- myFICO® Forums

- Types of Credit

- Credit Cards

- citi credit card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

citi credit card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

citi credit card

I applied for and was approved for the citi simplicy card in july, this card was my lowest starting limited ever. In six month I have not seen any love from Citi and I am thinking about closing the card. Want to know how it will hurt my credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

It will only hurt if you are using it for a buffer on util. If it is a small line and at $0, you should be fine. Have you tried and looked for a SP increase? Can you afford to take a HP and see if they will increase? How is/was your usage on the card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

Stupid question, but I just wanted to make sure: Have you tried initiating a SP CLI request online? Squeeky wheel gets oiled.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

Can not afford any hard pulls, and i have not asked for any sp cli. My uti is around 30% right now

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

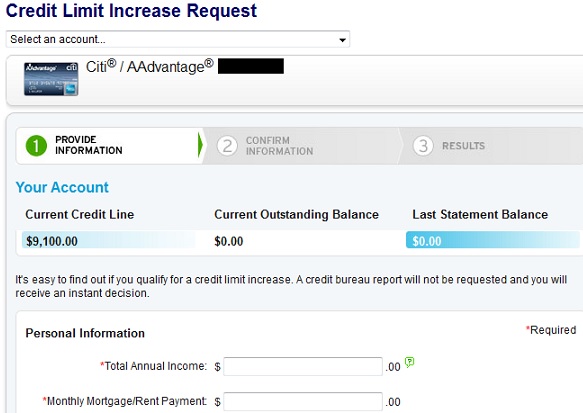

Then, as others have mentioned upthread, see if your account is eligible for a SP CLI. For instance, if the following language "It's easy to find out..." appears exactly as noted below, then it will be SP - no guarantee on the CLI but you can always try and see if it works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

@Anonymous wrote:Can not afford any hard pulls, and i have not asked for any sp cli. My uti is around 30% right now

Well let's see if you qualify for a SP.

Login to your account.

At the top, click on 'Account Management'.

Under the heading 'Balance Transfers, Lines & Loans' click on 'Request a Credit Line Increase'

If you have more than one Citi card, select the card you want the CLI on at the top.

Now read the wording of the page. It will say one of two things.

If it says "It's easy to find out if you qualify for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision." then you are eligible to request a SP CLI.

But if it says "By clicking "Continue" you understand that we will obtain a credit bureau report to evaluate your request." then Citi will require a HP.

If you got the SP prompt, then go ahead and put in your Annual Income + Mortage/rent payment. Then hit continue and see what Citi gives you.

Voila. Hopefully that helps you.

You are eligible for a successful SP CLI every six months. If they Citi cannot offer a SP CLI, then I think you have to wait 180 days to try again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

turned down, so now my next qustion since it my newest line will affect my credit as much closing it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

@Anonymous wrote:turned down, so now my next qustion since it my newest line will affect my credit as much closing it

Aw, sorry to hear that. ![]()

But no, it won't hurt your credit to close the card. Since it's a small limit, it shouldn't be much of a factor with your utilization across the board.

Credit cards, even after cancelling them, continue to show up on your credit report for 10 years. So you won't feel the 'effect' of closing the account until then, at which time it shouldn't really matter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

@mikelo22 wrote:

@Anonymous wrote:turned down, so now my next qustion since it my newest line will affect my credit as much closing it

Aw, sorry to hear that.

But no, it won't hurt your credit to close the card. Since it's a small limit, it shouldn't be much of a factor with your utilization across the board.

Credit cards, even after cancelling them, continue to show up on your credit report for 10 years. So you won't feel the 'effect' of closing the account until then, at which time it shouldn't really matter.

@mikelo22 wrote:

@Anonymous wrote:turned down, so now my next qustion since it my newest line will affect my credit as much closing it

Aw, sorry to hear that.

But no, it won't hurt your credit to close the card. Since it's a small limit, it shouldn't be much of a factor with your utilization across the board.

Credit cards, even after cancelling them, continue to show up on your credit report for 10 years. So you won't feel the 'effect' of closing the account until then, at which time it shouldn't really matter.

Exactly, as long as losing the credit limit hurt your utilization you should be fine. The damage is already done for the new line of credit and the inquiry - and closing it won't undo that - but as stated the account should stay on your credit report for 10 years, so you also won't have to worry about losing the slight account history it's accumulated.

However, IMO 6 months without a CLI isn't all that bad. I'd personally give it at least another 6 months before making a decision.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: citi credit card

don't close it, just see if you can PC it to Double Cash