- myFICO® Forums

- Types of Credit

- Credit Cards

- What makes the Sallie Mae card super-special and d...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curious?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

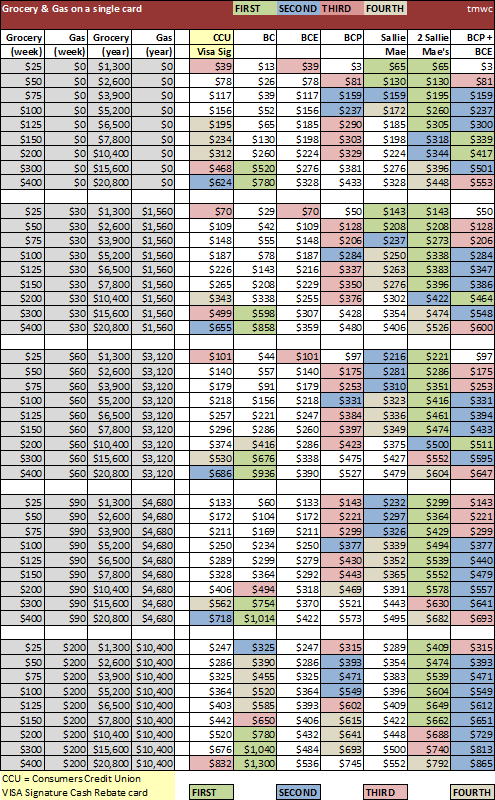

@Anonymous wrote:Only a TRUE forum master could decipher that chart.

I'm a Business Analyst and I can't figure out what

the total potential rewards are or could be.I was however to "Figure out" Nixons.

Really?? To me (not a forum master) it seems a fairly straightforward spreadsheet with columns labelled. The only thing that could be clearer is whether the value is annual or monthly (or something else) but a quick check of any card you know shows that it is annual. And yes, annual fees and all strangeness is included in the analysis.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

@Anonymous wrote:

Its not bad if you can get the lowest of the three. Not that APR should be an issue with this card but I feel like I need a written command from the Almighty to qualify for 13.99%Mine is the middle rate

I was also hoping for the lowest rate and ended up with the middle rate, but that was wishful thinking on my part, considering that I had (and still have) baddies on my reports. I may hit them up later this year when my reports are squeaky clean and see if they can get me that coveted 13.99%. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

@Anonymous wrote:

Its not bad if you can get the lowest of the three. Not that APR should be an issue with this card but I feel like I need a written command from the Almighty to qualify for 13.99%Mine is the middle rate

Wow, didn't notice before. That is a high middle rate. Have you tried to lower it a notch or two?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

@Imperfectfuture wrote:

@Anonymous wrote:

Its not bad if you can get the lowest of the three. Not that APR should be an issue with this card but I feel like I need a written command from the Almighty to qualify for 13.99%Mine is the middle rate

Wow, didn't notice before. That is a high middle rate. Have you tried to lower it a notch or two?

Its all of 1% higher than the middle rate of our US Airways cards so not really a big difference ![]() I called and inquired around January I believe and was told no offers were currently available. I may try again in a few months but carrying a balance on this card kind of defeats the benefits purpose so its not high on my necessities list.

I called and inquired around January I believe and was told no offers were currently available. I may try again in a few months but carrying a balance on this card kind of defeats the benefits purpose so its not high on my necessities list.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

@Anonymous wrote:

Its not bad if you can get the lowest of the three. Not that APR should be an issue with this card but I feel like I need a written command from the Almighty to qualify for 13.99%Mine is the middle rate

I don't know how the come to the APR that they approve. I got my Amex 20.99% and my DW got her Amex at 12.99%. My score is higher but my cards have lower limits and higher APRs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What makes the Sallie Mae card super-special and desirable to a lot of card holders, just curiou

@beautifulblaquepearl wrote:

@Themanwhocan wrote:

@TRC_WA wrote:I ran $4800 in 31 transactions thru my Sallie Mae this month... cashed in $50 in statement credits too and almost hit $75.

Gas... groceries... Amazon.

Between me (I'm single) and my Dad (AU) hitting the 5% caps is stupid easy in gas/groceries and then I switch to another card (Discover, Sam's MC) for the 5%. I spend $200-$300 a month in Amazon too.

It's my current go to card...

Perhaps you should get a second Sallie Mae card.

Would you mind explaining your spreadsheet? Thanks in advance!

This spreadsheet shows expected yearly cash back for each card or combination of cards, ignoring any sign up bonus or first year fee waivers. So, annual fees are deducted from earnings. You have to determine what your typical weekly or yearly spend is in the two spend categories of Grocery Stores and Gas Stations.

In other words, this chart shows the expected cash back per year after the first year, since first year is strongly effected by sign up incentives, which do change periodically. Choosing cards based on sign up bonuses is a completely different topic...

Sallie Mae is the Barclaycard Sallie Mae Mastercard: https://www.salliemae.com/credit-cards/sallie-mae-card/

CCU is Consumers Credit Union VISA Signature Cash Rebate Card.

BCE = American Express Blue Cash Everyday

BCP = American Express Blue Cash Preferred

BC = American Express Blue Cash card, which is still available if you know where to find the application

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content