- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Time to Report / Flex Spend CC

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Time to Report / Flex Spend CC

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

Thank you Lexi. So according to Ilecs's post here, "the TU versions used most, along with EQ and EX, will ignore it" thus "won't even factor it into utilization". Regardless, I have my spreadsheet on all of my cards with limits and utilization and I factor it in just in case. lol ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

Will do. I'm thinking of testing it by leaving a small amount (just on that one card) one month, let it report and then PIF the next month to see if it'll effect the score in any way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

Haha, I don't mind. As long as it will benefit others on the forums. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

@eddie84 wrote:Thank you Lexi. So according to Ilecs's post here, "the TU versions used most, along with EQ and EX, will ignore it" thus "won't even factor it into utilization". Regardless, I have my spreadsheet on all of my cards with limits and utilization and I factor it in just in case. lol

I suggest you read the rest of the thread. Ilecs said it himself that his remark referred to charge cards. Visa signature cards are not charge cards. They are revolving cards. Someone in that thread reported that his visa signature card was factored into utilization for FICO scoring, consistent with my personal experience. If you have a visa signature why don't you pull a fico score report and confirm that rather than making conjectures? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

This particular question has yielded different answers. New FICO model vs older versions the jury may be out on a definitive answer that fits everyone.

From my experience, it reported like Amex. As usual, YMMV.

http://ficoforums.myfico.com/t5/Credit-Cards/Any-one-get-BoA-VISA-signature-to-report-the-limit/td-p...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Time to Report / Flex Spend CC

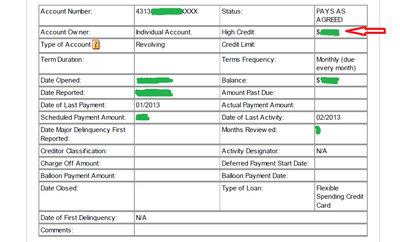

Hm, that's weird. They are not supposed to be reported the same way. Here's an example from my credit reports. The latest Equifax report I have on my computer doesn't show the Amex account because it was pulled too early, so I will also use the MyFICO Equifax report to illustrate the differences.

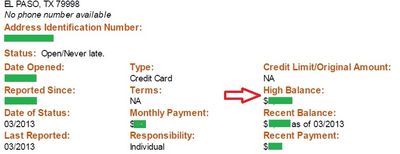

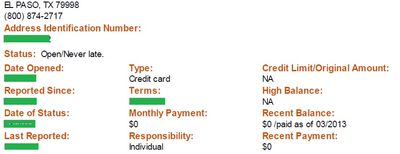

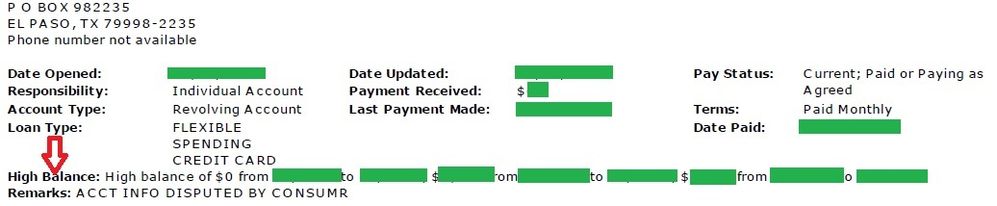

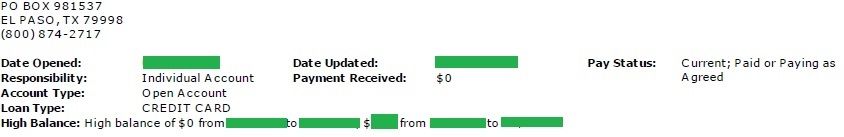

Notice the red arrows pointing to the high daily balance to be used in calculating FICO scores.

Starting with Experian. The most visible difference is that the Amex charge card doesn't have a High Balance: the High Balance field shows "NA"

Transunion illustrates the differences differently. The Visa Signature card is identified as a "flexible spending account", whereas the Amex charge card is identified as an "open account". Another difference is that the "high balance" of the Amex charge card is the high statement balance, while that of the Visa Signature is the high daily balance.

Equifax follows Transunion in making the distinction between a "flexible spending account" and an "open account".

So at least in my case there is enough distinction between the two types, and there is sufficient information, i.e., high daily balance, to take into account the Visa Signature card in calculating utilization even if the credit limit is not reported.