- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Zync Declined

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Zync Declined

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

Amex actually pulled all three reports, probably because I applied for a charge card and a revolver in the same day. They have done this to me in the past. The only reason why I mentioned Equifax is because that is what MyFico gives us, and it told me that Amex pulled it.

What's in my Wallet: Amex Zync | Amex BCP | Chase Freedom | Bank of America Power Rewards 123 | Banana Republic Visa | Capital One |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

Amex pulled TU, EQ and EX for me! I pulled the trigger a bit to early, knowing that my CA accounts had only been removed from EX.

I also made the mistake of apping for the credit card, expecting that I would probably be declined. My intention was to app for that and the Zync at the same time - thinking that they were only going to pull once, so why not try for the credit card too? However, my 2nd app, which was for the Zync was cancelled. So 3 hits for nothing ![]()

EQ: 662 | TU: 682 | EX Plus: 764

SL baddies fall off between Jan '13 - Oct '14

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

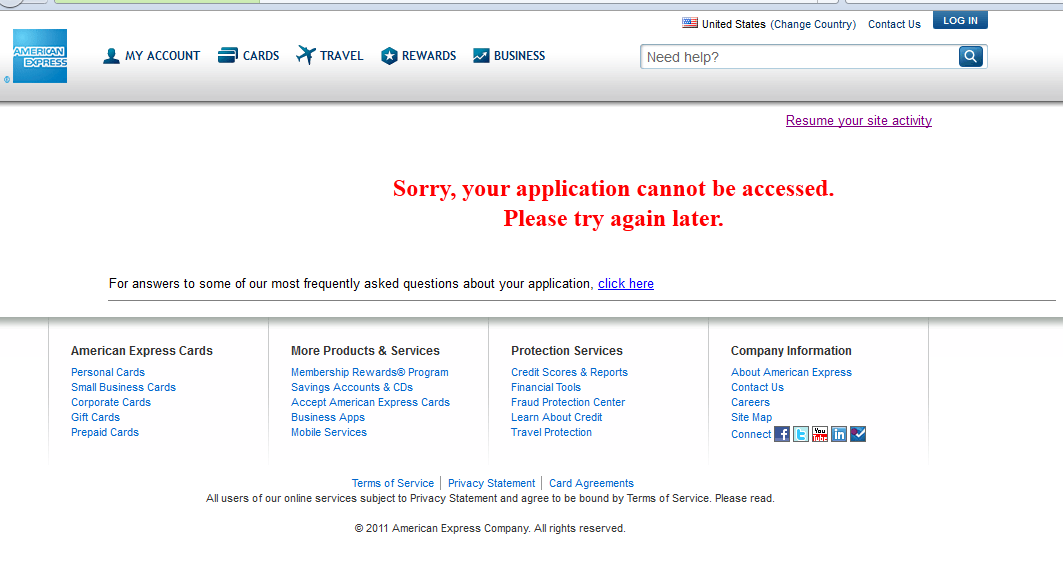

Anyone ever had an issue with seeing your application status??? It keeps saying "Your application cannot be accessed, please try again later".

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

No I checked mine to see what report was pulled about an hour ago.

Current Score: EQ 763~TU 706

Goal Score: 810

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

I got that reply when I app'd for the Blue and got denied. However, right after that I app'd for the Delta Gold and it got cancelled because I applied for three cards in the same day and I called and got them to manually review it.

What's in my Wallet: Amex Zync | Amex BCP | Chase Freedom | Bank of America Power Rewards 123 | Banana Republic Visa | Capital One |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

I had that screen for a few days after I was declined. Eventually it was updated with my denial letter.

EQ: 662 | TU: 682 | EX Plus: 764

SL baddies fall off between Jan '13 - Oct '14

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

Well.....

Spoke with AMEX today....

Got my laundry list of items to fix, and it looks like i'm about 2yrs away from obtaining an AMEX....yupper.

![]()

EQ FICO 548 3/3/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

If you can, maybe it's worth paying all cards off or at least very low.

I got the counter offer with a score of around 600 (EQ/TU, EX can't be that much different), even though the EX report they pulled showed two paid tax liens from 2007, two charge offs (both paid) from 2008, 30-day late payments from 2010 and 2011, an (incorrect) current 60-day delinquent on a paid-off car loan and a boatload of enquiries. The only real plusses were 0% utilization on the credit cards and a currently-healthy mortgage (but with a 60-day-late in early 2010).

Quite honestly, I had a hard time figuring out why I got the counter offer instead of a flat denial. I can only think that the 0% utilization looks good for a charge card that must be paid in full each month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Zync Declined

This is the response that I got

Dear Funky Winkerbean

Thank you for your recent application for Zync SM from American Express. We do value your desire to establish a relationship with us. We regret that we are unable to approve your request.

Reason(s) for Our Decision

Our scoring of your credit and other relevant information (See below)

****I do not have any charge offs on the big 3 so I am assuming there is something on Teletrack. I have ordered the report, should be here soon

We evaluated your application using a credit scoring system that considers various pieces of information, including your credit report. The following key factors contributed to our evaluation:

| You have charged-off financial obligations reflected in a report obtained from Teletrack Consumer Reporting Agency. Length of time accounts have been established (Experian) Too many recent credit checks. (Experian) In our estimation, the amount you have paid on your bank and retail credit card accounts over the last twelve months is too low. (Experian) |

Information About Your FICO? Score

We obtained your FICO score from Experian and used it in making our credit decision. Your FICO score is a number that reflects the information in your credit report. Your FICO score can change, depending on how the information in your credit report changes. On November 02, 2011, your FICO score was 668. The FICO score ranges from 300 to 850. The following are the key factors that contributed to your FICO score:

| Too few accounts currently paid as agreed. Length of time accounts have been established. Lack of recent installment loan information. Too many inquiries last 12 months. |

FICO is a registered trademark of Fair Isaac Corporation in the United States and in other countries.