- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Where do I start, new to this forum and buildi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Where do I start, new to this forum and building credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where do I start, new to this forum and building credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where do I start, new to this forum and building credit?

@Colombianking wrote:

Credit Cards Date Opened Credit Line Increase balance Credit Limit Utilization Amex Jetblue 1/16/2013 11/18/2015 2033.35 12600 16.14% Chase United Mileage Plus 8/30/2006 2/17/2015 3090.53 4800 64.39% Chase Flexible Rewards 6/26/2000 11/18/2014 175.23 4800 3.65% Citi Simplicity Aug-14 4/10/2015 3017.97 5000 60.36% Citi Diamond Preferred 4/9/2015 0 5600 0.00% Discover It 8/11/2014 3/1/2015 3018.8 3300 91.48% Overall 11335.88 36100 31.40%

Date of Inquiry Activity Viewable Until 3/27/2015 TransUnion Address 05/25/2016 3/17/2015 Experian Address 05/16/2016 2/18/2015 Experian Inquiries 04/19/2016 1/17/2015 Experian Inquiries 03/18/2016 1/6/2015 Equifax Inquiries 03/06/2016 12/31/2014 TransUnion Inquiries 02/29/2016 12/19/2014 TransUnion New Accounts 02/17/2016 12/11/2014 Equifax Changed Accounts 02/09/2016 12/3/2014 Equifax Address 02/01/2016 12/2/2014 Experian Address 02/01/2016 11/19/2014 TransUnion Inquiries 01/18/2016 9/26/2014 Equifax New Accounts 11/25/2015 9/24/2014 Experian New Accounts 11/24/2015 9/19/2014 TransUnion New Accounts 11/18/2015 9/15/2014 Equifax New Accounts 11/14/2015 9/13/2014 Experian New Accounts 11/13/2015 9/12/2014 Equifax Changed Accounts 11/11/2015 9/1/2014 TransUnion Address 10/31/2015 8/30/2014 Equifax Inquiries 10/29/2015 8/29/2014 Experian Inquiries 10/29/2015 8/20/2014 Experian Changed Accounts 10/20/2015 8/19/2014 Experian Address 10/19/2015 8/12/2014 Equifax Inquiries 10/11/2015 7/21/2014 Equifax Inquiries 09/19/2015 4/15/2014 Equifax Inquiries 06/14/2015 4/15/2014 TransUnion Inquiries 06/14/2015 4/14/2014 Experian Inquiries 06/14/2015

CRA Score Equifax 735 Experian 761 Tran Union 712

You definitely need to get the credit card balances down, so that at the time each card reports to the credit bureaus all cards report $0 balance except one card that reports a small balance. Looks like that will have to be a longer term goal. You can read about that strategy here: http://ficoforums.myfico.com/t5/General-Credit-Topics/How-do-I-play-the-1-9-Utilization-Game-Please-...

Why does your American Express card list a CLI in the future? Is that a typo?

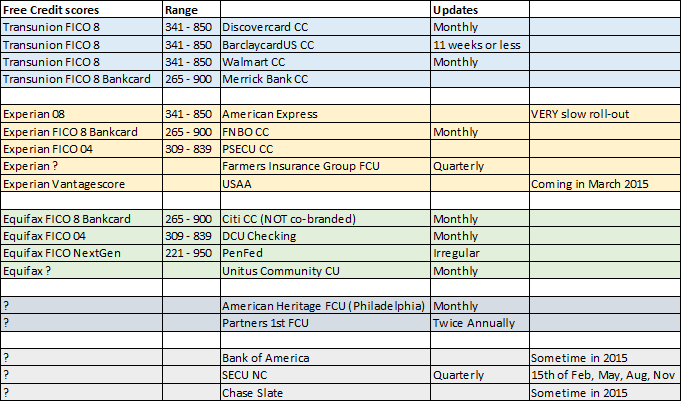

You might want to target some cards in the future that give free FICO scores, such as your Discover It card.

You're carrying what for me would be a large balance. And you stated interest in obtaining a lot more credit. Is this for a business you are running?

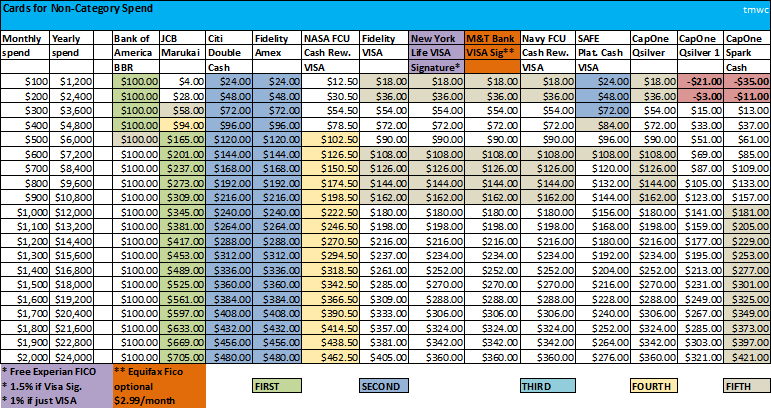

Obviously, carrying balances on your rewards cards is probably rather costly. So, are you mainly looking for short term 0% intro APR ofers, or something like the Coastal24.com Big Ticket Card that gives 6 months 0% on all purchases that are $600 or larger, or low APR cards (Apple FCU as low as 5.74% APR, University FCU as low as 5.90% APR) ?

You might have success with NASA FCU. Some say that boat has sailed, but some people are still having success. You would want to join NASA FCU first,and apply for a card such as their Platinum Cash Rewards afterwards.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where do I start, new to this forum and building credit?

Thanks for your input!

I'll answer in order:

1. 11/18/15 should be 11/18/14 it was a typo .

2. I would like to know what other credit cards provide a FICO score please... My discover card says I have a 729.

3. Yes I started a real estate business. I want to be able to do projects and either have a capability of a balance transfer or have a low interest credit card for access to do another project at the same time I'm doing but only in emergency cases ... I plan on using hard money lenders and building on my private money lenders... I am currently working on my business credit

4. I will be looking for low interest BT cards later but not at this moment... But I am open to suggestions for cards that provide low interest and are willing to increase Credit limits

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content