- myFICO® Forums

- Types of Credit

- Credit Cards

- anyone ever get this message from Discover ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

anyone ever get this message from Discover ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

anyone ever get this message from Discover ?

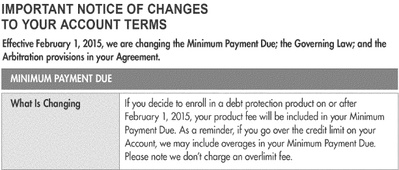

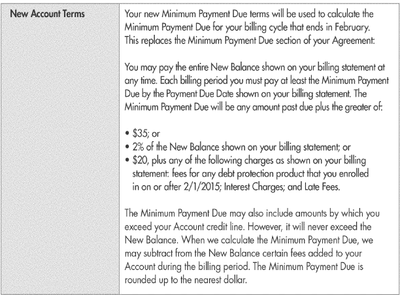

Had my card for over a year now and got a 8 page pdf letter stating that they were changing my minimum payment due, the governing law; and the arbitration provisions in your agreement. Is this common when you've had your card for over a year ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

sounds like something changed on your CR....

FICO 5 ,4, 2 - 10/2023 FICO 8 - 10/2023 FICO 9 - 10/2023 FICO 10 - 10/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

Never heard of this before on Discover.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

Sounds like the terms are changing. Give them a call and see if there is a specific reason for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

@anonymous4a wrote:Had my card for over a year now and got a 8 page pdf letter stating that they were changing my minimum payment due, the governing law; and the arbitration provisions in your agreement. Is this common when you've had your card for over a year ?

I had my card for 6 months and I just received this message when I logged in today. I wonder if it's something negative that I triggered?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

This seems to be the beefy part. I got it as well. Basically if you enroll in their protection service (which i believe is the "if you get sick or hospitalized you won't be responsible for this debt of up to however much" ) that fee is tacked onto your minimum payment, as opposed to just becoming part of your balance. There is also some stuff in there about collections, but I think this is the major change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

I got the same message when I logged in today. Looks like something they are doing across the board with all customers. Doesn't really affect me since I don't have the credit protection plan through them. Of course the arbitration part applies to everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

Isn't there some law that forces CC companies to charge a minimum payment that will actually get a card paid off eventually?

Once upon a time CC companies would charge such a small minimum payment that you were basically paying no principle and paying all interest.

Maybe Discover had to do it, to your benefit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

Barclays did something similar and I believe sent to many cardholders. mostly about fees et al

DOJ

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: anyone ever get this message from Discover ?

@Anonymous wrote:Isn't there some law that forces CC companies to charge a minimum payment that will actually get a card paid off eventually?

Once upon a time CC companies would charge such a small minimum payment that you were basically paying no principle and paying all interest.

Maybe Discover had to do it, to your benefit.

I think so but they can make the spread so thin that it could take 10 years of making payments to pay it off. Also making minimum payments doesn't guarantee that someone wouldn't just pay minimums and charge back up to the limit again, effectively carrying the debt forever.

EX FICO (AMEX): 728 (4/29/17) | TU FICO (Discover): 737 (4/7/17) | EQ FICO (Citi): 746 (3/28/17)