- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Yes, you too can join PSECU and find out your ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Yes, you too can join PSECU and find out your EX FICO score! --well, maybe

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

January scores are out today. 788 up from 775. This should be the highest i see since the PSECU Visa has yet to hit the reports. Sweet middle score though.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

I'm planning to apply in a few months, but I have a few questions:

1) it seems that the primary reason for denial for the cc is too many inquiries or too many new accounts - what's the lowest number of new accounts / inquiries that someone has been rejected over? I've been reading numbers like 7 inquiries and 3 new accounts, which I feel is kind of high, but maybe that's just me

2) You request the credit limit on the cc? I've never applied for a cc where you request a specific limit. If they don't like you for the 20k, has someone applied for a high number and approved for a smaller one yet?

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

1) TBH, they are probably just looking for denial reasons because they've already lent a lot and don't know how to control it. I was approved for the max with 5 new accounts and 3 recent inquiries back in early Dec.

2) They determine the amount

Here is what the app asks for:

Middle Initial:

Address:

Is this your correct address? *

Marital Status: *

Residential Status: *

Time at Present Address: * years months

Is this your home or school address? *

Do you have a school address? *

Do you have a home address? *

Monthly Housing Payments: * $

Home Phone: * ( ) -

Mobile Phone: ( ) -

e-Mail Address:

Is this your correct email address? *

Citizenship Status: *

School Address Line 1: *

School Address Line 2:

School City: *

School State: *

School Zip Code: * +

Home Address Line 1: *

Home Address Line 2:

Home City: *

Home State: *

Home Zip Code: * +

Employment Status: *

Employer Name: *

Title / Position: *

Business Phone: * ( ) -

Salary: * $ (Salary – Annual Gross.)

Time with Present Employer: * years months

Future Start Date: * (mm/dd/yyyy)

Other Income for Applicant (annual gross):

Amount Source

$

Other Income Employer Name: *

Alimony, child support and separate maintenance income need not be revealed if you do not wish to have it considered.

Monthly obligations for Alimony, Child Support or Other Court - Ordered Payments: $

Do you have a checking account? *

No Yes

Have you filed bankruptcy in the past 5 years?*

No Yes

Do you have any unsettled lawsuits or judgments for the business or any guarantor? *

No Yes

Are there any taxes past due for the business or any owner/partner? *

No Yes

Information for Government Monitoring Purposes

The following information is requested by the federal government for certain types of loans related to a dwelling in order to monitor the lender's compliance with equal credit opportunity, fair housing, and home mortgage disclosure laws.

You are not required to furnish this information, but are encouraged to do so. You may select one or more designations for "Race." The law provides that a lender may not discriminate on the basis of this information, or on whether you choose to furnish it. However, if you choose not to furnish the information and you have made this application in person, under federal regulations the lender is required to note ethnicity, race and sex on the basis of visual observation or surname. If you do not wish to furnish the information, please check below.

* I do not wish to furnish this information.

Ethnicity:

* Hispanic or Latino

* Not Hispanic or Latino

Race:

* American Indian or Alaska Native

* Asian

* Black or African American

* Native Hawaiian or Other Pacific Islander

* White

Sex:

* Female

* Male

Is this an individual or joint application? *

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

Thanks! I feel like I've read at least one post (and actually more) about applying for a specific amount and regretting not applying for a higher one. Ah well.

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010

Starting Score: EQ 583 TU04 619 EX 592 (lender pull) 2010Previous High Score: EQ 700 TU04 712 EX 726

Current Score: EQ 740 TU(Discover) 750 EX(AMEX) 747

Goal Score: 740+ all around

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

When applying do they ask everyone to send a copy of their license, social security card, pay stub, and utility bill?

Current Score:TU: 673 EQ: 701 EX: 675 (2/2011)

Goal Score: TU: 720 EQ: 750 EX:720

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

@stizzlerizzle wrote:When applying do they ask everyone to send a copy of their license, social security card, pay stub, and utility bill?

Nope. They only started doing that as they tightened up ship.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

@Anonymous wrote:1) TBH, they are probably just looking for denial reasons because they've already lent a lot and don't know how to control it. I was approved for the max with 5 new accounts and 3 recent inquiries back in early Dec.

2) They determine the amount

Here is what the app asks for:

Middle Initial:

Address:

Is this your correct address? *

Marital Status: *

Residential Status: *

Time at Present Address: * years months

Is this your home or school address? *

Do you have a school address? *

Do you have a home address? *

Monthly Housing Payments: * $

Home Phone: * ( ) -

Mobile Phone: ( ) -

e-Mail Address:

Is this your correct email address? *

Citizenship Status: *

School Address Line 1: *

School Address Line 2:

School City: *

School State: *

School Zip Code: * +

Home Address Line 1: *

Home Address Line 2:

Home City: *

Home State: *

Home Zip Code: * +

Employment Status: *

Employer Name: *

Title / Position: *

Business Phone: * ( ) -

Salary: * $ (Salary – Annual Gross.)

Time with Present Employer: * years months

Future Start Date: * (mm/dd/yyyy)

Other Income for Applicant (annual gross):

Amount Source

$

Other Income Employer Name: *

Alimony, child support and separate maintenance income need not be revealed if you do not wish to have it considered.

Monthly obligations for Alimony, Child Support or Other Court - Ordered Payments: $

Do you have a checking account? *

No Yes

Have you filed bankruptcy in the past 5 years?*

No Yes

Do you have any unsettled lawsuits or judgments for the business or any guarantor? *

No Yes

Are there any taxes past due for the business or any owner/partner? *

No Yes

Information for Government Monitoring Purposes

The following information is requested by the federal government for certain types of loans related to a dwelling in order to monitor the lender's compliance with equal credit opportunity, fair housing, and home mortgage disclosure laws.

You are not required to furnish this information, but are encouraged to do so. You may select one or more designations for "Race." The law provides that a lender may not discriminate on the basis of this information, or on whether you choose to furnish it. However, if you choose not to furnish the information and you have made this application in person, under federal regulations the lender is required to note ethnicity, race and sex on the basis of visual observation or surname. If you do not wish to furnish the information, please check below.

* I do not wish to furnish this information.

Ethnicity:

* Hispanic or Latino

* Not Hispanic or Latino

Race:

* American Indian or Alaska Native

* Asian

* Black or African American

* Native Hawaiian or Other Pacific Islander

* White

Sex:

* Female

* Male

Is this an individual or joint application? *

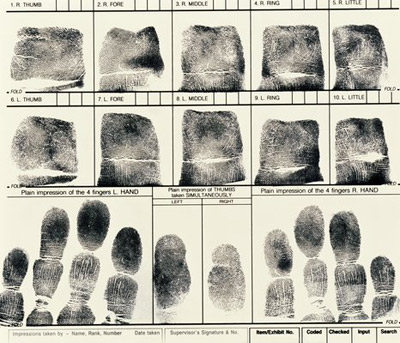

HOLY MOLY!!!! ![]()

The only thing missing...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

I just found this newest requirement to join PSECU. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

I just mailed my arm in last week.. so maybe soon i will be accepted!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Yes, you too can join PSECU and find out your EX FICO score!

@stizzlerizzle wrote:When applying do they ask everyone to send a copy of their license, social security card, pay stub, and utility bill?

I applied back on November 12th and they asked me for all this info ![]()