- myFICO® Forums

- Types of Credit

- Credit Cards

- USAA 2.5% Targeted Offer [UPDATE MARCH 2017]

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

USAA 2.5% Targeted Offer [UPDATE MARCH 2017]

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE NOV 2016]

@BornSupercharged wrote:I got mine and I'm in Texas. I imagine I was one of the first to get the card, feels like I've had it a while now. Applied and approved instantly Oct 15th, low 7k limit but happy to get 2.5% back on everything.

I thought Texas isn't in the test market. How is this possible?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE NOV 2016]

I've been wondering, is it normal for CC companies to run test markets? Why wouldn't their research, historical data, and trends, pricing, expenses, etc. be worked out already and figured into their business plan and product model? Why would they have to do backend research, then a limited test market pilot program before deciding the profitability. Their data should already confirm whether or not offering up to 2.5% CB is profitable and at acceptable margins.

Is this abnormal or normal for a CC company to do this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE NOV 2016]

@Anonymous wrote:I've been wondering, is it normal for CC companies to run test markets? Why wouldn't their research, historical data, and trends, pricing, expenses, etc. be worked out already and figured into their business plan and product model? Why would they have to do backend research, then a limited test market pilot program before deciding the profitability. Their data should already confirm whether or not offering up to 2.5% CB is profitable and at acceptable margins.

Is this abnormal or normal for a CC company to do this?

Well another aspect of this card is the direct deposit being required. It is a "tracked transaction" that says 2.5 LL DIRECT DEPOSIT when I look into my Limitless rewards. Because if you don't have that, rewards go down to 1.5%. So maybe they're testing how feasible it is to track the direct deposits... I dunno, just a guess...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE NOV 2016]

@Anonymous wrote:I've been wondering, is it normal for CC companies to run test markets? Why wouldn't their research, historical data, and trends, pricing, expenses, etc. be worked out already and figured into their business plan and product model? Why would they have to do backend research, then a limited test market pilot program before deciding the profitability. Their data should already confirm whether or not offering up to 2.5% CB is profitable and at acceptable margins.

Is this abnormal or normal for a CC company to do this?

Competitive market analysis and the rest that you mention isn't always foolproof. This is the first time to my knowledge USAA has done this sort of thing, it's really only been tried by CU's previously in terms of scaling rewards (or discounts in some cases) based on how much relationship has been established defined on any number of criteria.

USAA is a financial giant compared to many of those and we've seen what happens when there's a proverbial run on a credit card on this forum even. USAA is also a fairly conservative bank, so when they're going to run a product right out to the profit margin's razor edge, I can't fault them for being twitchy, and it's not abnormal corporate behavior let alone for a bank.

Texas is a decent market to try to test quietly, Chase / Amex / et al. are far more prevalent there than they are in some of the states that were officially announced; we've already seen where folks will push something for all it's worth, though if approved for this card I'd play it straight up anyway. As is my financial life is becoming more complicated with the HELOC and it's a two step process to shuffle money around now (USAA is flatly the best I've found for that) so simply dumping some direct deposit into USAA directly and then one hopping it to DCU or Chase or the rest of the financial institutions I have loan terms with probably would be a smart decision on my part for simple QOL and cut out half the transaction delays.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE NOV 2016]

I am looking to app for the USAA limitless card once it's available in my area. I may even give them a call in January and see if I can slip in.

Have a checking and savings account with them as well as vehicle insurance. Been a member since 1990. Have direct deposit established, not at $1K though. But can accommodate to meet the requirement.

The simplicity of 2.5% cash back for everything requires less thought. Additionally the end of life Sallie Mea rewards makes this attractive. About the best you can do without having multiple cards and shuffling around during purchases, just not worth it to me. Would have to app for a BCP or BCE for groceries and and Amazon card to come close to a sallie mae replacement.

I will get this one when available and hang on the my Fidelity Visa, BOA better balance rewards and call it a day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE DEC 2016]

Ok does anyone want to make any predictions for January 1st?

I'm hoping that if not January 1st, then January 2nd since that is Monday. But then if not, January 3rd since January 2nd is a Federal Holiday/Bank Holiday.

P.S. to OP: I am wondering if changing the title from "targeted offer" to "new USAA 2.5 card" to make this thread more related to the content...I have search all of the Internet and on other CC forums and this is the only forum that has mentioned this card....besides the redit forum you mention in your first post. Because I notice this thread quickly gets buried by more popular threads, idk why this IS such a great card!! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE DEC 2016]

They might be getting ready to launch this card!!!! ![]()

Anecdotal: while logged out of usaa, I went to the credit card section, selected my state and the cashback screen displayed "Showing 5 of 14 cards" the limitless card displayed shortly then disappeared as the page continued to load. After it disappeared the page still said "Showing 5 of 14 cards"

Looks like USAA is updating their website for this card to launch very soon!!! ![]()

Try it for yourself, clear cookies and cache, do not login, select your state and see what happens.....I had been doing this all along for weeks/months since finding out about this card and it never done this it only displayed "Showing 4 of 13 cards"

Go try it out!

I'm so excited!!!! ![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE DEC 2016]

I'm getting the same results... using my state it says "Showing five" but only displays four.

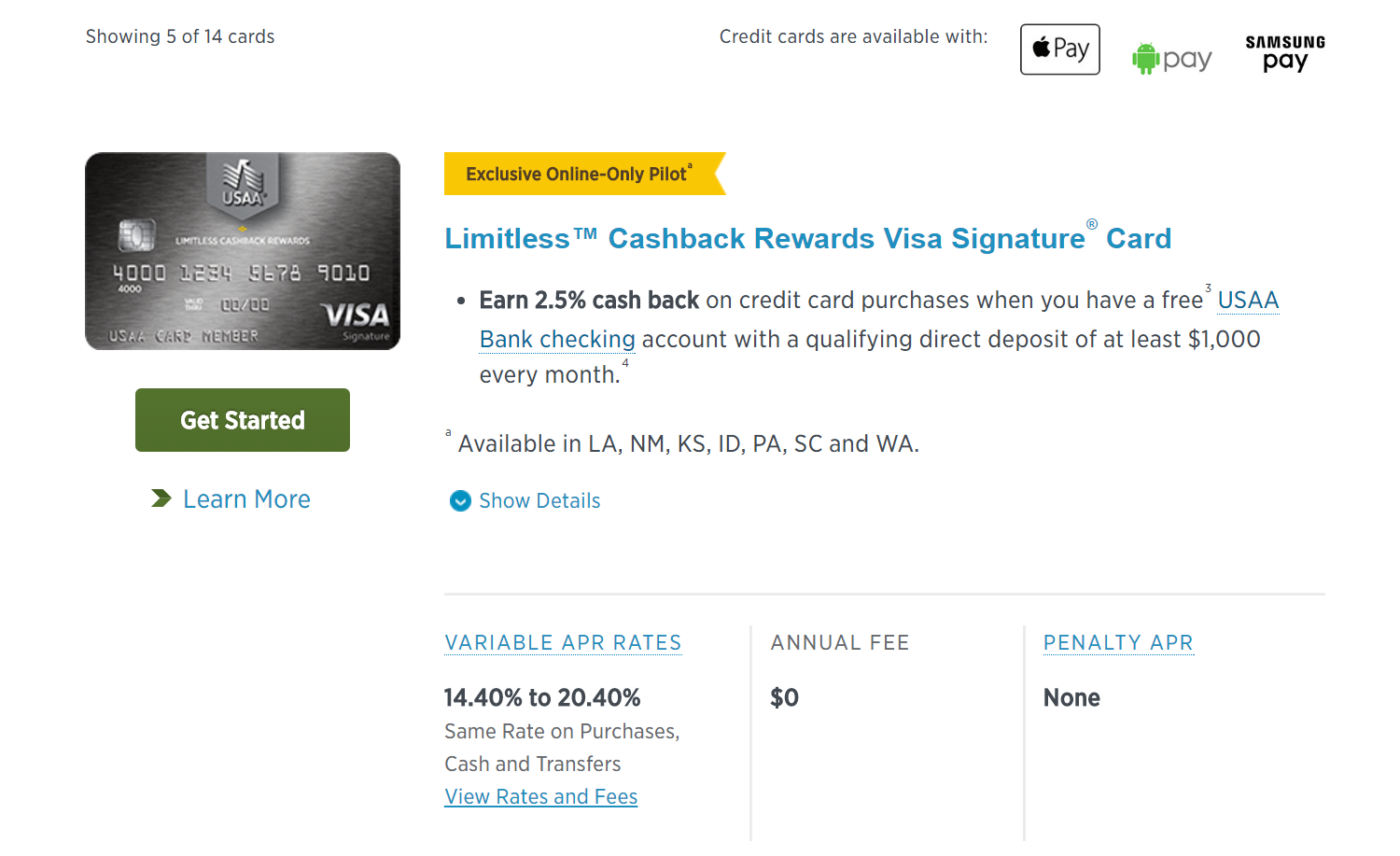

When I change the state to LA (using private browser) it shows all five, including the Limitless:

Hopefully this means they are getting it ready for the rest of us! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE DEC 2016]

I looked for my state and it said "showing 5 of 14" but only listed 4 cards. I went into the html source view and searched for "limitless" and found it there. So they are indeed updating their site but haven't made it show up automatically yet. However from the source I was able to pull the links from the screenshot where it says "Learn More" and another link labeled "view". Weirdly learn more actuall went to the preferred cash rewards CC page. But the other link went to the terms and conditions page for the limitless:

https://www.usaa.com/inet/wc/credit_card_limitless_cashback_rewards_terms

Also I don't live in the list of states that is says "Available in" in the screen shot so I think it's still restricted to those right now.

Discover It $8,600 Since 08/2014 // AmEx BCE $23,100 Since 10/2015 // Citi DC $7,000 Since 06/2016 // BoA BBR $1,800 Since 11/2016 // US Bank Cash+ $3,000 Since 11/2016

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: USAA 2.5% Targeted Offer [UPDATE DEC 2016]

Just checked to see if the limitless was available in Alabama.

It's on and popping folks! UnkaB you might want to check your area again.😉

We're about to light this one up! I already have one $25k card with them. This one should grow fast over the next 18 months. Current scores and stats in signature. 6th new account in less than two months.