- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Whose credit card portfolio is complete?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Whose credit card portfolio is complete?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@CreditScholar wrote:My portfolio is complete and has been for some time.

The following are part of my permanent collection:

Bank of America Privileges with Travel Rewards Visa Signature

Chase IHG Rewards World Mastercard

Chase Sapphire Preferred Visa Signature

Chase United MileagePlus Club World Elite MasterCard

Citibank Hilton Reserve Visa Signature

J.P. Morgan Ritz Carlton Visa Signature

I picked up the Amex Plat and Barclay's AA cards for the signup bonuses. I'm not sure if I'll keep either of them in the long run or not yet.

How would you rate the benefits of the IHG card relative to your other hotel cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Callandra wrote:At this point...yes. I am happy with my line up.

Way to go on a 10k Quicksilver!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Open123 wrote:

@CreditScholar wrote:My portfolio is complete and has been for some time.

The following are part of my permanent collection:

Bank of America Privileges with Travel Rewards Visa Signature

Chase IHG Rewards World Mastercard

Chase Sapphire Preferred Visa Signature

Chase United MileagePlus Club World Elite MasterCard

Citibank Hilton Reserve Visa Signature

J.P. Morgan Ritz Carlton Visa Signature

I picked up the Amex Plat and Barclay's AA cards for the signup bonuses. I'm not sure if I'll keep either of them in the long run or not yet.

How would you rate the benefits of the IHG card relative to your other hotel cards?

LOL! Hey now, be nice! Hahahaha. Maybe they have inlaws in iowa or something!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Open123 wrote:

@CreditScholar wrote:My portfolio is complete and has been for some time.

The following are part of my permanent collection:

Bank of America Privileges with Travel Rewards Visa Signature

Chase IHG Rewards World Mastercard

Chase Sapphire Preferred Visa Signature

Chase United MileagePlus Club World Elite MasterCard

Citibank Hilton Reserve Visa Signature

J.P. Morgan Ritz Carlton Visa Signature

I picked up the Amex Plat and Barclay's AA cards for the signup bonuses. I'm not sure if I'll keep either of them in the long run or not yet.

How would you rate the benefits of the IHG card relative to your other hotel cards?

Originally I just obtained the card for the signup bonus.

In terms of hotel status, Platinum doesn't get that much in the US. Asia on the other hand, is a different story. I've put in about 20 nights with IHG this year, and I've been upgraded multiple times by being Plat. If you stay at IHG properties at all, the 50% bonus is nice but nothing Earth-shattering.

However the on-going benefits make the card worth keeping for me. A 10% points rebate plus 1 free night each year is more than a fair trade for a $49 AF.

If you are renewing your Ambassador status and choose the $200 option (with the 10% points rebate), you can stack the rebates (10% AMB + 10% from CC). Essentially you can get 20% back for any points you redeem, and given how easy they are to come by it's not a bad deal if you just want to earn and burn.

They also have some decent values such as 35k points for the 2 ICs in Seoul (COEX and Parnas). With a 20% rebate it would be 28k per night.

It has horrible earning rates though, so I wouldn't bother putting any spend on it other for than IHG hotels.

Instead of asking "why should I keep the card?", I think the better question is "why not?"

American Express Platinum (NPSL) || Bank of America Privileges with Travel Rewards Visa Signature - $23,200 CL

Barclays American Airlines Aviator Red World Elite Mastercard - $20,000 CL || Chase IHG Rewards World Mastercard - $25,000 CL

Chase Sapphire Preferred Visa Signature - $12,700 CL || Chase United MileagePlus Club World Elite MasterCard - $26,500 CL

Citibank Hilton Reserve Visa Signature - $20,000 CL || J.P. Morgan Ritz Carlton Visa Signature - $23,500 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Anonymous wrote:

@Open123 wrote:

@CreditScholar wrote:My portfolio is complete and has been for some time.

The following are part of my permanent collection:

Bank of America Privileges with Travel Rewards Visa Signature

Chase IHG Rewards World Mastercard

Chase Sapphire Preferred Visa Signature

Chase United MileagePlus Club World Elite MasterCard

Citibank Hilton Reserve Visa Signature

J.P. Morgan Ritz Carlton Visa Signature

I picked up the Amex Plat and Barclay's AA cards for the signup bonuses. I'm not sure if I'll keep either of them in the long run or not yet.

How would you rate the benefits of the IHG card relative to your other hotel cards?

LOL! Hey now, be nice! Hahahaha. Maybe they have inlaws in iowa or something!

Hey I really liked Iowa the last time I visited! Granted that was awhile ago, but it didn't seem THAT bad.

American Express Platinum (NPSL) || Bank of America Privileges with Travel Rewards Visa Signature - $23,200 CL

Barclays American Airlines Aviator Red World Elite Mastercard - $20,000 CL || Chase IHG Rewards World Mastercard - $25,000 CL

Chase Sapphire Preferred Visa Signature - $12,700 CL || Chase United MileagePlus Club World Elite MasterCard - $26,500 CL

Citibank Hilton Reserve Visa Signature - $20,000 CL || J.P. Morgan Ritz Carlton Visa Signature - $23,500 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@CreditScholar wrote:Originally I just obtained the card for the signup bonus.

In terms of hotel status, Platinum doesn't get that much in the US. Asia on the other hand, is a different story. I've put in about 20 nights with IHG this year, and I've been upgraded multiple times by being Plat. If you stay at IHG properties at all, the 50% bonus is nice but nothing Earth-shattering.

However the on-going benefits make the card worth keeping for me. A 10% points rebate plus 1 free night each year is more than a fair trade for a $49 AF.

If you are renewing your Ambassador status and choose the $200 option (with the 10% points rebate), you can stack the rebates (10% AMB + 10% from CC). Essentially you can get 20% back for any points you redeem, and given how easy they are to come by it's not a bad deal if you just want to earn and burn.

They also have some decent values such as 35k points for the 2 ICs in Seoul (COEX and Parnas). With a 20% rebate it would be 28k per night.

It has horrible earning rates though, so I wouldn't bother putting any spend on it other for than IHG hotels.

Instead of asking "why should I keep the card?", I think the better question is "why not?"

Thanks, this is helpul.

I was considering one more Chase card in the future, and this is one of the few where I haven't gotten in the past. If they have good values in Asia, I'd likely find it useful. What's the highest bonus you've seen offered for this card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Open123 wrote:

@CreditScholar wrote:Originally I just obtained the card for the signup bonus.

In terms of hotel status, Platinum doesn't get that much in the US. Asia on the other hand, is a different story. I've put in about 20 nights with IHG this year, and I've been upgraded multiple times by being Plat. If you stay at IHG properties at all, the 50% bonus is nice but nothing Earth-shattering.

However the on-going benefits make the card worth keeping for me. A 10% points rebate plus 1 free night each year is more than a fair trade for a $49 AF.

If you are renewing your Ambassador status and choose the $200 option (with the 10% points rebate), you can stack the rebates (10% AMB + 10% from CC). Essentially you can get 20% back for any points you redeem, and given how easy they are to come by it's not a bad deal if you just want to earn and burn.

They also have some decent values such as 35k points for the 2 ICs in Seoul (COEX and Parnas). With a 20% rebate it would be 28k per night.

It has horrible earning rates though, so I wouldn't bother putting any spend on it other for than IHG hotels.

Instead of asking "why should I keep the card?", I think the better question is "why not?"

Thanks, this is helpul.

I was considering one more Chase card in the future, and this is one of the few where I haven't gotten in the past. If they have good values in Asia, I'd likely find it useful. What's the highest bonus you've seen offered for this card?

Highest I've seen is 80k, AF waived the first year. That's the one I got.

Previously there were offers floating around for 70k. Standard offer is 60k I think.

American Express Platinum (NPSL) || Bank of America Privileges with Travel Rewards Visa Signature - $23,200 CL

Barclays American Airlines Aviator Red World Elite Mastercard - $20,000 CL || Chase IHG Rewards World Mastercard - $25,000 CL

Chase Sapphire Preferred Visa Signature - $12,700 CL || Chase United MileagePlus Club World Elite MasterCard - $26,500 CL

Citibank Hilton Reserve Visa Signature - $20,000 CL || J.P. Morgan Ritz Carlton Visa Signature - $23,500 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@CreditScholar wrote:

@Open123 wrote:

@CreditScholar wrote:Originally I just obtained the card for the signup bonus.

In terms of hotel status, Platinum doesn't get that much in the US. Asia on the other hand, is a different story. I've put in about 20 nights with IHG this year, and I've been upgraded multiple times by being Plat. If you stay at IHG properties at all, the 50% bonus is nice but nothing Earth-shattering.

However the on-going benefits make the card worth keeping for me. A 10% points rebate plus 1 free night each year is more than a fair trade for a $49 AF.

If you are renewing your Ambassador status and choose the $200 option (with the 10% points rebate), you can stack the rebates (10% AMB + 10% from CC). Essentially you can get 20% back for any points you redeem, and given how easy they are to come by it's not a bad deal if you just want to earn and burn.

They also have some decent values such as 35k points for the 2 ICs in Seoul (COEX and Parnas). With a 20% rebate it would be 28k per night.

It has horrible earning rates though, so I wouldn't bother putting any spend on it other for than IHG hotels.

Instead of asking "why should I keep the card?", I think the better question is "why not?"

Thanks, this is helpul.

I was considering one more Chase card in the future, and this is one of the few where I haven't gotten in the past. If they have good values in Asia, I'd likely find it useful. What's the highest bonus you've seen offered for this card?

Highest I've seen is 80k, AF waived the first year. That's the one I got.

Previously there were offers floating around for 70k. Standard offer is 60k I think.

dont forget about the $50 credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Whose credit card portfolio is complete?

@Anonymous wrote:You guys have heard about netspend, I'm sure. Heck, I received one in the mail and I didn't even ask for one! But I just discovered their Premier version offers a 5% APY (4.91% technically) on amounts up to $5k. You can have up to 5 cards in your name. Is this a legit thing? Minimum requirement is a 500 direct deposit monthly.

If it is legit, THAT would make my port' complete.

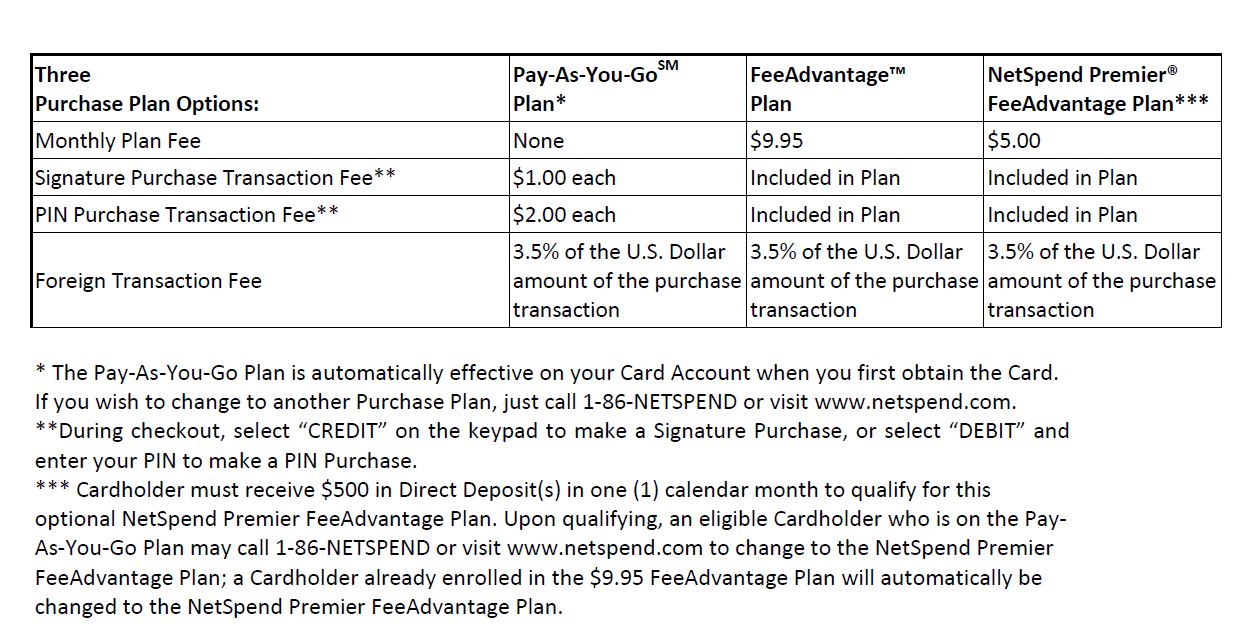

NetSpend looks like a prepaid card. You pay $5 per month for the privlege of being able to spend your $500 direct deposit in a sign or PIN transaction.

If you don't have the direct deposit, you pay $9.95 per month for the ability to spend.

If you do the Pay As You Go option, you pay $1 or $2 for each transaction to get your money out of the prepaid card. Swipe your card as a PIN transaction for a coffee, and the $2.50 coffee gets a $2 fee tacked on for the transaction.

I'm not sure where you are seeing the 5% APR borrowing, it seems they have overdraft protection that can provide $100 to you for the low cost of $45 per month, from some old articles about this.

Is it a payday lender in disguise?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765