- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: What the heck is going on with Synchrony?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What the heck is going on with Synchrony?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

@Spider15 wrote:After reading 67 pages on the subject of Synchrony Bank, I closed my eight year old JCPenney Card. Don't need any of this grief.

+1. Better cards with better APR's are out there! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

I closed all my Sync cards as well. I'm done with them. This unprofessional nonsense is a deal breaker for me. Prime lenders only going forward. It feels good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

@Anonymous wrote:I closed all my Sync cards as well. I'm done with them. This unprofessional nonsense is a deal breaker for me. Prime lenders only going forward. It feels good.

Unprofessional is the word I was thinking of as well. Glad it feels good to rid yourself of the dead weight! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

I see your point about being part of having credit but some of these cases just seemed unfortunate. To ask for a 4506 t after approving someone on 5 diiferent cards , 2 weeks after the fact, as per a very recent poster/thread, is just silly. They need to due their homework before approving people. Why else do they have underwriting and certain criteria?

Anyway, i think for me , after reading and learning from this thread, the third party sharing is uncalled for if they want to verify your income and such. Best of luck in your future endeavers my fico friend(s)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

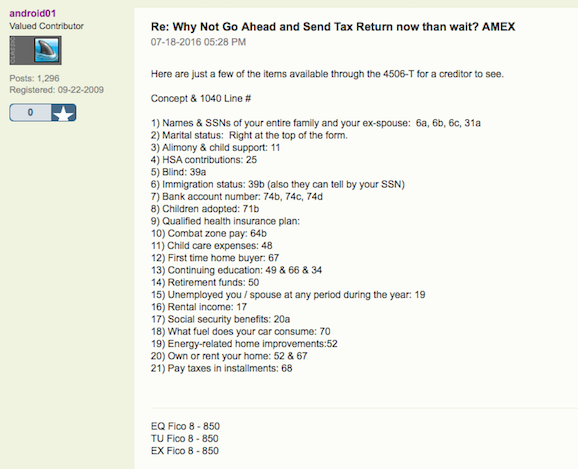

Here is a post that someone made in a different thread that I think clarifies quite a bit: (and these are just a few of the items provided on a 4506-T; this is not a complete list)

My response would be no thanks to sharing it all with third-party information collection services if asked.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

Quick update for those who’ve been following the many freezes of Synchrony. I’ve tried multiple times to attempt to get a return phone call from someone in Synchrony to discuss alternatives to this 4506-T nonsense, but to no avail. I have gone back and forth as to the best way to handle this, not wanting to react out of anger (though trust me, I am plenty angry, not only for myself, but the thousands of others, as well, who’ve dealt with similar issues).

I submitted a lengthy letter (what I’ve posted below is just the abbreviated version-sorry in advance, it's still a lot to read) to Synchrony yesterday, along with the 4506-T crossed out in ink and a copy of my W2s from last year as sufficient proof of income. A copy of the letter will also be emailed to the EO, as well. At this point, I could not care less as to whether the remaining 2 accounts are left open or not. If they choose to close them, however, that will be the end of our ‘relationship’, till the end of time! I’ll keep the community posted as to what response I ultimately receive.

To Whom It May Concern:

I am submitting this letter in response to a request for a 4506-T that was sent to me in July 2016. I have composed this letter for a few reasons: firstly, to express my sincere displeasure and disappointment at the manner in which my accounts and I, as a long-time customer, have been handled. Secondly, I am providing an explanation as to why I will not be executing the 4506-T; in lieu, I have provided W-2s and 1099 for 2015, which should be more than sufficient to demonstrate my income and means to fulfill my credit obligations to Synchrony Financial.

By the time that this letter is received by Synchrony, I will have closed all but 2 of my 12 accounts (the oldest of which is 12 years old) All accounts are paid in full and showing a zero balance. At this point, my biggest interest is in minimizing the exposure that I have with Synchrony Bank, given this most recent sequence of events. The freezing of my accounts began last month, the same day I initiated an online request to add my mother as an authorized used on my Walmart card. Within a few hours, every single account had been frozen and restricted from online access. It’s no secret that this is being done to tens of thousands of Synchrony Financial customers, I’m assuming in reaction to the rise of charge-offs that Synchrony declared in a recent financial report.

In your bank’s attempt to regain investor confidence, I feel that Synchrony has placed far too much trust in so-called predictive algorithms that detect potential red flags, and have lost sight of the fact that there are real humans at the receiving end of these massive freezes. Yes, there are banks who may, at some point, require proof of income when reaching a certain threshold (American Express for example), but it is never done in such a way that is ‘retroactive’, so to speak. In other words, they give the customer the option, if they are requesting a certain credit limit increase, to either submit income verification, or they can simply decline the increase. To have all accounts frozen when simply adding an authorized user, and then threatening to close all accounts for non-compliance if an executed 4506-T is not received within 30 days, I will simply say that this is a bank with which I have very little interest in doing business.

I requested, on three separate occasions, a call back from someone in the appropriate department so that I may discuss alternatives to 4506-T and I still have yet to receive a call. I expressed multiple concerns to several different people within the fraud department, and firstly, almost every single one of them had no idea even what a 4506-T WAS! You instruct your customers to call the fraud department with questions on their 4506-T request, and yet, as a bank, Synchrony completely fails to arm their representatives with the basic knowledge to even handle the calls. Additionally, I went on to state to a few different individuals I talked with, that I do not at all feel comfortable releasing personal tax information to Lexis Nexis. It is one thing for the information to go directly to Synchrony; it is a completely different scenario altogether for that information to be sent to a 3rd party that is known for their multiple FCRA violations and for incorrectly reporting that information to numerous ‘hidden’ CRAs and 3rd party data collectors.

In talking with individuals in your fraud department, I expressed the fact that I filed an extension for 2015, to which they indicated Synchrony would also request 2014 returns. As a financial institution who assumedly has interest in ensuring that they are receiving an accurate financial picture of a Borrower’s ability to repay, how does it make sense to rely upon information that is 2 ½ years old? My income has nearly doubled since that time. Again, I explained this, and emphasized that I really needed to hear back from someone at Synchrony who could address my concerns and options, and again, no phone call was ever received.

I have enclosed my W2s and 1099 from 2015 as proof of income. This is the last opportunity I will be extending to salvage this business relationship. If the business decision is made to close the remaining two accounts, as a consumer I will be forced to make the business decision to no longer do business with Synchrony in the future. There are so many ways that this could have been handled that would both appease your investors and maintain current relationships/customers. I am extremely disappointed in the fact that I am even having to write a letter such as this; it is the first time in all of my years of managing credit, and I sincerely hope that it is the last. I will be sending a copy of this correspondence to your Executive Office, as well, with the hope that someone might recognize the disservice that has been done to their customers as well as the potential future impact that this might have on any future relationships. News of this has traveled rapidly throughout the internet and credit forums; my assumption is that your office is already flooded with letters similar to my own.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the heck is going on with Synchrony?

@Anonymous wrote:

Thanks for the update, ohreally.

Sure thing, Musiclover. Who knows what impact the letter will have, if any, but darn it all, I could not just sit back and NOT speak up! It was cathartic to send the letter, if nothing else, but of course, I am hoping that it will reach the right set of eyes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content