- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Will the citi double cash last?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Will the citi double cash last?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

@Anonymous wrote:

@14Fiesta wrote:

@Anonymous wrote:

@14Fiesta wrote:One problem I see Citi made in launching this card is that it had 0% intro from the beginning. No one is paying interest on their balances on the card right now unless they missed a payment or defaulted.

What they should have done is skip that for the first year or so and let all the early adopters that are revolvers pay interest on their Double Cash balances and get a good mix to balance out the transactors. Then introduce the 0% intro period as new and improved for new customers only and I would think it's viable for Citi to survive on.

What stops people from canceling their card and reapplying for a 0% intro?

You can cancel and re-apply, but if you have had the card, you are inelegible for any signup bonus on this card - similar to (AMEX?)

Also, if a revolver canceled the card, they would have to PIF the balance and would forfeit the 1% from payments because the account is "closed"

Signup bonus, Implying they are giving any cashback bonus or statement credit with this card.

When you reapply, You reapply under the terms being offered at the time. Easy. BT your balance to another card, perhaps a no fee CU card or CapOne and BT it back once you have your new one.

Ack you got me there ![]()

But like mentioned the general public most likely would not do this or even notice that they are paying interest on their balances.

EX FICO (AMEX): 728 (4/29/17) | TU FICO (Discover): 737 (4/7/17) | EQ FICO (Citi): 746 (3/28/17)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

does double cash follow the citi travel card policy of at least 18 months before getting new signup bonus ? I guess with cashback cards signup bonus isn't as important as say citi aa cards are.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

@14Fiesta wrote:One problem I see Citi made in launching this card is that it had 0% intro from the beginning. No one is paying interest on their balances on the card right now unless they missed a payment or defaulted.

What they should have done is skip that for the first year or so and let all the early adopters that are revolvers pay interest on their Double Cash balances and get a good mix to balance out the transactors. Then introduce the 0% intro period as new and improved for new customers only and I would think it's viable for Citi to survive on.

Since 0% intro APR is so standard with credit cards you have to assume that it is very profitable long term for the card company. It's pretty easy to imagine the average customer continuing to pile up charges during this period with the intentions of paying off most or all of them. Alot can change in 12-15 months and pretty soon you're only making minimum payments on that couch and TV that you bought last year. Intro period ends and you've got a $3500 credit card balance and they have you right where they want you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

A few random thoughts in no particular order:

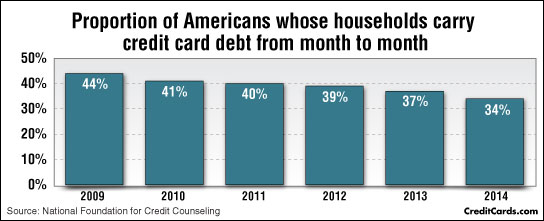

Just a guess, but I imagine that somewhere around 35% of DC cardholders will be carrying

an interest bearing balance one year from now. That's about the numbers on CC's in general.

It isn't always the same 35%, accounts tend to rotate into and then out of paying interest as

the account holder's finances evolve. Otherwise Citi probably would just figure out who the

dumb profitable ones were then cull the rest. Probably more than half of their accounts spend

some time in the dumb profitable category.

Look up some banking stock analyst's opinions on Citi as a major bank. You'll find terms

commonly used like "Zombie". Citi and their balance sheet is a mess.

By not paying the second 1% until the balance is paid, Citi is cutting costs a little since there is

a few percent default rate on typical credit cards. In other words, how Citi structured it is slightly

less expensive than how other 2% cards that were nerfed were structured.

I don't have a Double Cash. I get more than 2% value for my particular lifestyle from my AlaskaAir card,

and so it is used as my non-category spending card. Most frequent flyer programs are worth more than

2% on credit card spend - if you travel that much anyway. I'm not interested in a 2% cashback card

because of my travel profile and also because my uncategorized spend isn't much.

I love my Sallie Mae, I want a second one, and I sometimes spend over the caps and put small non-bonus

purchases on it. The little swipes, for a candy bar or a soda, are more profitable, percentage wise, for issuers.

I give those swipes to most favored card which is my Sallie Mae. Please don't nerf it Barclays.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

@Anonymous wrote:If it's nerfed, they will no longer be able to call it DoubleCash.

They could reduce the purchase reward to .75% and the payment reward to .75%, and it could still be called DoubleCash. Then it would be like Quicksilver ... but not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

I just think it's inevitable it will be nerfed somehow, even if it turns into a .75% and then .75% (1.50% total) card.

That being said, maybe it won't, who knows. Any of our cards could be nerfed at any time! You never know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

people do realize there is no sign up bonus that a normal person can get for the double cash right? You would have to spend 20k on the card just to break even if you got the CAP one QS visa card with 100 dollar sign up bonus. There are so many other cards that give more than 2% back i dont see how anyone would spend that kind of money on the card anyways. And if i had another card that had 2 points back like say the marriott card that gives me 2 points on restaurants i can make even more money cause i can make those points worth a lot more.

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

I agree in that I think Double Cash is overhyped and I prefer the Quicksilver just because the rewards are more straightforward. appear instantly, and have no minimum redemption, but, some people prefer Double Cash. It is a higher return, it's just that unless you are a huge spender, the difference isn't going to be huge on just general spending.

Although I understand your argment about sign up bonuses and it makes sense since the DC doesn't (usually) have one, I always felt like they were overhyped. The bonus is meant to entice you into the card, but some people make it seem like it's a make or break reason to get a card. Since you shouldn't churn for bonuses anyway, you should be looking at the long term value of the card, not just the instant $100 or $200 it is giving you (I realize with travel cards it's a lot higher, but you still have to spend a lot of money to get it, so you should be looking at a card you would want to keep IMO).

I like the Quicksilver better and it seems like a product that is more sustainable, but, who really knows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Will the citi double cash last?

Seeing how, according this article published in creditcards.com, about 34% of people carry interest on the card month over month, they may be banking on the fact that say 18% will make up the difference AND THEN SOME.

http://www.creditcards.com/credit-card-news/credit-card-debt-statistics-1276.php

In 2012, the average credit card balance for those who carry a balance is $7,145 (again referencing he same article). That is a lot of potential for profit. ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Starting Scores: 590s on 12/2013. Hover over card image to view details! *After Amex approvals - [I was supposed to be] Gardening!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content