- myFICO® Forums

- Types of Credit

- Credit Cards

- Why have so many credit cards?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why have so many credit cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

@Anonymous wrote:Wow, over 60! That's a serious full deck and then some. I'd probably go cross eyed trying to read that credit report! I imagine there are a ton that you haven't used in ages.

Na i try to use them so ey dont close but i definaly have my goto cards to try and save where i can. But i never say no to free money. We had a trip planned for Louisiana this year so i got the amex delta. the bonuses Pretty much paid for our round trip well worth the AF. We fly about 5 tims a year. ill close that one before the next AF.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

For me I was just excited to be able to get a approved for credit cards after having awful credit for so long...

Two years later and I have like 17, I think. If I had to do it all over again some cards like discover, walmart, chase, some comenity cards, etc, wouldn't be in my wallet, or should I say SD.

I'm over the credit card craze. I get mailers from lenders like amex, citi, barclay all the time, and back then, I would have jumped on it(well all except for barclay)...doesn't get me excited like it once did. I never bite. lol...Sometimes Ill go to the prequalify sites like cap1, citi, amex, just for fun.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

You need to think long term when building your credit profile and having 5 to 8 credit cards is much better than having 1 or 2 credit cards.

Ten years from now if you have 5 ten year old cards, they represent 50 years of credit history. If you have only 2 ten year old cards, they only represent 20 years of history. Ten years from now if you have the 5 ten year old cards your scores will stay very stable at a high level when you need to apply for other needed loans like those for a house, auto, motorcycle, boat or beach house.

More cards builds a thicker file faster and will stabilize your scores at a high level in about 3 years. (That is 3 years after you quit apping for new cards.)

If you have a low number of cards, let's say 2 or 3, you have to worry about the lender relationship. What happens if the lender goes out of business in 5 years and closes your account? What happens when they make you angry for screwing something up and you would like to close the account and quit your relationship with them?

By having 5 to 8 credit cards you diversify your portfolio and don't really need to worry about the lenders. No matter what happens, chances are a few of them will still be in business 5 years from now and be willing to do business with you.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

@jamie123 wrote:You need to think long term when building your credit profile and having 5 to 8 credit cards is much better than having 1 or 2 credit cards.

Ten years from now if you have 5 ten year old cards, they represent 50 years of credit history. If you have only 2 ten year old cards, they only represent 20 years of history. Ten years from now if you have the 5 ten year old cards your scores will stay very stable at a high level when you need to apply for other needed loans like those for a house, auto, motorcycle, boat or beach house.

More cards builds a thicker file faster and will stabilize your scores at a high level in about 3 years. (That is 3 years after you quit apping for new cards.)

If you have a low number of cards, let's say 2 or 3, you have to worry about the lender relationship. What happens if the lender goes out of business in 5 years and closes your account? What happens when they make you angry for screwing something up and you would like to close the account and quit your relationship with them?

By having 5 to 8 credit cards you diversify your portfolio and don't really need to worry about the lenders. No matter what happens, chances are a few of them will still be in business 5 years from now and be willing to do business with you.

Your AoAA wont take a hit either. Applying for 1 card in 5 years, having 5-8 card history will have less of an impact AoAa scoring wise than 1-2 cards. In 5-10 years i'll never have to worry about AoAA till i die. Lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

I might not be saving every last penny possible, but I'll still save a bit over using a debit card, and no matter what happens with various banks i can always switch which cards are primary as needed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

Oh where to begin...

I'm young, 22, so when my credit journey began 2 years ago in April, it was just to get my credit history going. Then after a while with only one secured card, I applied for a new card at Walmart, and I was actually approved (it was my first unsecured card). I then went home and realized I'd caught the bug. I began applying for cards left and right, and I think I managed to get 3 more cards. All of which have over $8K limits now. I then kept applying for everything that seemed beneficial. I have some cards that I use for interest free balances, some cards for great cash back, some are there to pad my utilization. There's plenty of reasons to have numerous cards. It's all about spending habits. Because of credit cards, in just 2 years I was able to build my credit up enough to buy a brand new home at the age of 22. But I'm now trying to control myself, and I've actually closed 5 accounts and I'm down to 11 now. And I will close more in the coming months. Now that I have cards with higher limits, it's not necessary for me to keep a bunch of low limit cards that I hardly use, and dilute my rewards earnings. But I'll still end up with around 6-8 cards. And I really only have two cards in sight for the future.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Good info guys, thanks. Differing reasons. And as always, thanks for the subtle passive aggressive response Irish80

I don't see Irish being passive-aggressive in his response at all. He is letting you know there is a lot of duplication and it is sometimes best to search before posting a new thread or idea. Helps keep the boards more streamlined and easier to find things if people don't keep asking the same questions in different threads.

+1

And I'll add something else. It doesn't just help the board, it also helps you. The search function gives you a lot more resources than what this thread alone could provide, and it also takes much less time to do a search than create a new thread. This advice is something that a new member, as you state you are, would stand to benefit from.

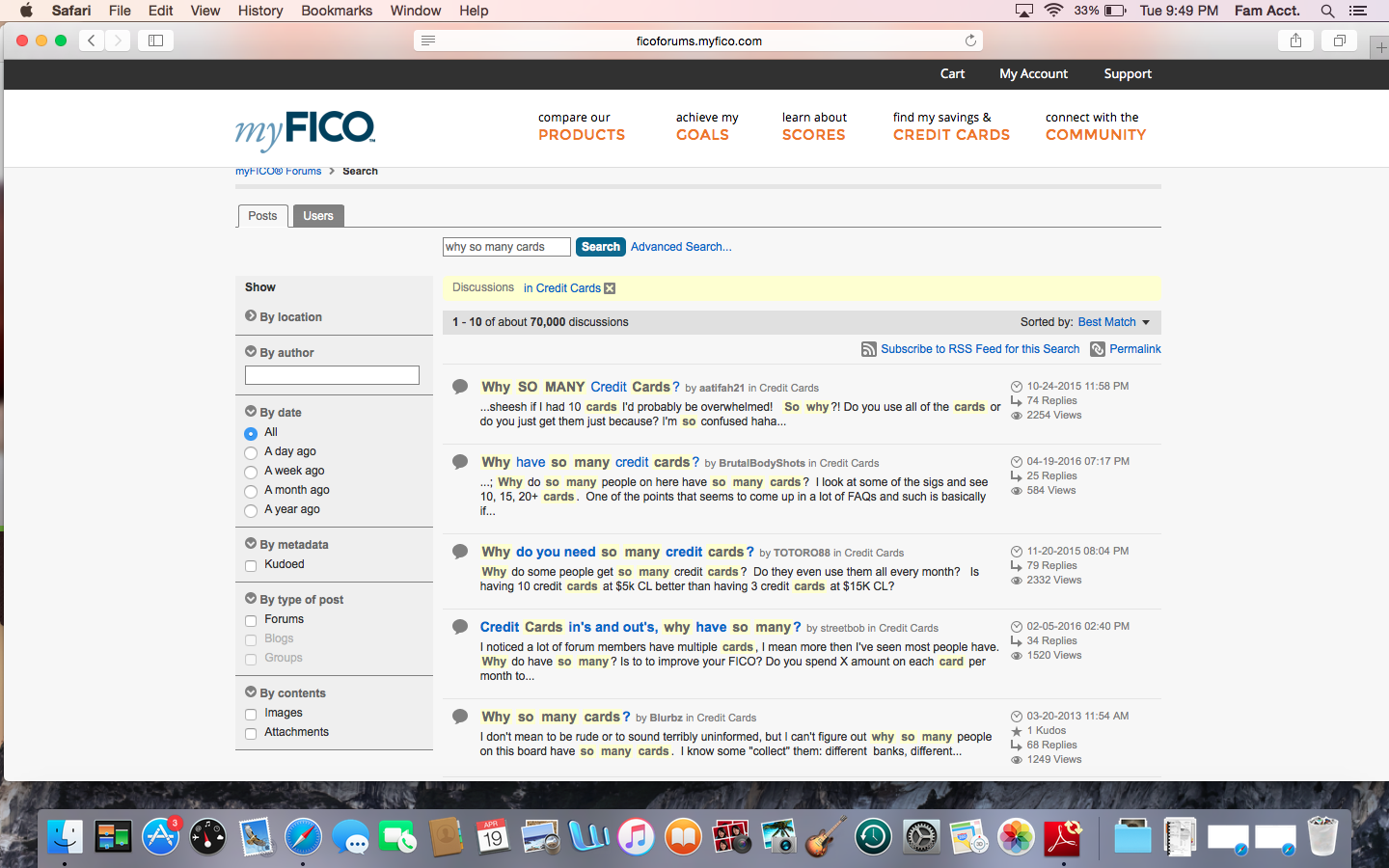

EDIT: To that point, here are just the first five results -- admittedly one of them being yours -- when you search "Why so many cards?" (and there are many more!).

Do you search "Community" or "Board" if you are looking for threads like this one? Not sure of the difference to be honest but I get different results.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

@Anonymous wrote:

@jamie123 wrote:You need to think long term when building your credit profile and having 5 to 8 credit cards is much better than having 1 or 2 credit cards.

Ten years from now if you have 5 ten year old cards, they represent 50 years of credit history. If you have only 2 ten year old cards, they only represent 20 years of history. Ten years from now if you have the 5 ten year old cards your scores will stay very stable at a high level when you need to apply for other needed loans like those for a house, auto, motorcycle, boat or beach house.

More cards builds a thicker file faster and will stabilize your scores at a high level in about 3 years. (That is 3 years after you quit apping for new cards.)

If you have a low number of cards, let's say 2 or 3, you have to worry about the lender relationship. What happens if the lender goes out of business in 5 years and closes your account? What happens when they make you angry for screwing something up and you would like to close the account and quit your relationship with them?

By having 5 to 8 credit cards you diversify your portfolio and don't really need to worry about the lenders. No matter what happens, chances are a few of them will still be in business 5 years from now and be willing to do business with you.

Your AoAA wont take a hit either. Applying for 1 card in 5 years, having 5-8 card history will have less of an impact AoAa scoring wise than 1-2 cards. In 5-10 years i'll never have to worry about AoAA till i die. Lol

See, I knew someone would find a plus. I am in the same boat. In 10 years my AAoA will be bulletproof. I will be able to app every FOTM and my AAoA won't even blip on the screen. For now, though, it's flickering like an old light bulb.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why have so many credit cards?

I get the whole 5-8 cards thing and certainly agree with it as a way to build a portfolio and set yourself up for success in the future. I was more directing the thread at people with 20 cards or so and am amazed that someone on this forum has 60! I couldn't even imagine managing that many cards.

With respect to opening similar threads in this forum, come on guys. There are over 1.2 million posts in this section; the vast majority of information if it isn't brand new has likely been discussed at some point. That doesn't mean we shouldn't start new threads about topics that have been hashed out before. As someone above said they're happy this thread was made as it brings new ideas and opinions to the forefront. Is it that big of a deal to do that rather than resurrect a thread from 2015 or even 2008? Isn't the idea to contribute and add value to the forum? If a thread gets 30+ replies in a day, certainly it was worthy, and I just don't see why there needs to be 1-2 posts thrown in that basically say "you shouldn't have made this thread." When I'm searching for something, I actually PREFER there to be 5 or 6 solid hits with 3-4 pages of information from different time periods as I feel the information presented in that fashion is more concise and manageable. If that was instead one thread with 20+ pages there's a good chance that people wouldn't read half of it. I know I probably wouldn't.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content