http://www.foxnews.com/story/2005/06/29/american-express-fined-5m-for-overcharging-customers.html $5M for overcharging customers

and other banks are similar (with Barclays and HSBC perhaps leading the pack)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@longtimelurker wrote:

As for:

Most of us also have no desire to deal with companies who repeatedly break the law

Mmmmm. Amex, which the poster has no concerns about:

($85M for breaking FCRA, EEOA, Equal Opportunities Credit Act)

http://www.reuters.com/article/us-financial-amex-idUSN0644580020070807 $65M for money laundering

http://www.exportlawblog.com/archives/5325 $5M for violating sanctions etc

http://www.foxnews.com/story/2005/06/29/american-express-fined-5m-for-overcharging-customers.html $5M for overcharging customers

and other banks are similar (with Barclays and HSBC perhaps leading the pack)

Not worried about Amex, LTL, but I don't choose to do business with 3rd party data aggregators, thanks! ![]()

Have a fantastic day and enjoy the beautiful weather ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@Anonymous wrote:+1000. Outstanding example, Uncle B! Well done.

And for those very rare one or two people who think LexisNexis is your buddy, feel free to share. The rest of us don't trust them as far as we can throw them with our children's and family members personal data and also sensitive medical expense information.

Most of us also have no desire to deal with companies who repeatedly break the law.

The certainly don't have any business knowing whether a cardmember's spouse is blind, whether a cardmember is disabled, their children's social security information, or about very large sensitive (and very private) medical expenses, among many other things.

No one here thinks there are conspiracies or anything ridiculous of that nature. We just don't like sharing our children's private information with bottom feeder companies whose reputation is in the toilet.

Right... so since you can't have any personal familiy info touched by LN, you carry absolutely no medical or other insurance?

Sure.

Outside of that fantasy world... since you do have insurance - LN already has detailed personal info, SSNs, and every insurance-covered medical billing detail on those family members.

And unlike their 4506-T processing services, that info is cross-shared. And you can't really "opt-out".

This certainly isn't "thinking LN is your buddy". This is recognizing objective reality.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony Bank Requested 4056T !!!!!

@iv wrote:

@Anonymous wrote:+1000. Outstanding example, Uncle B! Well done.

And for those very rare one or two people who think LexisNexis is your buddy, feel free to share. The rest of us don't trust them as far as we can throw them with our children's and family members personal data and also sensitive medical expense information.

Most of us also have no desire to deal with companies who repeatedly break the law.

The certainly don't have any business knowing whether a cardmember's spouse is blind, whether a cardmember is disabled, their children's social security information, or about very large sensitive (and very private) medical expenses, among many other things.

No one here thinks there are conspiracies or anything ridiculous of that nature. We just don't like sharing our children's private information with bottom feeder companies whose reputation is in the toilet.

Right... so since you can't have any personal familiy info touched by LN, you carry absolutely no medical or other insurance?

Sure.

Outside of that fantasy world... since you do have insurance - LN already has detailed personal info, SSNs, and every insurance-covered medical billing detail on those family members.

And unlike their 4506-T processing services, that info is cross-shared. And you can't really "opt-out".

This certainly isn't "thinking LN is your buddy". This is recognizing objective reality.

You're entitiled to your opinion, which is exactly that - an opinion.

Many of us have stated that we don't wish to share our minor children's or our own sensitive medical information (among many other factors) with a third-party data aggregator with whom we have no relationship. (and one whose reputation is in the toilet, incidentally). And that's a very legitimate concern of many of us.

We can choose to do whatever we like, as can you.

Have a fantastic day! ![]()