- myFICO® Forums

- Types of Credit

- Credit Cards

- US Bank blues (question)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

US Bank blues (question)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

Should I have seen the SL on the credit card list or do I have to go past the 'review and submit' page first? I'm not really interested in establishing yet another bank account or having another HP, just trying to satisfy my curiosity.

Also, does US Bank ever offer financial incentives for opening accounts like some of the other banks do? I try to reserve actual account openings for those periods...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

I know what you mean...I didn't want another checking account either just to satisfy my curiosity...but I tried anyway lol. They immediately pulled Experian. I was approved for the Gold checking account after paying my $25 deposit, but my CC application is under review--which I'm sure means a denial. 😔 lol oh well. I will wait to see if it has indeed been denied and then will probably close my US Bank account and have them return my deposit. 😁

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

Not sure about the other question, but US Bank does targeted mailers for opening checking accounts (my wife has one at the moment.) They may also do public offers, but I'm not sure about that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

i have a gold business, and a gold personal with USB... I love them, the cli will increase pretty quick even if you dont ask if you have the gold package.. I would keep the card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

@Anonymous wrote:

So I came out of the garden to do my BofA cli (which increased my limit from 2 to 6k, also got a bump from Amex from 2500 to 7k thank you very much) and decided to app for a us bank card since I got a prequal offer.

I got a 5-10 day wait message but was approved. Today, I received my card with my giant limit of.........$500

Can this be reconned? I’m inclined not to keep the card even though I took the hit because I can’t do anything with a card that low unless someone has a good argument for me to keep it. Any input would be appreciated. Thanks!

You can call and request a recon for a higher limit. So it within 30 days and they will use the same pull that they used to approve you.

Barclays: Arrival+ WEMC

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Platinum WEMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 5.23, EX: 812 / EQ: 825 / TU: 815

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

@Anonymous wrote:Should I have seen the SL on the credit card list or do I have to go past the 'review and submit' page first? I'm not really interested in establishing yet another bank account or having another HP, just trying to satisfy my curiosity.

Also, does US Bank ever offer financial incentives for opening accounts like some of the other banks do? I try to reserve actual account openings for those periods...

If you didn't see a set SL and APR then there was zero point to proceed. I was just mentioning this route as the easiest way to determine if you are really pre approved for a card and what your SL will be, as opposed to a pre-qual with a set APR only cold app hoping for a high limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

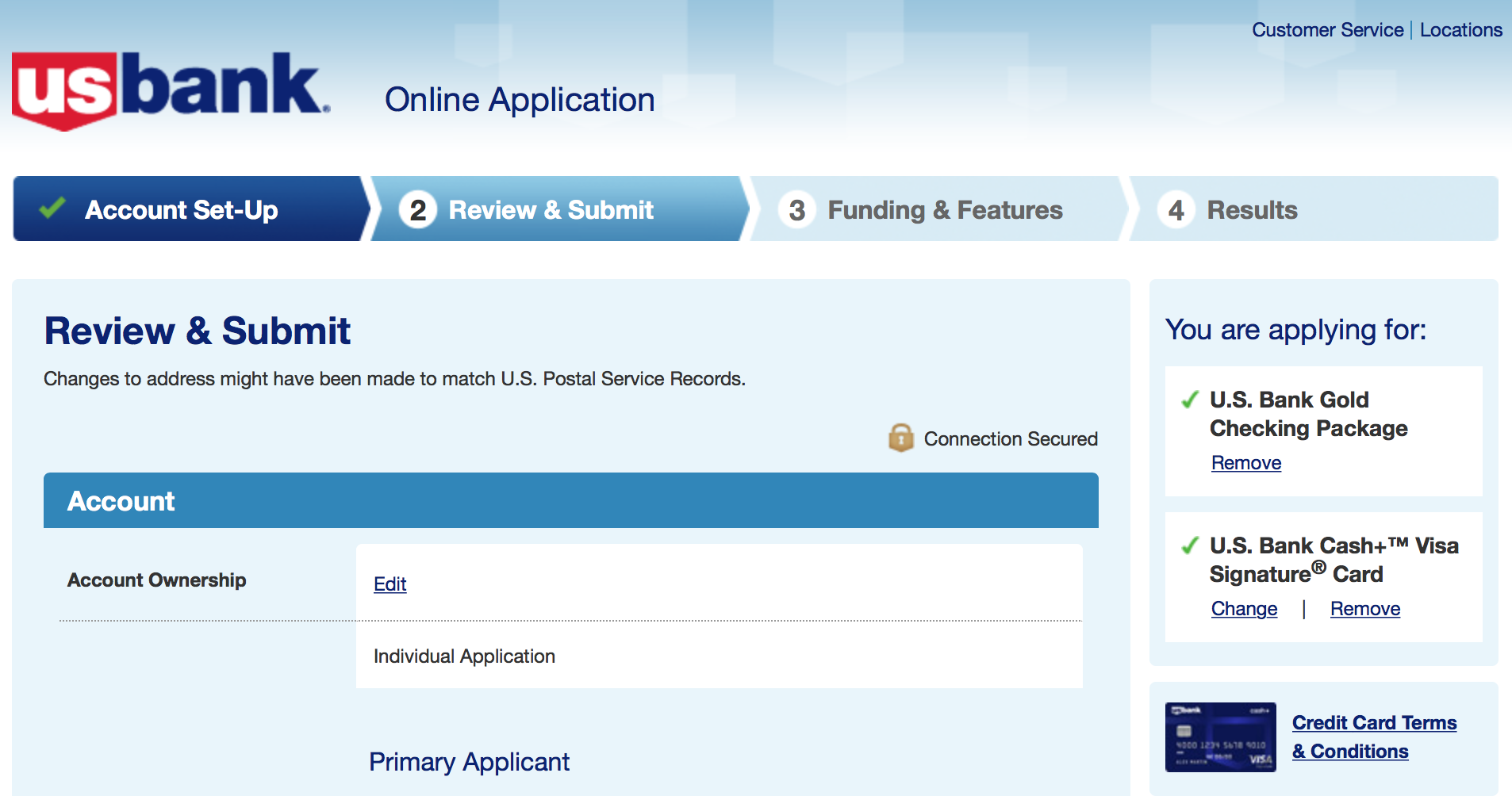

Went through the link and filled out the app for the gold package, added the cash + visa signature but recieved no firm apr or SL so saved the application for later. Funny thing recieved an email for Kroger Rewards Visa from them today. Never ever received any type of offer from US Bank to this point. Wondering if I should app for the Kroger Rewards instead.

Current FICO08 Scores SEP 2023 (TU 834) (EQ 831 (EXP 831)

“The credit is no longer bruised, it has endured the test of time” (formally know as bruisedcredit)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

Is there any credit expectation regarding acceptance on USB VS+ via checking package? Fico8 score? Recent inquiries or AoYA?

BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclay View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

$944,008 Amex BRG

$91,953 Amex SC

$58,351 Discover It

$50,046 BofA CR

$36,146 Amex PRG

$6,774 Cap1 QS

$963 Amex CM

$1,188,241 Yearly Spend

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: US Bank blues (question)

@Anonymous wrote:

Thanks for the info so far. I am new to US Bank. I liked the idea of picking categories for 5% (even if the categories weren’t always great).

The other reason I’m inclined not to keep it is I’m afraid that super low SL is a flag to them to keep me in a group that will never truly grow. I feel like that SL is a “we’ll let you in but you’re a huge risk”.

I am going to absolutely confirm this suspicion and here is why.

My first US Bank Card was at the time the highest limit back in 2012 for 2K.

Fast forward a few years and it seen a couple of 1K SP CLI's and eventually made it to 4500. Only just last year and being my sole oldest card account and FICO Scores hovering around 770+ it was turned down for a CLI.

For pity sakes i would been satisfied just to crack 5K which is really all i wanted to see but didn't happen.

I had enough and jettisoned US Bank. Recently they been throwing preapprovals this way but i am so done and not in the mood to babysit them anymore especially with a stable chocked full of 20K lines.

Yeah, i got stuck in some weird risky pool they have too.