- myFICO® Forums

- Types of Credit

- Credit Cards

- What to do with Capital One?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What to do with Capital One?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do with Capital One?

@NRB525 wrote:

@Anonymous wrote:I've never paid interest on any of my cards so far, but I still like to keep my APRs as low as possible, just in case I ever get in a bad situation and end up carrying a balance.

I also have a line of credit at 8% that I've never used, for the same reason. My theory is that if I ever can't pay the full balance on a credit card by the end of the grace period, I can still pay it off with the LOC and save myself a bundle over what the cards charge. But I like to keep as many options as possible, because I know life has plenty of curveballs.If the Capital One has no AF, keep it open. Your apping results for a new CapOne card will be much better with an existing, active CapOne card than if you close it now, then try to come back for a CapOne app later.

The LOC interest rate looks OK, but really, with that Discover limit? You should have basic Discover BT offers that include a no-BT-fee 4.99% APR that beats the line of credit, on APR and available credit, and is an easy path to transfer from other cards if you want to move a balance. While you may not have paid any interest on any cards so far, it might be worthwhile just to try a small BT to Discover to see how it works.

Your Capital One has no BT Fee also. I have been using my 10.9% QS for "fun transfers". I transfer $400 from another card to the QS. The QS is on a $212 per month auto payment. The first statement on the QS has no interest cost. The second has less than $2 interest cost, and $212 is paid during this period. The third statement is back to a zero balance, and has no interest cost. So really, the QS can be a "float" source at "low APR" as well, for a few months.

Thanks for the tip about Discover balance transfer offers! I had no idea tI had any since I'd never gotten anything in the mail or seen them on my discover account portal online. But I looked it up after I read your post and found out I do indeed have two balance transfer offers with discover right now, one at 4.99% and one at 0%. My standard purchase APR on my discover card sucks because I had very little credit history when I got the card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do with Capital One?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do with Capital One?

@NRB525 wrote:An easy way to keep your QS active, without actually using it for swipes, and without paying any interest, is to do the following:

Set up the QS with autopayment of some large amount, say $300.

Just after a QS Zero statement cuts (statement #1), arrange a BT from another card for an amount somewhere under that Autopayment amount.

Let's transfer $250 to the QS two days after the QS statement #1 prints.

At the next QS Statement (statement #2), there won't be any interest cost. The statement will indicate an autopayment of $250 will be made on xx date.

The autopayment will occur, for the $250.

When the Statement #3 prints, it will also be zero balance. No interest cost.

A few days later, do a no-fee BT of $250 (or whatever your number is) onto the QS, and start the cycle all over again. Fun!

So balance transfers have no interest just like a purchase, if you pay them off on the same statement cycle? My Quicksilver APR is somewhere north of 25% (remember, it's a mutant platinum PC) so I really don't want to risk paying interest on a balance transfer. I always assumed BTs didn't get a grace period like standard purchases do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do with Capital One?

I recommend calling them and asking for any promotions or offers on your current card. They are known for temporary apr reductions and upgrades.

Otherwise, open a new card with better limit. Wait 6 months, combine, then close old card. I did and it worked great. A lot to go through I know for a higher limit. Cap 1 has been very good to me and I will keep them. Never have any problems with them. The cash back rewards are good as well.

IMO/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What to do with Capital One?

@Anonymous wrote:

@NRB525 wrote:An easy way to keep your QS active, without actually using it for swipes, and without paying any interest, is to do the following:

Set up the QS with autopayment of some large amount, say $300.

Just after a QS Zero statement cuts (statement #1), arrange a BT from another card for an amount somewhere under that Autopayment amount.

Let's transfer $250 to the QS two days after the QS statement #1 prints.

At the next QS Statement (statement #2), there won't be any interest cost. The statement will indicate an autopayment of $250 will be made on xx date.

The autopayment will occur, for the $250.

When the Statement #3 prints, it will also be zero balance. No interest cost.

A few days later, do a no-fee BT of $250 (or whatever your number is) onto the QS, and start the cycle all over again. Fun!

So balance transfers have no interest just like a purchase, if you pay them off on the same statement cycle? My Quicksilver APR is somewhere north of 25% (remember, it's a mutant platinum PC) so I really don't want to risk paying interest on a balance transfer. I always assumed BTs didn't get a grace period like standard purchases do.

That has been my experience on both my CapOne cards, with recent tests of putting BT onto the card. The first month doesn't have interest costs.

For the QS, due to the multiple months sequence, I am not adding new charges.

With the Venture, the latest experiement included adding new charges during the month. No interest charged.

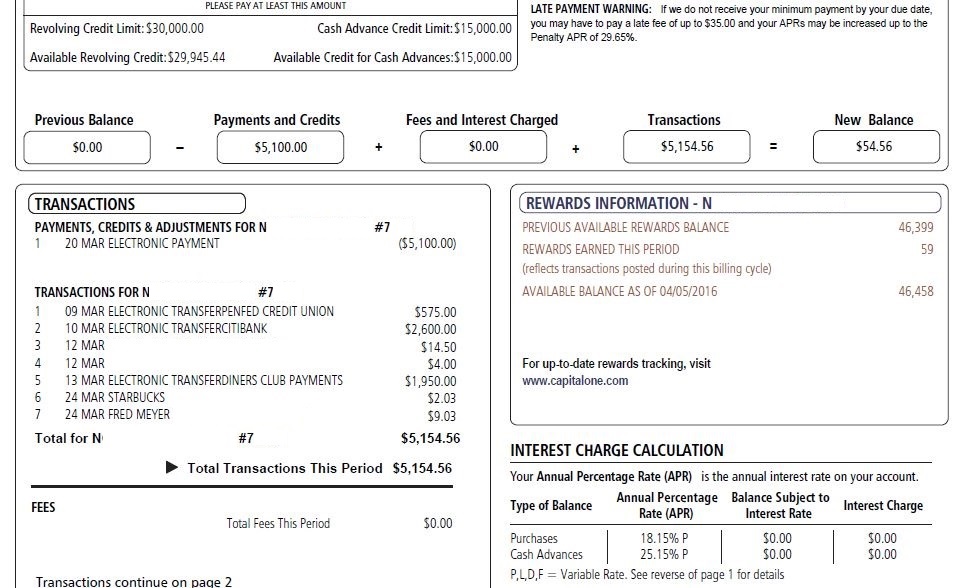

I just went through a gathering sequence, put balances from 3 different cards onto the Venture, in order to have one $5,000+ amount to make a single $5,000+ BT to PenFed to get the $50 bonus from PenFed. The Venture card statement printed with all that, and some new swipes, and no interest charged:

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765