- myFICO® Forums

- Types of Credit

- Credit Cards

- Thinking about doing a balance transfer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Thinking about doing a balance transfer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

I get the 0% for 12 or 18 month and 3% fee offers and checks in the mail from Cap1 a lot on Quicksilver visa and mc's, I just received the 2% fee for 18 months yesterday.

i only will take advantage of them if my account has a 0 balance and im not going to spike the utilization on the card over 30 percent. I prefer to use the b/t checks, deposit it in checking account and pay credit card from checking.

Once I start to get out the balance transfer check options, I usually realize it's time to re-evaluate my spending and reel it in a lil bit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

@beautifulblaquepearl wrote:

I don't see a down side. Is the 3% BT fee less than the interest you will be billed once the introductory period is over? If yes, it's a win-win for you. Enjoy!

Oh yes. The interest in the first month would be more than the BT fee for sixteen months. If I couldn't BT it then I would just PIF to avoid the interest.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

@red259 wrote:

@beautifulblaquepearl wrote:

I don't see a down side. Is the 3% BT fee less than the interest you will be billed once the introductory period is over? If yes, it's a win-win for you. Enjoy!Oh yes. The interest in the first month would be more than the BT fee for sixteen months. If I couldn't BT it then I would just PIF to avoid the interest.

Okay. Then I would do it. It may be best to deposit the check into your account like someone else mentioned and then make a payment to Barclay. Please verify that writing the check to yourself won't be treated like a cash advance. Keep us posted.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

@beautifulblaquepearl wrote:

@red259 wrote:

@beautifulblaquepearl wrote:

I don't see a down side. Is the 3% BT fee less than the interest you will be billed once the introductory period is over? If yes, it's a win-win for you. Enjoy!Oh yes. The interest in the first month would be more than the BT fee for sixteen months. If I couldn't BT it then I would just PIF to avoid the interest.

Okay. Then I would do it. It may be best to deposit the check into your account like someone else mentioned and then make a payment to Barclay. Please verify that writing the check to yourself won't be treated like a cash advance. Keep us posted.

Weird I don't remember seeing that. I wouldn't think they would allow you to deposit a check for a BT like that, since its a special offer to do BT not a cash advance...

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

you can write the check to yourself for balance transfer, that's how I have done them in the past as well as website transfer too. it has never been treated as cash advance but there could be ones out there like that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

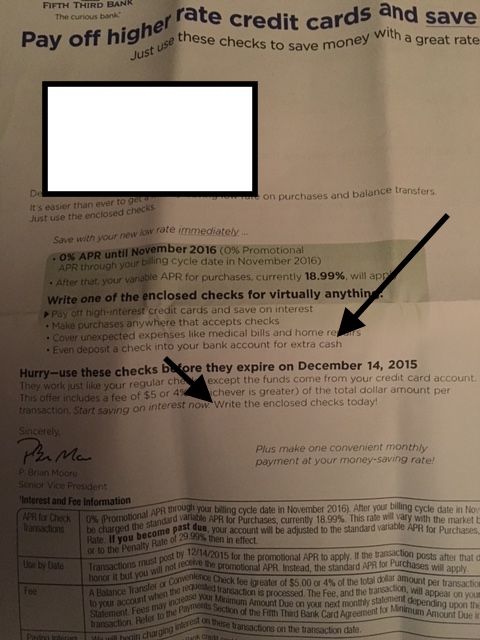

have to read the terms, but usually all the balance transfer checks I receive have this kind of statement on it; this is a recent one from 5/3 bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

@red259 wrote:

@Anonymous wrote:You said it's 0% APR, but is there a BT fee? Often they're in the neighborhood of 3%. Sometimes there are no fee offers. Not saying that means you shouldn't do it if there's a fee if it helps in other ways. Just want to make sure you're aware of the cost if there is one.

Yea there is a 3% fee, but the longterm 0% apr makes it worth it to me. I'd probably pay down the barclays card to 3k and then transfer the rest. I don't recall getting any no-fee offers (at least not ones where I would have the 0%apr). Chase sent me a 2% offer for my chase sapphire card but the problem is I actually use that card for restautant spend, so don't really want to be putting a long term BT on it.

For the Chase non-CoBranded cards (at least my Slate and Freedom, and I'm guessing the CSP as well) they have the "Blueprint" payment modifiers available. One of these modifiers is "Full Pay". If you are carrying any kind of a balance, whether low rate BT or you just don't want to add to an interest paying balance, setting Full Pay to pick out certain categories of charges, such as Dining (or all categories of new charges) sets up your account to pay those items as part of your "Blueprint" autopayment. So, you could put a BT on the card, set up 1) Autopay for the minimum payment, set up 2) Full Pay for any new charges (selecting many or all categories), and 3) Finish It to set a higher payment amount than minimum payment, and Chase will auto calculate and auto pay those 3 items on your regular monthly payment, all in one payment.

I've tried this on my Slate, which is carrying a Forever 4.99% BT offer, and indeed, the new charges were paid with no additional interest, through the Full Pay option. Along with the Finish It, which I set up for $600 additional each 12 months, and it allocates out to just over $50 per month. I just set up Finish It for another 12 months since the old one, well, finished.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

I remember that you also wrote of Blueprint in

Using a CC with a Balance Transfer without added interest cost

Thank you. I hope to put it to good use soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Thinking about doing a balance transfer

@red259 wrote:

@beautifulblaquepearl wrote:

@red259 wrote:

@beautifulblaquepearl wrote:

I don't see a down side. Is the 3% BT fee less than the interest you will be billed once the introductory period is over? If yes, it's a win-win for you. Enjoy!Oh yes. The interest in the first month would be more than the BT fee for sixteen months. If I couldn't BT it then I would just PIF to avoid the interest.

Okay. Then I would do it. It may be best to deposit the check into your account like someone else mentioned and then make a payment to Barclay. Please verify that writing the check to yourself won't be treated like a cash advance. Keep us posted.

Weird I don't remember seeing that. I wouldn't think they would allow you to deposit a check for a BT like that, since its a special offer to do BT not a cash advance...

Not all institutions consider it a cash advance. I have the ability to direct deposit money into my personal account with Citibank [Simplicity & Double Cash], Bank of America [BBR & Cash Rewards], and Barclay [Ring]. I don't know if it's an option with Capital One which is why I suggested you verify before doing it.