- myFICO® Forums

- Types of Credit

- Credit Cards

- The Garden is an evil place....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Garden is an evil place....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Garden is an evil place....

So, here I am, rocking along in my 3rd month in garden, and feeling proud of myself with no desire for anything and BAM!

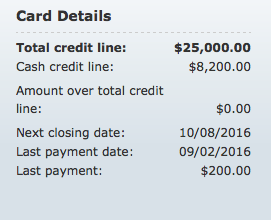

While checking all my accts this morning, Out of the blue BOFA decides that I'm eligible for a CLI on my Cash Rewards card. This is the first time that the CLI button popped up on my acct since I've had it. Ugh!! I've had No INQ on TU since May!

I will remain strong, but have come to the community for encouragement lol!! 😔

just a a little info for those curious.....I run about $275-$300 per month thru it, PIF before statement cuts.

Also...received my 1st ever BT offer from Cap1 on my Venture card! 0% / 18mo 3%fee. They are also PIF monthly but after statements cuts, and run about $1500-$2800 thru it monthly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

Of course it is your choice, but it is really not worth it, imho. It will still be there when you are ready to leave the garden.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

@pizza1 wrote:So, here I am, rocking along in my 3rd month in garden, and feeling proud of myself with no desire for anything and BAM!

While checking all my accts this morning, Out of the blue BOFA decides that I'm eligible for a CLI on my Cash Rewards card. This is the first time that the CLI button popped up on my acct since I've had it. Ugh!! I've had No INQ on TU since May!

I will remain strong, but have come to the community for encouragement lol!! 😔

just a a little info for those curious.....I run about $275-$300 per month thru it, PIF before statement cuts.

Also...received my 1st ever BT offer from Cap1 on my Venture card! 0% / 18mo 3%fee. They are also PIF monthly but after statements cuts, and run about $1500-$2800 thru it monthly.

I can confirm from experience with BofA that they seem to relax after you garden for 3-6 months, you'll see CLI link appear and card prequals start to show up. Gardening is healthy!![]()

Next app: Mortgage in September 2025

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

Stay strong don't do it...you don't need it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

Nobody beats BofA when it comes to HP CLI's, they are the most generous. That being said, I think you should wait and garden, maybe 6mo+, that will increase the size of the CLI's. In no time at all your Cashrewards will be a Visa Signature with a generous limit![]()

Next app: Mortgage in September 2025

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

Sorry, I am new. what is gardening?? I am guessing when you sit on your CC's and let your score rise?? Tips on gardening??

Also, Off topic (maybe not): My credit score dropped 6 points because I actually used one my CC's and reached 31% UTL (I think that's the word I am looking for, lol) Once i lower it next month will I recover?? I have to ALWAYS have it under 30%??? HELP!!!! Can you can see i am a newbie. I just want the basics I'm not sure where I went wrong. Well minus the over 30% part.

I have 3 credit cards: Navy Federal Rewards Card $500

Finger Hut: $200.00

Credit One: $300.00

CREDIT ONE: (I KNOW, I already paid the annual fee before coming to this forum. My plan was to close it at the 1 year point. I am scared closing it now will lower my credit or should i just bite the bullet and close it NOW??) *covers eyes*

Thank you for any advice you have!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

@Anonymous wrote:Sorry, I am new. what is gardening?? I am guessing when you sit on your CC's and let your score rise?? Tips on gardening??

Also, Off topic (maybe not): My credit score dropped 6 points because I actually used one my CC's and reached 31% UTL (I think that's the word I am looking for, lol) Once i lower it next month will I recover?? I have to ALWAYS have it under 30%??? HELP!!!! Can you can see i am a newbie. I just want the basics I'm not sure where I went wrong. Well minus the over 30% part.

I have 3 credit cards: Navy Federal Rewards Card $500

Finger Hut: $200.00

Credit One: $300.00

CREDIT ONE: (I KNOW, I already paid the annual fee before coming to this forum. My plan was to close it at the 1 year point. I am scared closing it now will lower my credit or should i just bite the bullet and close it NOW??) *covers eyes*

Thank you for any advice you have!!!

Welcome to the board! Close Credit One now and no need to feel embarrassed.

Have you tried to apply to Capital One? That would seem to be a good card given your above lineup and limits.

Ideally you want 1 card reporting at under 10%. Realistically, that can be difficult when your cards have low limits. There is good information in the FICO scoring section related to your question.

pizza, agree with the other advice provided here and I would suggest to wait. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

@Anonymous wrote:

@Anonymous wrote:Sorry, I am new. what is gardening?? I am guessing when you sit on your CC's and let your score rise?? Tips on gardening??

Also, Off topic (maybe not): My credit score dropped 6 points because I actually used one my CC's and reached 31% UTL (I think that's the word I am looking for, lol) Once i lower it next month will I recover?? I have to ALWAYS have it under 30%??? HELP!!!! Can you can see i am a newbie. I just want the basics I'm not sure where I went wrong. Well minus the over 30% part.

I have 3 credit cards: Navy Federal Rewards Card $500

Finger Hut: $200.00

Credit One: $300.00

CREDIT ONE: (I KNOW, I already paid the annual fee before coming to this forum. My plan was to close it at the 1 year point. I am scared closing it now will lower my credit or should i just bite the bullet and close it NOW??) *covers eyes*

Thank you for any advice you have!!!

Welcome to the board! Close Credit One now and no need to feel embarassed.

Have you tried to apply to Capital One? That would seem to be a good card given your above lineup and limits.

Ideally you want 1 card reporting at under 10%. Realistically, that can be difficult when your cards have low limits. There is good information in the FICO scoring section related to your question.

pizza, agree with the other advice provided here and I would suggest to wait.

Thank you so much for your response. I will pay my balance Friday and CLOSE Credit One!!! Thank you!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Garden is an evil place....

Stay strong bro. BofA CLI is definitely not worth a HP when you can get 400+ bonus with other creditors easily.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content